New Crown CEO Steve McCann not told of tax underpayment until June

Crown CEO Steve McCann read about the casino group’s potential tax liability through a newspaper article.

Crown failed to inform its new chief executive Steve McCann that it may have underpaid more than $270m in taxes until June 7, reflecting a culture at James Packer-backed group where staff are afraid to escalate “bad news”, a royal commission has heard.

The growing controversy of who knew what about the tax issue has also been magnified by the question of how much Crown owes, with the Victorian royal commission into the company learning the former Lendlease boss told the Victorian government the liability was just $8.8m.

On Tuesday it was heard Mr McCann, who began his tenure at Crown on June 1 and is set to become a Crown director, did not learn of the underpayment until a week later when it appeared in a newspaper article, despite several senior directors and executives having knowledge of the issue.

“Is it surprising you weren’t told about it until June 7, and the way you came to know about it is someone from corporate affairs sent you a newspaper article?” said counsel assisting the commission Meg O‘Sullivan.

Mr McCann replied: “I don’t think it was surprising, I think it was disappointing now that I know what I know.”

“But at the time there was a lot of activity around trying to disclose everything required to be disclosed for the purpose of the commission. People we’re trying to bring up to speed on a lot of things.”

Mr McCann also said he could not be briefed on “non-public information” inside Crown until after his employment began, given the strict rules around ASX disclosure requirements and denied his failure to be informed represented a culture where “people do not escalate, or are scared to spread bad news.”

It was previously heard the tax issue arose from a practice of deducting the cost of deducting loyalty benefits like free hotels, dining and parking from poker machine revenue, with an internal spreadsheet seen by the commission indicating the liability could be $272m.

Mr McCann said Crown had received new legal advice on what deductions may be legitimate or not, as well as the input of consulting groups EY and KPMG, with Crown promising to pay the amount owed to the state government plus interest.

The commission then examined a letter Mr McCann wrote on July 1 to the Victorian Department of Treasury and Finance with input from Crown CFO Alan McGregor.

It said based on the recent legal advice, Crown calculated the liability at around $8.8m – despite the legal advice indicating it could be higher.

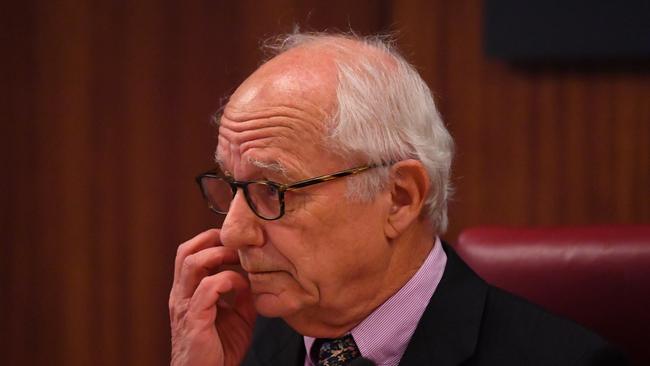

“Do you think this was an honest letter to write when you had advice from counsel that was problematic and suggesting – that at least in counsel’s view – the amount at issue, from that counsel’s perspective, might have been three times this figure?” Commissioner Raymond Finkelstein asked.

“All I can say commissioner is that I was honest when I wrote this letter,” Mr McCann replied.

Ms O’Sullivan asked Mr McCann if he knew when writing the letter Crown had received legal advice multiple times since the practice’s implementation in 2012 that would indicate the liability being higher.

“No I did not,” Mr McCann replied, adding that Crown had sought further legal advice on the issue.

On Monday Crown Melbourne CEO Xavier Walsh told the commission he did not believe the tax liability would exceed $40m, with the $272m figure deriving from an incorrect reading of the internal spreadsheet.

Mr McCann said he also believed the $272m figure was incorrect, and that Crown had currently two different “most likely” amounts based on legal advice and intended to pay the higher one.

Later in the day Mr McGregor appeared before the commission, and was told to calculate a figure based on the categories counsel assisting Penny Neskovcin thought were likely incorrectly deducted.

“I want you to assume that in closing submissions counsel assisting in this commission will submit that Crown had at minimum underpaid tax from the perspective of bonus jackpots, being those three components that I mentioned, and also in respect in match play,” she said.

Mr McCann rounded out his appearance in the afternoon with an emotional testament to Crown’s cultural reform, saying he had been encouraging employees to voice their concerns.

“There is a very significant population at Crown who are crying out for the ability to speak up, the ability to be involved, the ability to restore the pride to the organisation that they used to feel but currently is obviously challenged, because their family and friends are struggling with what’s going on,” he said.

“To me, when I say there is a culture of openness and transparency that I've walked into, that’s my experience.”

This sentiment was echoed by Nick Weeks, former Chief Operating Officer at the NRL who was appointed the executive general manager of Crown’s transformation and regulatory response in March after he offered his services to the company.

“In my experience in life, the quality of people in organisations are key and if you have people in organisations that care about their reputation, that have strong ethical grounding, that understand their role and have good judgment, that’s a good starting point,” he told the commission.

“I think the company hasn’t had that historically, but it has that now.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout