Packer says Crown had no choice but to exit Macau

James Packer says his casino group had no choice but to sell out of Macau once Crown staff were arrested in China.

James Packer says his Crown Resorts casino group had no choice but to sell out of Asian gaming company Melco Crown Entertainment once Crown’s staff were arrested in China last year, and that he feels “let down” over the scandal.

In an interview with The Weekend Australian, Mr Packer also suggested Robert Rankin’s tenure chairing Crown and running the Packer family’s private company, Consolidated Press Holdings, was hijacked after CPH was forced to take on significant debt to provide Mr Packer’s sister Gretel with the liquidity she was seeking from their late father’s estate in 2015.

But he said CPH’s costs were too high during Mr Rankin’s time running the company and were now being reduced under a “back to basics” approach adopted by new chief executive Guy Jalland and Crown executive chairman John Alexander.

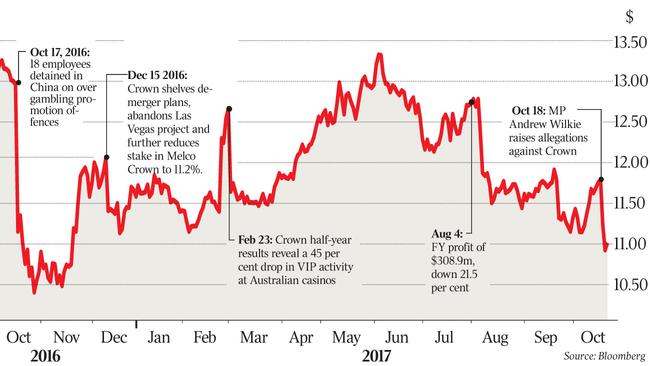

Eighteen Crown staff, including the head of its international VIP business, Jason O’Connor, were arrested last October for alleged “gambling crimes” after defying warnings from the Chinese government about a crackdown on foreign casinos marketing their properties directly to its citizens on the mainland. Mr O’Connor and Australian-Chinese dual citizens Jerry Xuan and Jenny Pan Dan were subsequently handed 10 and nine-month jail terms and were released in August. Crown also agreed to pay a $1.67 million fine.

Crown’s two most senior executives, Mr Rankin and managing director Rowen Craigie, stepped down from their roles in January and February this year.

“I definitely feel let down,’’ Mr Packer said, without referring to either directly.

“I wasn’t on the board at the time, but it is pretty clear Crown should not have been put in the position it found itself.”

Crisis management experts have claimed that, for all Crown’s faults and failures in risk management in the lead-up to the arrests, its successful response could become a template for companies that end up on the wrong side of the law in China.

“The company got Jason and his colleagues out of jail. There were lots of people who predicted it would take longer,” Mr Packer said.

“And my view, not being a director at the time, was that Crown had little choice but to sell our shareholding in Melco Crown once our staff were arrested in China.”

He stressed his view was a personal one and had no impact on the Crown board’s decision. And that he remains positive about the future of China.

“Crown’s experience in China has been very profitable but ended in a very embarrassing way.

“China has been kind to me financially. I regret deeply that Crown is no longer a shareholder in Macau,” he said.

“But with those caveats, I think China continues to lift more people out of poverty than any country has in the history of the world, and continues to be a bigger and bigger player in the world.

“Australia needs to continue to increase its engagement with China.”

Crown has paid a heavy price following the arrests as its lucrative VIP business has since halved.

In January Mr Packer returned to the Crown board, installed Mr Alexander as executive chairman and Mr Jalland as CPH chief executive. The latter is now also a Crown director.

The move answered critics who had questioned the management of Crown since Mr Packer stepped off its board in late 2015.

While Mr Rankin is said to have played a key role in ensuring Crown adopted a “whatever it takes” attitude to get its people out of jail in China, and stayed on as a director earlier this year after stepping down as chairman to assist in working with the Chinese authorities, investors remain critical of his time at the helm.

Mr Packer had hand-picked Mr Rankin at the end of 2014 from running Deutsche Bank in London, to run his public and private companies. But he was criticised by investors for travelling extensively between his homes in London and Hong Kong and to other parts of the world, and for not spending enough time in Australia until the final part of his tenure.

There were also question marks about a blowout in CPH’s expenses during his period as chief executive.

Mr Rankin declined to comment, but his supporters have previously claimed his travel related to his work on a potential privatisation of Crown, the sale of Crown’s Melco Crown investment and Crown’s proposed demerger, which was scrapped late last year.

At CPH Mr Rankin also hired former high-profile Scientology spokesman Tommy Davis to be based at a CPH office in Santa Monica near Los Angeles, to assist Mr Packer’s work with the RatPac film production group.

It is believed Mr Packer initially employed Mr Davis as his new personal assistant following the departure of his long-serving PA Jacquie Murray at the end of 2015.

But the Santa Monica office and other CPH international offices have since been dismantled by Mr Jalland and Mr Alexander, who have also been slashing Crown’s cost base in response to the collapse in VIP revenues. Mr Davis is no longer with CPH.

“What was hard for Rob was, my balance sheet fundamentally changed from the time I employed him in December 2014 and then we were forced to deal with Gretel literally before Rob started work,” Mr Packer said of the initial request from his sister at the end of 2014 to divide her father’s estate with her brother.

“My balance sheet went from one with a bit of spare capacity to one which was overstretched. That made it difficult.”

Asked why a privatisation of Crown failed — the casino group reportedly talked with private equity firms Blackstone, TPG, Apollo and several Canadian pension funds on the deal during 2015 — Mr Packer simply replied: “We couldn’t raise the money ... I am not fussed”.

It is understood the deal would also have allowed CPH to take advantage of significant tax losses within its corporate structure. While the finance is said to have been available, it was not at a price acceptable to Mr Packer.

He said Mr Jalland was focused on getting both CPH and Crown “back to basics”.

“I trust Guy (Jalland) completely. Guy agrees with me that we are not trying to do deals, we are not trying to pretend we are bigger than we are. And we have to run the businesses we have got well, focus on getting costs down, the CPH head office costs have been too high.

“It is a back-to-basics approach,” he said.

Some investors still worry about other legacy deals from the Rankin era, like Crown’s purchase of stakes in Robert De Niro’s Nobu restaurant and hotel chain, and the Packer family’s Ellerston property in NSW. The second is now in the process of being unwound. But some argue Nobu looks like an overhang from Mr Packer’s Hollywood era, where he invested in RatPac and was engaged to singer Mariah Carey.

Crown paid $141m for 20 per cent of Nobu in October 2015, just days after Mr Packer and De Niro opened the $4 billion Studio City casino in Macau, where the Hollywood actor starred in an elaborate, 15-minute promotional short film for the resort called The Audition, which reportedly cost $US70m to make.

The purchase valued Nobu at $US500m, yet some analysts still ascribe no value to Crown’s interest, given the lack of visibility on any earnings contribution it will make to the company.

The investment was attacked last year by the likes of then Crown investor Colonial First State as highlighting Crown’s corporate governance problems.

But Mr Packer said DeNiro and “all the Nobu partners have been terrific to me”.

“It’s been asserted that our $US100m investment is worth nothing. I am more confident than ever that we will not only get our money back but make a good profit on Nobu,” he said.

“Anyone who says Nobu is a dud investment doesn’t realise how much money it is making today, let alone its growth profile in both restaurants and hotels into the future. And Nobu is delivering an approximate 6 per cent dividend yield to Crown on its investment today.”

Despite his residing in Argentina this year, those inside Crown are said to have felt Mr Packer’s presence at the helm again since January, when he finally called time on the Rankin/Craigie era.

“James has a way of operating which is fairly agnostic as to his location. He doesn’t need to physically be here to be as connected to the business as he feels he needs to be,” said one observer. “He can be in other places and have less scrutiny of his life. Australia is not the place for less scrutiny.”

Crown’s investors also seem comfortable a stronger company is emerging from a troubled past two years, despite the latest scandal that emerged this week involving alleged tampering of poker machines by staff.

“With John Alexander, a stronger more disciplined company is operating. Crown now has conservative financial settings which are necessary to build Sydney. Crown is now almost back to its roots of a pure play, Australian- focused casino operator,” said Yarra Capital Management managing director Dion Hershan.

“Perth and Melbourne are both weak for cyclic reasons but continue to be great assets. The long-term thesis around Crown being leveraged to the rise of the Asian Middle class, even without Macau, is still valid.”

Mr Packer said while the company had sold its stake in Melco Crown Entertainment and abandoned its plans for a casino development on the Las Vegas strip, he had been determined to retain a significant shareholding in Crown.

Over the past year he has sold only small parcels of Crown shares and instead focused on offloading other assets to pay down debt, following the agreement struck with his sister.

The settlement agreement was reportedly worth $1.25bn.

“From a pure financial point of view, I should have sold Crown when I sold our media businesses (in 2006 Mr Packer sold the Nine television network and ACP magazines to a private equity fund) and invested with the likes of (Magellan’s) Hamish Douglass, (Caledonia’s) Will Vicars and (Macquarie Group’s) Ben Brazil. But I always wanted to have an operating business and I still have a business,” Mr Packer said.

“Good luck to my sister and she might compound at a much higher rate than I do. But I still have a business and I have sold all my other assets so I can keep the business. I prefer to have a business that one day my kids can go into.

“It may not be as big as I hoped it would be. But it still a very meaningful business with Perth, Melbourne and Sydney. Changing precincts in cities is an incredibly exciting thing to be a part of.”