Sonic Healthcare pivots for growth beyond Covid-19 sugar hit, sending its shares surging

Despite a massive decline in PCR tests to detect Covid-19, the group’s net profit is still well up on pre-pandemic levels, triggering a share rally.

Sonic Healthcare has pivoted itself away from Covid-19’s fast-fading sugar hit, recording strong growth across its base pathology business, including a double-digit revenue surge in January, and sending its shares soaring more than 14 per cent.

The focus on strengthening its core operations comes as the company’s profit has more than halved in the six months to December 31 after demand for pathology-based Covid-19 testing all but evaporated.

Almost $1bn was wiped off its pandemic-related revenue as most restrictions ended and more Australians opted not to use highly accurate PCR tests to confirm a Covid-19 diagnosis.

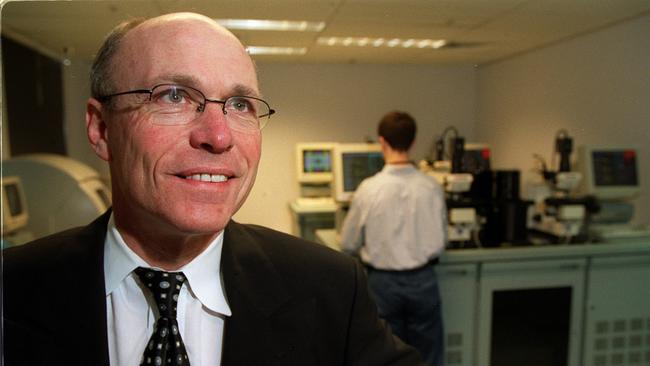

But chief executive Colin Goldschmidt said Sonic delivered an “amazing” underlying result, with net profit leaping 50 per cent on pre-pandemic levels thanks to strong growth across its base business.

The underlying result sent Sonic shares soaring 14.3 per cent to $33.20 on Thursday, in midday trade on Thursday, valuing the company at $15.97bn. This compared with 0.8 per cent gain across the broader share market. It is now advancing its use of artificial intelligence via its joint venture with Harrison.ai to make its operations more efficient.

“At face value, Sonic Healthcare’s result for the half-year shows declining revenue and earnings as a result of a dramatic reduction in revenue from Covid-19 related services against the same period in the prior year,” Dr Goldschmidt said.

“Taking a longer-term view, our net profit for the half year is an amazing 50 per cent higher than in the most recent pre-pandemic comparable period, being H1 FY 2020.”

Taxpayer-funded Covid-19 tests have delivered a bonanza to listed pathology companies, including Sonic, Healius, Australian Clinical Labs and Integral Diagnostics, fuelling record earnings and generating billions of dollars in revenue.

The dramatic fall in Covid-19 test revenue sent Sonic’s net profit crumbling 54 per cent to $382.4m, with revenue from pandemic-related services collapsing to $379m from $1.34bn a year earlier.

Despite PCR test revenue plummeting more than 350 per cent, Sonic’s overall revenue dipped 14.2 per cent to $4.1bn.

And stripping out PCR testing, Dr Goldschmidt said Sonic’s base revenue jumped 8.5 per cent to $3.66bn.

“The reduction in Covid related revenues also tends to mask the performance of our base business, which remains strong and is gaining further momentum,” he said.

“For the month of January 2023 base business organic growth for the group was 10 per cent versus January 2020. I am particularly pleased with the growth momentum of our Australian pathology business, where growth in January was 16 per cent versus January 2020.

“Comparing our own Australian base business Medicare billings to the national Medicare data over the last decade shows that Sonic has been consistently growing market share organically.”

Dr Goldschmidt said the company was cutting costs as demand from Covid-19 testing drops. Like other pathology companies, it had invested heavily in ramping up capacity to meet pandemic demand in the past three years.

“With the reduction in Covid revenues and the current global inflationary environment, cost management is even more of a focus than is usual.

“During the half year, Sonic’s operations intentionally maintained Covid testing capacity in case of new waves/strains. Costs are being wound down to reflect recent Covid volume levels, including through reductions in overtime, casual and contractor hours”.

Dr Goldschmidt said Sonic was focused on delivering organic growth now the “worst of the pandemic (is) seemingly behind us”.

“Organic revenue growth continues to be a core focus and strategy for all of Sonic’s businesses, leveraging our medical leadership culture to drive market share growth, especially in the specialist and hospital referrer sub-markets.

“We are well positioned to capitalise on the accelerating trend towards higher value tests and modalities in both laboratory medicine and radiology. We expect ongoing strong growth in genetic testing, including prenatal tests, and through exclusive or limited provider tests such as ThyroSeq, Oncotype DX, microbiome testing and others.”

Dr Goldschmidt also said the company’s AI joint venture – called Franklin.ai – with Harrison.ai was “progressing at pace”.

“Critical milestones have been achieved along the path to the release of the first histopathology solution within the next 18 months. Sonic intends to use Franklin products in-house to enhance efficiency and quality in our global operations, whilst Franklin’s strategy is to sell its AI products into global markets following regulatory approvals.”

The company will pay an interim dividend of 42 cents a share – a 5 per cent increase on the previous corresponding period – on March 22.

RBC Capital Markets analyst Craig Wong-Pan said “the market should be pleased with the core pathology and imaging segments, which were either in line or beat consensus revenue and EBITDA estimates”.

“While EBITDA and EBIT were below our forecasts, they were 1-2 per cent ahead of consensus. Net profit after tax was slightly lower than consensus estimates due to higher interest costs,” Mr Wong-Pan said.

“We expect the market will be focused on the improving base business organic revenue growth which was 6 per cent in 1H23 (versus 3.5 per cent for four months to October 22) and increased to 14 per cent in January 23.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout