Magellan Financial Group aims to ‘hit accelerator’

Magellan Financial Group is reaping the rewards of a stellar investment performance.

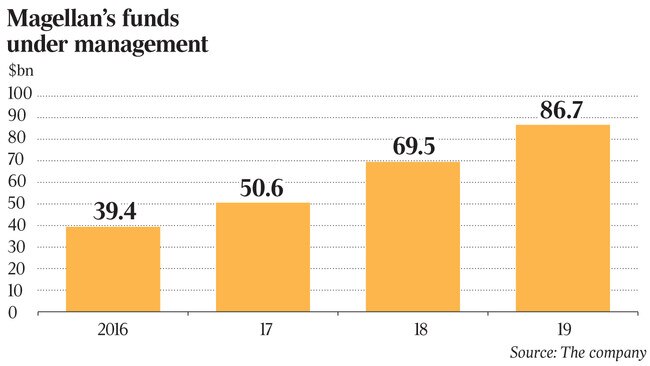

Magellan Financial Group is reaping the rewards of a stellar investment performance, with a 28 per cent rise in funds under management driving a 35 per cent increase in its adjusted net profit after tax to $364.2 million for the year to June.

Analysts have struggled to keep up as Magellan shares surged as much as 166 per cent to a record high of $62.60 this year, but chairman and chief investment officer Hamish Douglass says the global fund manager he co-founded in 2007 has now “got the model to a scale where we can hit the accelerator”.

While the active funds management world is battling an inexorable shift to passive investing, fuelled by the rise of exchange traded funds and a renewed interest rate cutting cycle by central banks this year, Magellan is leveraging its scale to engage directly with its retail customer base to sustain its rapid growth in funds under management that is being richly rewarded by the sharemarket.

Indeed, Douglass believes Magellan is only scratching the surface of the potential growth in FUM from its “partnership” approach with retail investors that sees it cutting out the middle man and incentivising its client base to take up more of its products.

Magellan easily raised $275m from institutional investors yesterday at $55.20 a share — a slim 7.7 per cent discount to its latest price — as it announced an initial public offer of the Magellan High Conviction Trust, a closed-end fund that will invest in Magellan’s eight to 12 best ideas, replicating a proven investment strategy that has returned 16.6 per cent net of fees since inception in 2013.

The new money will meet the costs of the IPO, while $50m has been earmarked for the new retirement product currently under development. The rest will seed other investment strategies and strengthen the balance sheet for future growth opportunities.

As with the Magellan Global Trust launched two years ago, the High Conviction Trust will be highly incentivised with additional “loyalty units” — paid for by Magellan — for existing retail investors and “IPO foundation units” for wholesale and general public offer investors.

“The concept of the partnership is that we pay upfront and ongoing benefits to retail investors that are highly attractive to them,” Douglass told The Australian. “Magellan pays for that and those people support us by putting more funds into our closed-end funds.

“That’s highly attractive to us because when people see that if you’re in the fund, you get more benefits, the fund trades well, you don’t get big discounts to net asset value — and you have more direct clients. We now have about 84,000 direct investors, from none four years ago.

“We’re doing this in a scaled way, in partnership with our direct investors, and we’d like to grow that side of the business very materially over the next five years. It’s very hard to get scale in this part of your business, but we think we’ve got to the tipping point.

“We’re now offering to anyone in that closed-end fund, anyone in Magellan Financial Group and anyone who’s in the High Conviction strategy, the right to subscribe to $50,000 of units and they get a 7.5 per cent bonus of additional units, paid for by Magellan.”

First-time investors in Magellan funds who take up the public offer will get a bonus issue of units worth 2.5 per cent of their application.

The 2.5 per cent is equivalent to the fees that are normally paid out to stockbrokers to put their clients into such investments.

“So we’re bypassing the brokers and paying it directly to the retail investors,” Douglass says.

“The partnership is to provide benefits to underlying investors to come in and support your product and keep the benefits going.

“When we do that, they become more engaged, more loyal and it attracts more people into the club, so that 84,000 will keep growing.

“It gives us funds under management in a closed-end form which has seen the Global Trust grow to $2.2 billion in two years.”

Douglass now sees an opportunity to “materially scale up” Magellan’s direct investor base.

While Magellan spent $97m in incentives and costs to establish its Global Trust two years ago, it has delivered $2.2bn of funds under management, with the base management fees on that sum recovering the set-up cost in four years.

The sharemarket is now pricing that FUM at Magellan’s much higher earnings multiple of 28 times, rather than four times.

“What’s really interesting about this is that if you look at the value creation, “that $2.2bn is effectively — from the base management fees alone — a PE multiple of around four times earnings,” Douglass says.

“We are acquiring funds under management at a PE of four times and we trade at materially more than 20 times.” As for the new retirement product, it’s “probably six to 12 months away” as the fund manager waits for various regulatory approvals.

“The goal is to provide an equity product that gives people a consistent income and some growth in retirement, without exposing them to the capital drawdown risk in a sharemarket sell-off.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout