Bank bosses, like any chief executive, would rather have a strong economy rather than a weak one and, to the extent it’s measured by booming home loans, they would rather Canberra be aware of all the good work they have done in boosting their profits by lending more into the housing boom.

Bank returns on equity for existing loans run as high as 69 per cent, according to Jefferies analyst Brian Johnson, with returns running down to 17 per cent for fixed-rate loans from a mortgage broker. The point is the big banks make their money in housing booms and make most from people who sit and accept the mortgage rate on offer rather than seeking better terms.

Last week’s cut in the unemployment rate to 5.6 per cent was indeed welcome, but the bank bosses did overstep the mark by calling it miraculous.

At last count, on IMF figures, government handouts to boost the economy accounted for 16 per cent of GDP and totalled some $232bn.

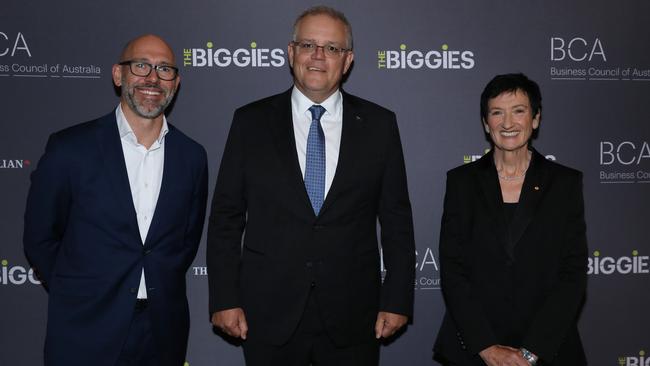

Throw in record low interest rates and persistently high iron ore prices and little wonder BCA chief Tim Reed noted on Monday night “the task at hand remains far from complete”.

In other words, the government responded superbly to the pandemic impact and should be commended but hopefully, vaccines willing, the worst is over and wasn’t as bad as was expected.

The economy has enjoyed the massive boost to liquidity, but some chief executives privately warn the real fear a couple of years down the track is asset valuations.

The coming budget will test the government’s preparedness for real reform — starting, as Reed said, “to improve the economic security of women in our community, including through childcare and paid parental leave reform”.

The reform list cited by Reed included “encouraging greater investment in projects that transform our economic base, including accelerating decarbonisation — allowing us to not only achieve net zero emissions by 2050 [but also] creating new, clean, export industries and thereby assist other countries decarbonise”.

Then there are the long-running calls to ensure people “have the skills for the jobs of today and tomorrow”, moving to ensure Australia is “a leading top five digital nation by 2030” and “getting better at commercialising our research so it can contribute to our prosperity”.

These are under way, but let’s not congratulate ourselves about an economic recovery built on excessive liquidity and instead work for more sustainable solutions.

Crown desperation

There was a look of desperation in Crown Resorts chair Helen Coonan’s decision to release Oaktree’s purported offer to help the company, which may do something to help James Packer but frankly not much for anyone else.

The good news is the offer showed some wider interest in Crown that may one day lead to a higher offer and the $12-a-share price is a step above the $11.85-a-share offer from Blackstone.

But shareholders contacted on Monday were perplexed as to just why Coonan decided to release the proposal in the first place, saying it smacked of desperation and a board that has been attacked so much it’s doing anything to appease people.

The proposal, as best understood, is for Oaktree to lend Crown money to buy 37 per cent shareholder Packer’s stake.

This then would boost the value of other shareholders and rid the company of the governance nightmares.

The first question is, if a buyback is the answer, why wouldn’t the company do it itself to leverage the better returns?

Crown’s stock edged higher on Monday to $12, based on the early advice from the NSW regulator that suggests it is not being as tough as it could.

The more good news there is from the regulator, the better it is for all of Crown — including, but not restricted to, Packer. That is the crux of the Blackstone offer, which is to take the regulatory risk off the table for all shareholders.

Easy Medibank choice

Medibank chair Mike Wilkins had on some reckoning an easy choice in selecting David Koczkar as Craig Drummond’s replacement as chief executive.

As chief customer officer during Drummond’s term, he was directly responsible for the marked turnaround in the company’s ability to attract new members.

Five years ago the company was facing a 4 per cent fall in member numbers and in the last six month it increased policyholders by 44,000.

Drummond for one is quick to give his replacement credit for the turnaround, noting a leader’s job is to motivate his staff and give people the opportunity to do their job.

Drummond, it should be said, was a skilled leader who also helped lead the insurer’s push for reform from Canberra.

His day job now is to be president of AFL club Geelong, but a couple of other board seats will soon be revealed.

Neither will be on a bank board, with the former bank executive making clear he has zero interest in the sector, which he worries faces potential asset quality issues in the not too distant future flowing from the COVID-19 bailouts.

Wilkins in a statement praised Drummond’s work, saying the changes he had implemented “have resulted in improved advocacy, retention and growth of customer numbers, significant improvement in the products and services experienced by our customers and enhanced performance for our shareholders”.

Koczkar said in a statement: “Medibank plays an important role in our community, and my commitment is to ensure that we continue to meet these needs, with our people and our broad network of partners, in a manner that anchors to our values and purpose — better health for better lives.”

He will receive fixed pay of $1.5m, slightly under the stipend paid to Drummond.

Koczkar is a passionate fan of AFL side North Melbourne, which lost to Geelong at the weekend.

He said on Monday: “Medibank was a team effort and Craig (Drummond) had set his team up for success so the agenda from here will be more of an evolution.

“The battle ahead is to support members to get better care and more choices for treatment.”

There is a reason why big bank bosses go to Canberra and tell the government what a great job they are all doing — and it’s called talking their own book.