Michael Hill underpaid staff $25m

Crisis-plagued jewellery chain Michael Hill underpaid its staff by up to $25m over the past six years.

Daniel Bracken, the veteran fashion executive who quit troubled department store Myer in 2017 to turn up at jewellery chain Michael Hill in September, is adamant the retailer has “huge latent potential” despite discovering it had underpaid staff for six years and may have to pay $25 million in backpay.

It’s the latest crisis to hit the company, which runs more than 300 stores in Australia, New Zealand and Canada and has issued a string of profit downgrades in recent years, shrinking its share price by 70 per cent.

In 2018, its profit slumped by 85.9 per cent as its accounts were crunched by $25.5m in closure costs for its US and Emma & Rose businesses, and now it looks likely its 2019 profits will be wiped out by paying back wages to staff of between $10m and $25m after a glitch was found in its rostering and wages processes.

However, Mr Bracken has assured investors that Michael Hill can remain profitable after rectifying the underpayment of wages, which is believed to have been going on since 2013, and ensuring the business pays the proper level of wages to its staff from now on.

“I am absolutely thrilled to be here,” the chief executive said.

“I think this is a fantastic brand (and) it has got, in my view, a huge latent potential, and we have formed a strategy that we have shared much of with the market and I am excited about the strategy as it unfolds over the next 12 to 24 months,” Mr Bracken told The Australian.

“We have got a great business here. This is a profitable business, which will be even more profitable in the future.”

But for now Michael Hill is staring down the barrel of at least $10m in underpaid wages it must pay back to staff, which will include interest. This follows a review instigated by Mr Bracken with the help of PricewaterhouseCoopers, which uncovered irregularities and underpayments linked to retail employment contracts and rostering practices.

A more detailed look at employee records, rostering and payments was expected to take several months to complete and was estimated to mean a one-off cost in the range of $10m to $25m, the company told the ASX yesterday.

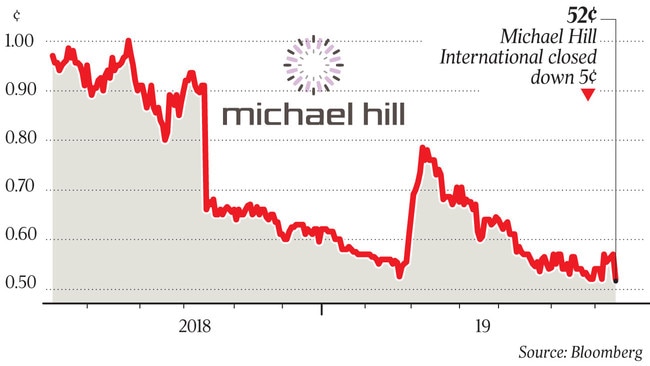

Shares in Michael Hill sank more than 12 per cent on the news and later closed down 5c, or 8.7 per cent, at 52c. The stock is down 30 per cent since March and almost 70 per cent since 2016.

“We will move as quickly as possible to rectify any underpayments with those team members affected,” Mr Bracken said.

“I will be in contact with all team members today to apologise on behalf of the company and to provide an outline of the process we are following to establish who is impacted.”

Meanwhile, in a trading update also supplied to the market yesterday, Michael Hill said it expected to book total same-store sales of $523.98m, down 3.5 per cent on the prior year, while total sales across all stores fell 4.5 per cent for the period.

“Even though we are experiencing an extremely competitive retail environment, particularly in Australia, with intensive competitor clearance-related activities and lower foot traffic, the company has continued to deliver improved sales momentum for the fourth quarter,” Mr Bracken said. There had been a general improvement in sales trajectory through the year — although it was still negative — with same- store sales growth falling 11 per cent in the first quarter, down 6 per cent for the half-year, weaker by 4.8 per cent for the nine months to March 31 and for the full year sales down by 3.5 per cent.