Mastercard’s plan to be master of digital

For the punter, a Mastercard could still be just a card in a wallet but today the $500bn global juggernaut plays everywhere in digital, from data to the Metaverse.

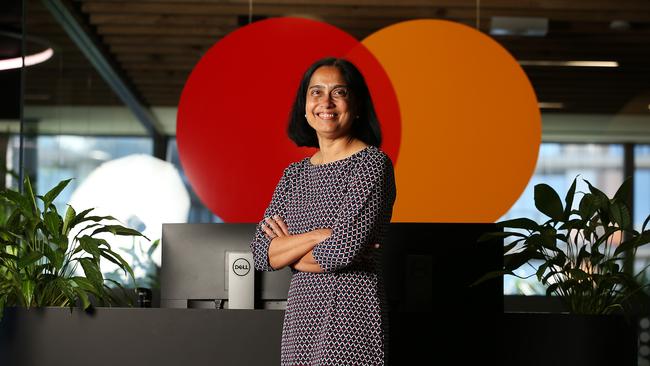

Raj Seshadri, the president for Data and Services, made her first trip to Australia last week. She took on the role in January 2020 just when pandemic fog set in.

Seshadri leads a global team that services 3,000 customers in hundreds of countries in one of the fastest moving spaces for tech innovation. Australian customers include most of the top 10 major retailers.

Mastercard has been around since the 1960s but there are two reasons it has not gone the way of Kodak.

First, its original business model of credit cards continues to be a cash cow while all eyes are on how to regulate big new forces in payments like Apple.

But more importantly there is Seshadri’s growth in new services that enhance the value payments and then go well beyond payments: consulting, data analytics, loyalty and test and learn services for customers.

“It’s very different market. When you look at all of these services which I’m responsible for, each of them has competitors that are different,” she says.

In payments Seshadri sees the market as less about disruption and more about consumer choice.

“There are many different choices for a consumer to pay now. We’d love to see which ones really materialise, from crypto to open banking to buy now pay later in this market.”

Mastercard’s operating model is business to business to customer, B2B2C. It is well-known for driving payments through businesses for their customers. “The end ‘C’ is very important to us,” says Seshadri. “The middle B could be a financial institution, a merchant, it could be an acquirer, a fintech or a government. Tourism was a great example where we do a lot of work.”

Mastercard’s cards business is a giant springboard to expand data analysis and services – an annual 112 billion transactions from 3 billion cards in 210 countries. Aggregated and anonymised over decades and mixed with third party available data, there is now access to new data through open banking where Mastercard adds enhanced privacy technologies.

Seshadri says while not in the business of selling data directly Mastercard has created “domains of intelligence”.

They offer macro-economic insights for customers. SpendingPulse gives insights into consumer spending across all tender types: card, cash, cheques and new types of payments. Location insights during Covid helped inform consumers which retailers were open or not, and has other uses in navigation.

Behind Seshadri’s petite and vivacious present, lie big credentials. As President of US issuers for Mastercard, in four years she grew regional card programs and services across the competitive US market.

Raj Seshadri grew up in India and won a scholarship to go to college in the US. “I turned down medical school and engineering school, which as you know to Indian families is sacrilege,” she says.

From liberal arts, she added a PhD in Physics from Stanford and a Harvard MBA. There was a decade at McKinsey in New York, then leadership roles including head of Citigroup’s small business banking globally and at Blackrock running its iShares US retail ETF business.

Her job at Mastercard is to make it a constant innovator.

In July research by Truist Securities, owned by one of the top American ten banks noted: “We see Mastercard as a core holding and the best FinTech we cover.” It noted innovation around value added services, new flows, cross border exposure, operational leverage and a fortress balance sheet.

“Customers came to us and said, we’d like to be innovative,” says Seshadri. “You are providing us with your products and services, but can you also provide us with your techniques? And so we created Labs as a Service, our Innovation Services that they could use techniques for to help them with innovation.”

The same thing happened with Mastercard’s scenario planning business for customers. The firm used its macro-economic insights combined with its consultancy services to help customers think about how their business might behave under different scenarios.

“What are no regret moves? What are things that are controllable versus non controllable? What are trigger points that might make you make a decision one way or the other?” she says.

Mastercard’s Test and Learn platform, bought in 2015 for $US600m, offers what Seshadri calls massively parallel experimentation that adds value by taking the guess work out of innovation.

“You can double down on the bets that work and cut back the bets that don’t — from store and branch locations to pricing decisions to marketing, or targeting office segmentation. It allows you to iterate faster in an innovative environment where you are trying to innovate,” she says.

In April Mastercard bought Dynamic Yield. This is very modern, she says. “If you go into a McDonald’s store and you order off the kiosk, the intelligence that personalises the offerings to you is Dynamic Yield. And separately we are already working on AI driven automated drive through to change that experience.”

Raj Seshadri’s other responsibility at Mastercard is professional services, with a third of employees joining through data and services. “Because we have this professional services organisation, and are hiring very actively we have incredible demand for talent across the globe.”

It is no surprise that Mastercard takes a keen interest in regulation of data. “As regulators are thinking about this in each country, we work with them so they can navigate it and get to the right answer, which supports innovation, but at the same time, supports privacy and security in the right ways,” says Seshadri.

She will not buy into the debate in Australia on whether Buy Now Pay Later should be regulated as part of the Credit Act. “It’s a good question. I think each country needs to decide for itself as to whether to be regulated or not.”

Mastercard takes far more interest in the world of crypto and blockchain when it thinks about expanding financial services: currencies, non-fungible tokens and central bank digital currencies.

Mastercard’s latest research in Australia supports crypto as the next frontier in payments. A survey of 1,000 Australian by The Harris Poll from March 21 to April 19, 2022 found 51 per cent agree they would use cryptocurrency more if they understood it better, a rise of 7 per cent from 2021.

The survey found only 42 per cent being comfortable using BNPL today, although 60 per cent agree they would feel safer using a BNPL solution if backed by a major payment network.

Customers want crypto, says Seshadri, and already Mastercard has 25 programs and 60 partnerships including in Australia CoinJar, BTCMarkets and Fresh Supply Co.

At present Mastercard only passes fiat currency on its network but consumers can switch crypto into fiat and fiat into crypto and the firm is thinking about what might go on the network, including some stablecoins.

In July Mastercard joined Blockchain Australia. Board member Michael Bacina cited regulation as a key motivator for it to join the peak body.

Across the spectrum, Seshadri is looking at loyalty programs based on crypto, at cyber — where Mastercard has bought blockchain business CipherTrace — and she is working with NFTs in the art and entertainment market and experimenting with customers in the Metaverse.

Mastercard does not disclose which of the central banks it works with on development of central bank digital currencies. It has a sandbox and is working with several of them. In Australia the RBA is looking seriously at the technology, which has the potential to up-end payments.

In 2019 Mastercard decided to drop its name from its logo. The interlocking red and yellow circles were a modern flexible symbol that would work across the digital landscape, like Apple or Target.