James Packer sells half of Crown stake to former partner Melco

Crown shares fall after the $1.8bn James Packer deal to relinquish control of his casino empire.

James Packer has signed off on a $1.8 billion deal that will for the first time see him relinquish control of his Crown Resorts casino empire.

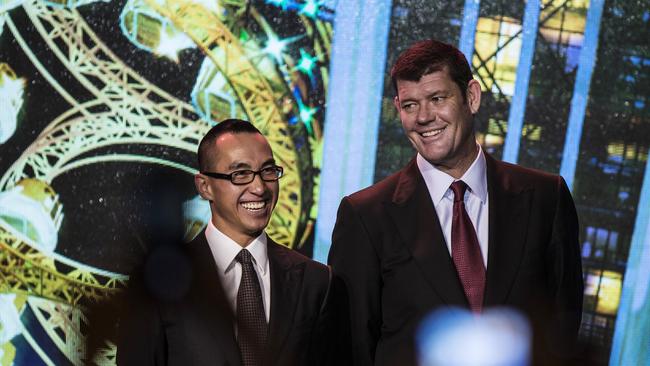

Mr Packer has sold almost half his stake in Crown to Hong Kong casino mogul and former partner Lawrence Ho, who heads Melco Resorts & Entertainment.

Shares in Crown lost ground in early trade following news of the deal, falling 3.6 per cent to be trading at $12.45 at 10.25am (AEST).

The deal comes a month after merger talks between Crown and Las Vegas casino giant Wynn Resort broke down.

Mr Packer’s private investment vehicle, Consolidated Press Holdings, sold down part of its shareholding in Crown on Thursday night to diversify its investment portfolio.

Melco, which once had a joint venture with the Australian casino company until Crown sold out of the partnership, will take a 19.9 per cent stake in the takeover target at $13 a share. Crown last traded at $12.92. Following the share sale, Mr Packer’s interest in Crown would be reduced from 46.1 per cent to about 26 per cent. This values Mr Packer’s stake at about $2.3bn.

The deal comes at a critical time for Crown which is pushing ahead with the $2bn development of a Sydney casino development at Barangaroo, while its casinos in Melbourne and Perth are coming under pressure from a fall in VIP turnover reported at its half-year result in February.

Following the deal, Mr Packer will still have a representative on the Crown board. He said he remained optimistic about the future prospects of Crown. The billionaire stepped down from the Crown board last year citing mental health reasons.

“Crown has been a massive part of my life for the last 20 years and that absolutely remains the case today,” Mr Packer said on Thursday night. “My continuing Crown shareholding represents my single largest investment.

“I am still vitally interested in Crown’s success as a world-class resort and gaming business.”

Mr Packer said he was “thrilled” Mr Ho and Melco had chosen to invest in Crown. “Over the last 15 years, Lawrence has built one of the world’s leading resort and gaming companies,” he said. “Melco’s award-winning resorts have set the standard internationally and are a testament to Lawrence’s vision and efforts. Crown is a stronger company with Lawrence and Melco as a strategic shareholder.”

Melco will seek a board position on Crown and has also outlined that subject to obtaining regulatory approvals, it welcomed an opportunity to increase its ownership in Crown.

The son of the late media mogul Kerry Packer, James Packer has long ranked among Australia’s wealthiest individuals. He recently ranked at No. 15 on The List — Australia’s Richest 250, published by The Australian.

‘I love him like a brother’

Mr Ho weclomed the opportunity to renew ties with Mr Packer. “I view Melco’s investment in Crown as an incredible opportunity to purchase a strategic stake in what I believe to be Australia’s premier provider of true integrated resort experiences,” Mr Ho said.

Mr Packer and Mr Ho have long been associates and the two casino companies had a joint venture, Melco Crown, with casinos in Macau.

But following the arrest of 19 of Crown’s staff in China in 2016 for gambling-related offences, Crown started selling out of its interests in Macau. By May 2017, the 12-year partnership between Mr Packer and Mr Ho officially ended when Mr Ho’s Melco International Development purchased Crown Resorts’ remaining 11.2 per cent stake in Macau-focused Melco Crown Entertainment.

In Damon Kitney’s biography of Mr Packer, The Price of Fortune, Mr Ho said he was open to again doing business with Mr Packer.

“I would not close the door to being partners again,” Mr Ho said.

“[James] is the best partner I have ever had. Everywhere we have been at Melco, we have worked well with partners. I would not hesitate for a moment to do anything together with James.

“He was amazing. I love him like a brother. I miss him. I do. I am a very private person and I don’t socialise that much. But I really enjoyed my time with James.”

The Australian understands that the talks with Melco started once the Wynn deal fell over and that CPH handled the transaction in-house rather than use external advisers.

Crown had been hoping to sell the business to the Nasdaq-listed Wynn and disclosed the confidential talks to the Australian market on April 9 after it was leaked in the media.

Through the Wynn deal, Mr Packer could have walked away with about $2bn and a 10 per cent stake in Wynn Resorts.

The deal had an implied value of $14.75 per share — a 26 per cent premium to Crown’s share price before the bid was announced.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout