Murray Goulburn takes bigger bite of rival Warrnambool

MURRAY Goulburn has boosted its stake in rival Warrnambool Cheese and Butter to 14.5pc, but denies it is planning a takeover bid.

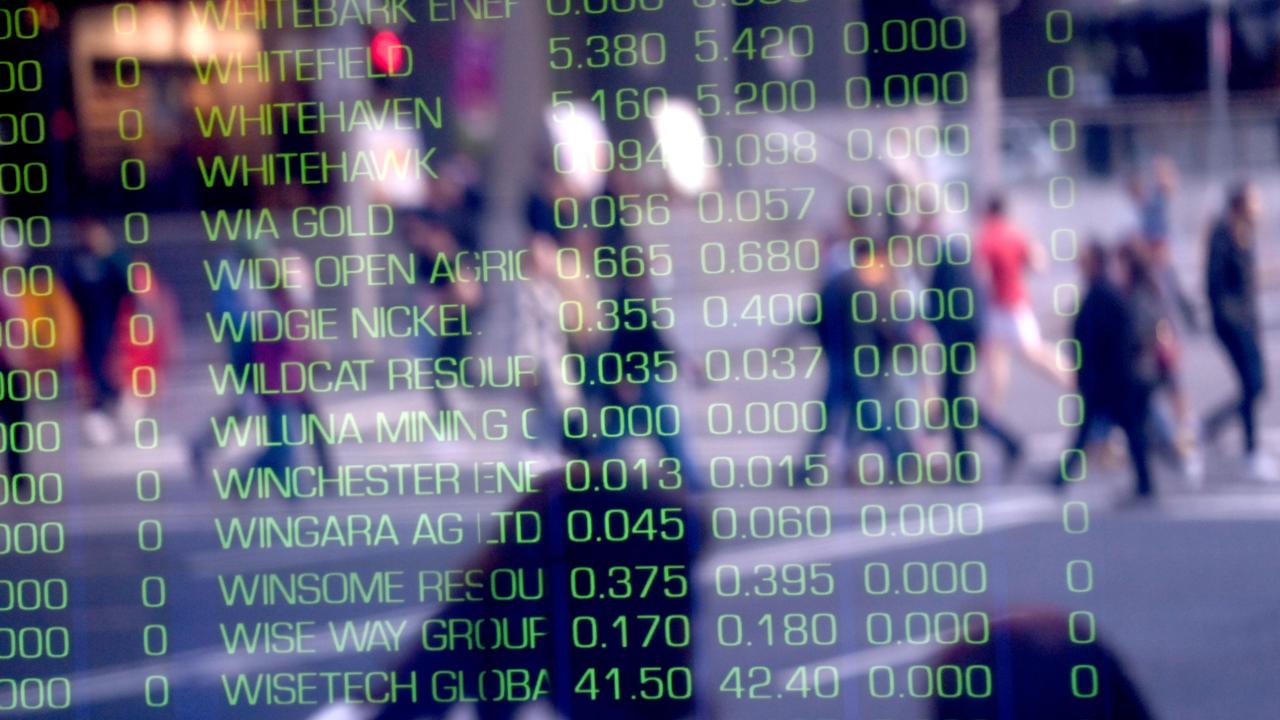

MILK-PROCESSING co-operative Murray Goulburn has outlaid $5.5 million to boost its stake in smaller listed rival Warrnambool Cheese and Butter to 14.5 per cent, but denies it is planning a takeover offer.

Murray Goulburn said it had acquired 1.2 million shares in WCB at $4.60 apiece today, boosting its stake from 12.0 per cent to 14.5 per cent.

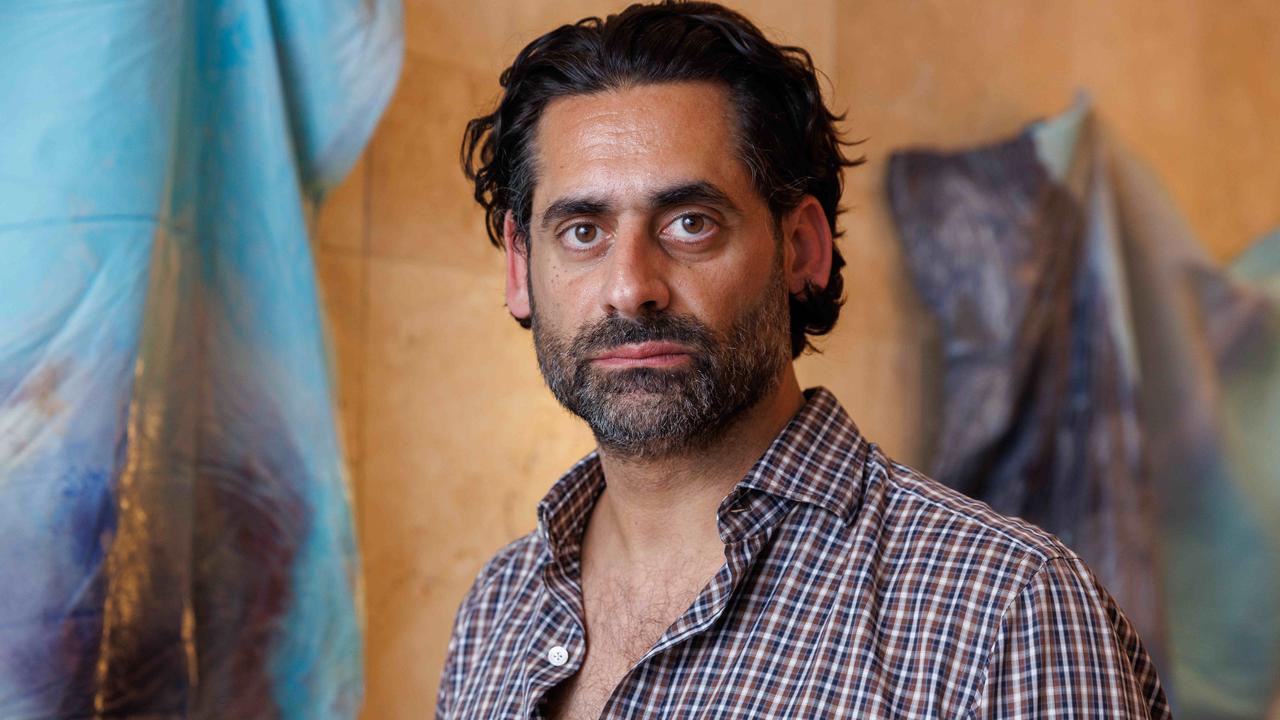

Chief executive Gary Helou described the purchase as a “strategic investment”.

“There is no current intention to make a takeover offer for WCB, nor do we currently intend to seek board representation,” he said.

“The acquisition of these additional shares and the increase in our stake to 14.5 per cent is a reconfirmation of Murray Goulburn’s commitment to its long-term investment in WCB.”

However Murray Goulburn is now offering to acquire additional shares in WCB at the same price, with the potential to take its holding up to a maximum 19.9 per cent – the limit it can hold before being forced to make a takeover offer for the entire company.

“There is however no assurance Murray Goulburn will acquire any further shares in WCB – Murray Goulburn is satisfied with its 14.5 per cent stake,” the company said.

The $4.60 purchase price is an 18 per cent premium to WCB’s volume-weighted average share price over the past 30 days, and a 16 per cent premium to its most recent trading price of $3.98.

Mr Helou has said he wants to grow Murray Goulburn's annual revenue from its current level of $2.2 billion to at least $4 billion, making it one of the 20 biggest dairy processors in the world.