James Packer’s private company Consolidated Press Holdings pays $140m dividend

James Packer’s flagship private company has undertaken a landmark restructure. Here is why.

A landmark restructure has seen James Packer’s flagship private company almost halve its level of borrowings from subsidiaries and increase its net asset position as it awaits regulatory approval of a fresh $880m cash injection from Lawrence Ho’s Melco Resorts and Entertainment Group.

The annual accounts for the entity Consolidated Press Holdings, obtained by The Australian, show CPH reported a net profit of $45.6m last year, down from $49.8m in 2018 and $73.3m in the prior year.

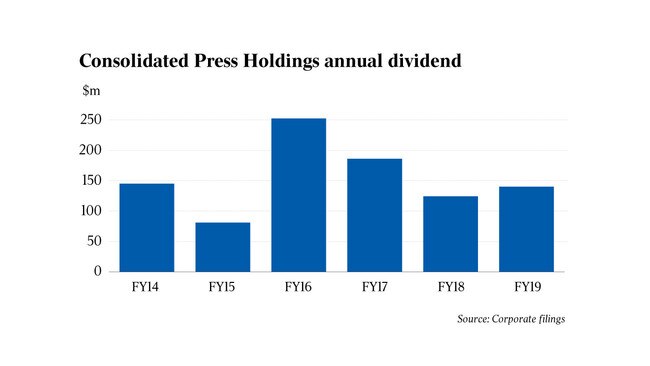

The company increased its unfranked dividend payments to $140m, up from $124.2m a year ago. But they remained below the $186m paid in 2017.

The accounts confirm that CPH received $880m in cash from Mr Ho’s Melco Group on June 6, the first tranche of the Hong Kong billionaire’s purchase of half of CPH’s shareholding in gaming company Crown Resorts. The sale was unconditional and not subject to Mr Ho and Melco passing any probity inquiries.

READ MORE: What might bring James Packer back to Australia? | Ho’s casino gamble not paying off

But the accounts also note that as at June 30, 2019, “based on the signed Share Sale Agreement at that time, CPH recorded the sale of the remaining 50 per cent (Tranche 2) as a receivable of $880m as the risks and rewards had passed to the buyer at that point of time”.

The agreement was amended in late August following an inquiry into the purchase by the NSW Independent Liquor and Gaming Authority to investigate Mr Ho’s links with his father Stanley Ho.

The sale of the second tranche will now only proceed if there are no adverse findings against Mr Ho and the purchase is approved by gaming regulators in Victoria and Western Australia.

“Management have taken the view that the amended agreement provides a new condition that arose after the reporting period and therefore is not an adjusting event,’’ the accounts say.

It remains to be seen if ILGA seeks to reverse the sale of the first tranche if it finds Mr Ho or Crown is not suitable to hold a licence for the $2.4bn Crown Sydney development.

Borrowings from subsidiaries within the CPH group fell from $6.8bn to $3.5bn over the past year, which CPH finance director Michael Johnston — who is also a director of Crown — said was the result of a major restructure.

In the middle of last year, as he battled a mental health crisis, Mr Packer resigned from all 22 of his Australian corporate directorships, including CPH.

However he remains director of the Bahamas-registered Consolidated Press International Holdings, the ultimate parent company of the CPH group.

“We have been going through a simplification process across the group. So we have liquidated 40-50 entities over the past two years,’’ Mr Johnston told The Australian on Thursday.

“We still have more than 40 companies in the group and we intend to keep reducing that.

“The net asset position of the company has increased slightly over the past year and we are in good financial shape with no net debt.”

Net asset position

The group’s only third party debt is $593m in long-dated notes in the US private placement market flowing from Mr Packer’s 2015 division of the family empire with his sister Gretel. But following the Crown share sale to Mr Ho, there is significant cash in the group offsetting that liability in an entity known as CPH Crown Holdings that holds CPH’s Crown investment.

CPH’s net asset position rose from $4.43bn to $4.52bn over the past year following an increase in the value of investments in its $140m private equity portfolio.

As part of that portfolio CPH is an investor in Uber, alongside the Paul Bassat-led venture capital firm Square Peg Capital. Both invested before the ride-sharing group listed on the New York Stock Exchange in May with a valuation of $US80bn.

The shares are now 20 per cent below their closing price on the first day of listing.

The Uber holding is part of a CPH US stock portfolio of around half a dozen stocks, which generated profits from share sales of $38m last year, according to the CPH accounts.

CPH has around $95m directly invested in Square Peg and co-invested with the venture capital firm in a range of companies, including Israeli freelance marketplace Fiverr, southeast Asian property portal PropertyGuru, and Singaporean search engine Wego.

CPH also has a separate investment in Terra-Firma, the European private equity group owned and run by billionaire Guy Hands, who is a friend of Mr Packer’s.

Terra Firma is in the process of unloading its investment in the nation’s biggest privately-owned cattle company, Consolidated Pastoral, which is being purchased by Mr Hands and the company’s management.

During the year CPH sold its investment in Bondi Beach’s iconic Icebergs Dining Room and Bar when advertising mogul John Singleton offloaded the leasehold in the property for about $15m in April to the Melbourne hospitality business O’Brien Group.

In August last year Mr Packer offloaded his Bondi Beach apartment across the road from Icebergs for $29m to Sydney property investors Roy and Anthony Medich.

CPH also owns a 40 per cent stake in Mr Packer’s first wife Jodhi Meares’ swimwear business called The Upside, as well a stake in peer-to-peer lender SocietyOne, which also counts News Corp, the publisher of The Australian, as an investor. CPH also has a stake in the South Sydney rugby league club.

It retains an interest with Hollywood actor Robert De Niro in a $US250m luxury resort project called Paradise Found Nobu on the Caribbean Island of Barbuda, which is still to be developed.

It also owns a block overlooking the Sea of Cortez, 10 minutes from San Jose El Cabo in Mexico, where Mr Packer is building a holiday home, and other properties around the world.

Construction has slowed in the Cabo house over the past year after Mr Packer took delivery in July of a famed 108-metre yacht named IJE, in honour of his children Indigo, Jackson and Emmanuelle, whom he had with his former wife Erica Baxter. It was built by the Benetti shipbuilders over six years at a cost of $170m.

CPH’s accounts lodged with ASIC are not consolidated, so never give a complete picture of Mr Packer’s wealth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout