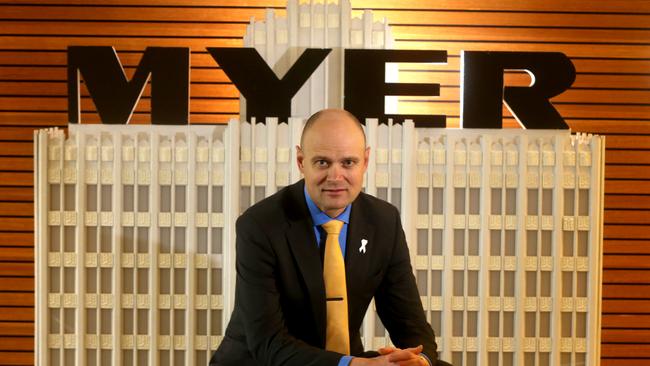

Myer CEO keeps the faith as shares tank following fresh profit warning

Myer’s CEO has pledged to stick with his turnaround plan, as Solly Lew’s Premier says new warning shows it’s in “peril”.

Myer chief executive Richard Umbers has refused to be drawn on whether he has offered his resignation to the board after overseeing a third profit warning since launching a $600 million turnaround strategy in late 2015, and has put up a spirited defence, pledging he can’t “lose faith” and that he is “getting stuck in”.

Mr Umbers said he and his Myer (MYR) team weren’t the kind of people to be thrown by setbacks.

“We have to keep our eye on the prize, even though right now in the context of this result that might seem way off, it is interesting that we are still making really good progress on so many elements of the strategy but getting on with it is really the important thing here.

“What we have got to do is not be interrupted because of what has happened, we need to actually get on with it and really trade the business hard.”

Speaking to The Australian this morning after Myer unveiled a shock profit downgrade off the back of worsening sales in December and January, Mr Umbers hinted he wasn’t going anywhere just yet and emphasised his commitment to his “New Myer” strategy despite horrendous retail conditions laying waste to the department store’s earnings.

“I can’t lose faith in what we are trying to achieve here, and we have got see through the strategy and make sure that we use occasions like this to really make sure that we are putting the right amount of emphasis into changing the business,’’ Mr Umbers said as shares in Myer collapsed 10 per cent to new lows in the wake of the souring earnings outlook.

Pressed if he had offered his resignation to the Myer board given he has presided over three profit warnings since June, Mr Umbers — a former officer in the British Army — showed no signs of surrender.

“This is about getting stuck in actually,’’ Mr Umbers said.

“Realising when you have a setback, as this indeed is, but we are not the kind of people to get thrown by setbacks we need to get stuck in and start sorting out some of the issues and make sure we are getting the balance right between delivering the short term results and staying committed to the strategy in the longer term.’’

“My employment is a matter for the board and for the chairman, my job is to be really in touch with the business to make sure I am very close to what is going on and make sure that we have a really good understanding of what is going on in the business and get struck in with sorting out the issues. And that has been my focus through this whole journey.’’

The dour news for Myer’s profit, balance sheet and the further commentary that it doesn’t see any improvement in conditions in the second half will only serve to provide more ammunition for billionaire and major shareholder Solomon Lew who this week kick started his campaign to turf out the entire Myer board.

In a statement this afternoon Myer’s biggest shareholder, Solomon Lew’s Premier Investments, issued an alert to shareholders to “unite to save the company from its failed board”.

Premier said Myer was now in “peril”.

“As Premier has said from the outset, the numbers don’t lie. Today’s numbers show that the disastrous sales and profit decline within Myer is accelerating.

“Myer is now in peril and shareholders must urgently unite to save the company and what is left of our investments. Premier will caucus with other significant shareholders in order to reconstitute the entire Myer board. Following shareholder discussion, a board comprised of a majority of independent directors would be put to a proposed EGM of all shareholders.’’

Earlier this week Premier said it would soon call an EGM to eject all Myer directors.

Umbers said there were some positive signs within the business among the turmoil, including slimmer inventory positions, cost cutting, an improved Myer One loyalty scheme, better use of data and 48.9 per cent first half growth in Myer online sales.

“These are all demonstrating the progress we are making here, and for me it’s about making sure we do stay true to that and committed to the long term strategy. But I absolutely recognise that in the short term we have got to trade the business hard and make sure we are really responding to the trading conditions … and it’s a tough market.’’

In 2015 Mr Umbers unveiled his “New Myer” strategy, promising to return growth to Myer’s flatline sales and earnings and directing $600m of investment into its stores, online platform and operations.

Myer has nearly $1 billion in intangible assets on its balance sheet, with the company admitting this morning it is starting to review the carrying value. This could threaten its banking covenants.

The shock profit warning could encourage other investors to join with Mr Lew, who is seeking to call an extraordinary general meeting to kick out all Myer directors, and is also expected to send Myer’s already weakened share price into another nose dive.

After profit warnings in June and December, Myer has now unveiled its third earnings downgrade in the face of some of the worst conditions for the retail sector in decades.

Myer said this morning in a statement to the ASX that after like-for-like sales were down 5 per cent in the first two weeks of December, that its trading during the key stocktake sales period was also below expectations with total sales for January down 6.5 per cent on the previous corresponding period.

Total sales for the first half of 2018 were down 3.6 per cent to $1.719bn, the company said, and down 3 per cent on a like-for-like sales basis. Myer said despite the sales shortfall through December and January, it remained comfortable with the quality of its inventory.

“The significant deterioration in trading reflects ongoing challenging retail conditions with widespread industry discounting, a subdued performance of Myer’s stocktake sale and a continued shift in consumer behaviour characterised by reduced foot traffic and an increase in online shopping,’’ said Myer chief executive Richard Umbers.

As a result of this worsening sales performance, Myer expects first half 2018 net profit to be between $37m and $41m before implementation costs and other significant items.

Myer is also assessing the carrying value of its assets on the balance sheet, which could take a significant impairment. Only a few weeks ago David Jones impaired its own assets by more than $700m due to poor retail conditions.

Myer also said it didn’t expect any improvement in retail trading conditions during the second half, given recent sales volatility. Myer cant provide a profit range for the full year at this time, it said.

“Myer recognises the ongoing, challenging and competitive retail conditions and remains resolutely focused on improving foot traffic and sales across all channels during the second half including the need to remain competitive in key categories where we are facing the most competition.’’

Myer chairman Garry Hounsell said he recognised that shareholders will be disappointed with the announcement.

At 12.50pm (AEDT), Myer shares were down 8.91 per cent at 58.75 cents.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout