Online retail giant Kogan in hunt for acquisitions

Online marketplace Kogan.com is building a $115m war chest to take advantage of any retail shakeouts caused by the health crisis.

Online marketplace Kogan.com, whose shares have almost tripled in the past year as it benefited from an online shopping bonanza during the coronavirus pandemic, is building a $115m war chest to take advantage of any retail shake-outs caused by the health crisis.

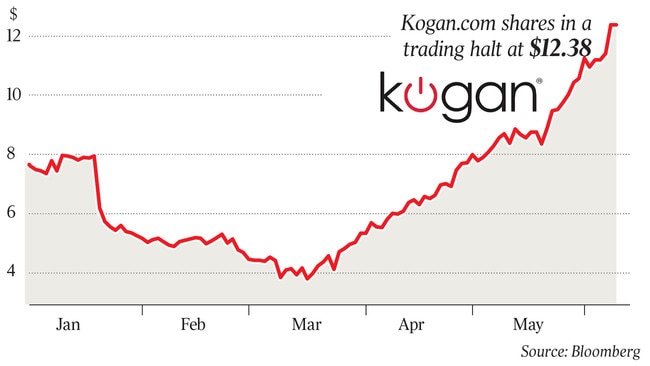

Kogan.com, whose shares listed four years ago in an IPO that priced the stock at $1.80 per share, was in a trading halt on Wednesday as it organised a $100m institutional placement struck at a price of $11.45, to be followed by a share purchase plan to raise another $15m. The shares last traded at $12.38.

The company told the ASX it planned to use the funds to “provide financial flexibility to act quickly on future value-accretive opportunities that broaden the company’s offering, expand its customer base or enhance its operating model’’.

The online retailer has shown interest in scooping up embattled retailers that have prized assets such as valuable brands or an extensive database of customers.

Last month, it acquired furniture retailer Matt Blatt, which broadened its exposure to the online furniture market. In 2016, it bought the online business of failed consumer electronics retailer Dick Smith.

Now it looks like Kogan.com, under the leadership of its founder and chief executive Ruslan Kogan, is keen to play a leading role in any consolidation of the retail sector as the industry endures a tumultuous trading environment caused by the coronavirus pandemic.

“Kogan.com is well positioned to take advantage of current market conditions, given the company’s ability to extract synergies through its leading proprietary systems, diversified supply chain and low cost of doing business,’’ the company said.

“Management have a strong track record of acquiring and integrating iconic Australian retailers such as Dick Smith and Matt Blatt. Kogan.com is able to drive value from acquired businesses that have a strong brand by leveraging its existing systems, processes, supply chains and technology.’’

Mr Kogan said the company was committed to making the most popular products and services more affordable, with a corporate focus on growth.

“Our long-term strategy has enabled us to thrive in the current challenging environment, and we are now in a better position than ever to take advantage of growth opportunities,” he said. “Our low cost of doing business and digital expertise have put us in the driver’s seat to capture market share as the retail industry undergoes significant change.”

In a financial update accompanying an investor presentation on the capital raising, Kogan.com said gross sales were up 103.6 per cent year-on-year across April and May, while adjusted EBITDA was up 219.3 per cent.

It said between the IPO in July 2016 and June 2020, the company had delivered a total shareholder return of 654.5 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout