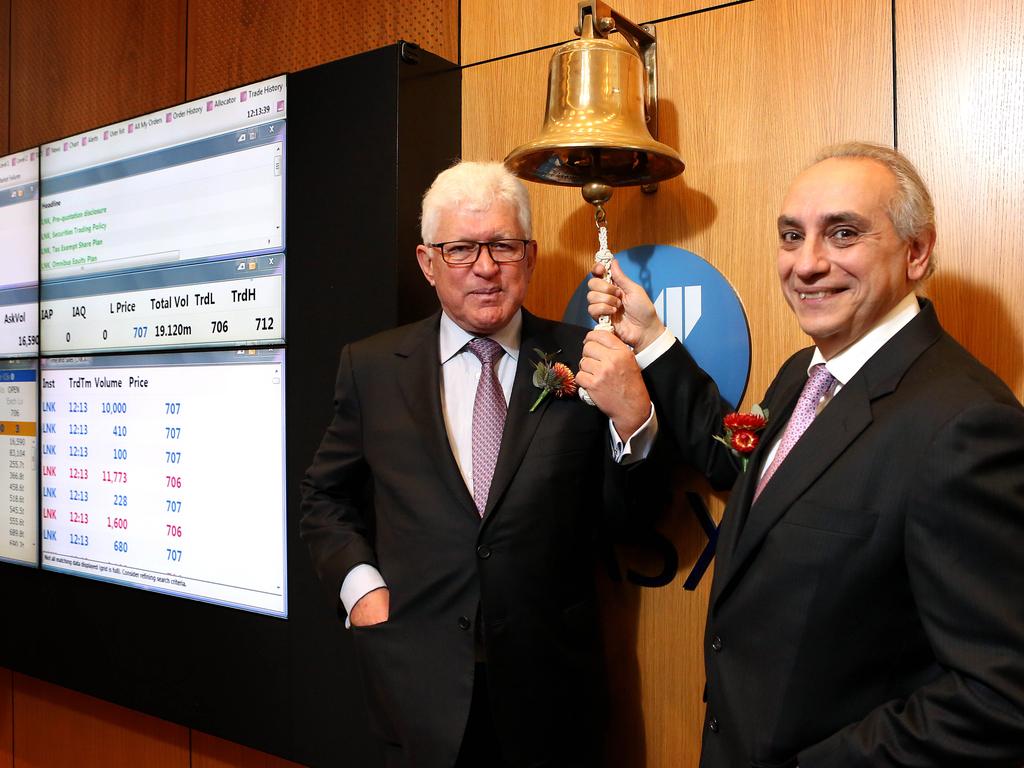

Registry services business Link was one of PEP’s star assets, a 10-year workout that was floated for $6.37 a share, or $2.7bn, in 2015.

On Monday, PEP teamed with Carlyle for a $5.20-a-share bid for the same asset, and even offered to sell its prized 44 per cent stake in electronic conveyancing unit Pexa back to shareholders.

Suffice it to say the offer as it stands is not serious and Link chairman Michael Carapiet should demand a realistic offer before opening the due diligence door.

To be fair, since floating the stock has not exactly been a superstar, underperforming the market by 35.2 per cent.

There are two big shareholders, in Perpetual with just over 10 per cent and Yarra Capital with just over 7 per cent, and they hold opposing views on the stock.

Yarra’s Dion Hershan is fresh to the stock, having built it in the past few months, at a considerably lower entry price, and is consequently bullish particularly on Pexa, which he regards as one of the quality technology assets in the market.

Perpetual’s Paul Skamvougeras is a long-term holder who has clearly lost confidence in the stock from the board down to some problem assets. His bottom line is to put the company into play and see what happens.

This is a classic market battle with two big holders with opposing views.

For starters, Link’s Carapiet will want to know exactly what is meant by the offer to shareholders to keep the Pexa electronic conveyancing assets.

On face value Pexa is worth $2.5bn, which means Link’s 44 per cent share is worth $1.1bn, or about $2.07 a share, which means private equity will give shareholders $3.13 a share for the old Link assets.

They are expected to earn about 28c a share, which means at $5.20 a share less the Pexa stock, private equity is offering 11.5 times for the Link assets in a market trading at 17 times.

Maybe Link is a dog and shouldn’t be traded any higher after jumping 25 per cent, or $1, to close at $4.99 a share on Monday.

This is a stock that in the past year has traded between $2.64 and $6.98, so Perpetual’s frustration is not without some explanation.

This bid comes in the wake of the imminent retirement of Link’s highly regarded boss, John McMurtrie, and political intrigue surrounds his replacement, Vivek Bhatia. The proposed deal also comes in the middle of a pandemic sweeping hard back through Europe and at a time when regulatory changes have softened earnings.

McMurtrie is still on the job with Bhatia, yet to formally take over so the long-time boss will be handling the bid along with chairman Carapiet, who as a former head of Macquarie Capital has been involved with plenty of takeover battles.

“Caras”, as Carapiet is known as to his friends, made his name in the infrastructure game with former Macquarie boss Nicholas Moore. Having spent 19 years building the business, McMurtrie’s proposed November 1 exit date is now on hold and he will stay on as an adviser.

To say the bid is opportunistic is more than an understatement.

Link is being advised by Macquarie and UBS, while PEP and Carlyle are being advised by Jarden, which of course is manned in part by some former UBS bankers like Robbie Vanderzeil and soon Aiden Allen, along with former Goldman ECM executive Sarah Rennie.

Link provides administration services to superannuation funds among other businesses and government efforts to manage through the pandemic have included the offer of early withdrawal of superannuation, which in some cases has cleared out accounts, while the long-term push to consolidate funds also means a business like Link, which earns money per account holders, loses funds.

This in part explains why its most recent profit underwhelmed.

Activity in terms of equity capital market and mergers and acquisitions are also down this year, which also hurts Link’s performance.

Its stake in Pexa is considered its best growth option, but in some respects while everyone wants growth, private equity works best by creating its own well-placed leverage, but the digital assets are already well placed.

Australian shareholders have little patience for offshore investments that don’t immediately turn to gold, and Link has had its share of dogs that are a work in progress.

These include the $1.5bn Capita business, which opened the door to the UK market in both registry services and funds administration.

Link has technology challenges in many places, including of course on the ASX, which sometime in the next decade will move to its CHESS replacement clearing and settlement system.

Pexa is an electronic conveyancing business with real competition — thanks to the ACCC — in the shape of ASX and InfoTrak- backed Sympli, which means its earnings potential may be capped.

The potential offer was handed to Link’s Carapiet on Saturday and the traditional private equity-listed company dance has only just begun.

Step one is to clarify exactly what is meant by the Pexa divestment, then talks can start on the potential offer, with Carapiet sure to play a cautious game to keep potential interest without opening the door too quickly.

An actual bid has yet to be lodged and depends on what due diligence might uncover, which is why the starting price is important.

But first, PEP and Carlyle have to get serious about the price they put on the table, because $5.20 a share isn’t even close.

IFM’s green push

In November last year, IFM spent $15bn buying a US oil pipeline and storage business that didn’t win many friends in the ESG movement. On Monday, new IFM boss David Neal laid down a map to being carbon neutral by 2050 with a new task force designed to look at each asset and investment to meet that target.

IFM is already committed to removing 200,000 tonnes of carbon from its assets by 2030. That is the equivalent of taking 70,000 cars off the road.

Neal defends the Buckeye deal saying the assets are essential assets in transition and better off under responsible management.

He also noted IFM is developing solar farms on the 280ha of land that came with the deal.

IFM also has a joint venture with Trafigura investing in renewable energy.

Only private equity could, with a straight face, bid for an asset at a price less than it floated the business for five years ago, but that is precisely what Pacific Equity Partners and Carlyle are doing with their $2.8bn bid for Link Group.