KKR, Ramsay takeover collapse costs philanthropic foundation $1bn

Almost $1bn has been wiped off the value of the Paul Ramsay Foundation’s shareholding in Australia’s biggest private hospital group after takeover talks failed.

Almost $1bn has been blasted off the value of the Paul Ramsay Foundation’s shareholding in Ramsay Health Care following a collapse in takeover talks between the hospital group and US private equity behemoth KKR.

The foundation, one of Australia’s biggest philanthropic organisations aimed at breaking the “cycles of disadvantage”, is Ramsay’s biggest shareholder, owning almost 19 per cent of the company.

It had given crucial support for KKR’s $20bn, or $88 cash a share, takeover before talks collapsed last Monday.

The termination of negotiations have sent Ramsay’s shares diving from a six-year high of $80, reached in late April when the company confirmed it had opened its books to KKR, to $57.28.

For the Paul Ramsay Foundation, which the hospital group’s founder Paul Ramsay bequeathed $3bn in 2014, the value of its shareholding has plummeted from $3.44bn to $2.45bn, as of Friday’s close.

At the same time, Ramsay Health Care has come under pressure with its annual profit crumbling almost 38 per cent, as it battled the fallout of pandemic-fuelled elective surgery restrictions and fresh waves of Covid-19.

The antics of KKR, known as one of the original ‘‘barbarians at the gate’’ over its leveraged buyout of US tobacco and food company RJR Nabisco in 1988, have attracted criticism with its approach to Ramsay branded a “leak and tweak” deal.

The $88 a share price was enough for the company’s board to grant KKR due diligence, but it appeared KKR had no intention of solving a key puzzle to reach that figure: Ramsay’s French operations.

KKR withdrew its $88 a share cash offer after it said it was unable to complete due diligence on Ramsay’s 52.8 per cent-owned French business, Ramsay Sante. Instead, it pursued a cheaper cash and scrip alternative, valued at $84.93 a share.

This enraged Ramsay’s board, which has refused to engage further with the KKR-led consortium, which also included the nurse superannuation fund HESTA, “on these terms”.

It is understood that KKR relied on Ramsay to grant it access to Ramsay Sante, rather than directly approach the French company’s board, which had the sole authority to grant due diligence.

Ramsay Sante attempted to engage with KKR, sending it a list of questions about its intentions for the company. But KKR did not provide responses to these questions.

Complicating matters further is the fact KKR owns Ramsay Sante competitor Elsan, making Ramsay’s French arm reluctant to open its books to the private equity giant.

The end of takeover talks comes after KKR sent a letter to Ramsay chairman Michael Siddle that was made public three weeks ago and said that it was prepared to walk away unless Ramsay agreed to a new price – a textbook bear hug by KKR. In other words, it was hoped that Ramsay’s investors might apply pressure to the board to force it back to the negotiating table to accept a lower price.

Instead, Ramsay held firm, saying it “remains focused on its business, driving its strategy to be a leading integrated healthcare provider of the future and the creation of long-term value for shareholders”.

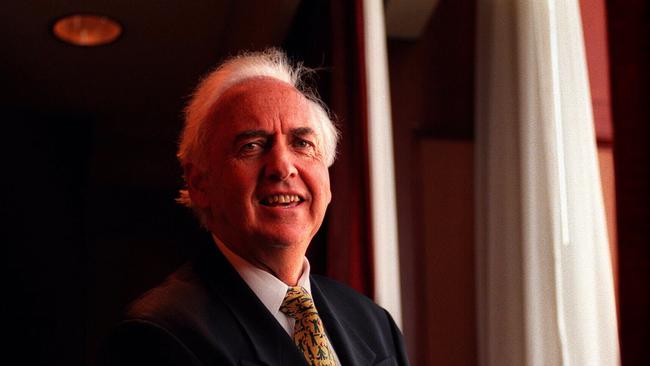

Single, with no children, Mr Ramsay left about $3bn to the foundation that bears his name - the largest philanthropic donation in Australian history - when he died in 2014 to support a range of community projects.

The foundation’s shareholding was considered a big hurdle in any takeover. But soon after KKR’s indicative proposal was announced, a spokeswoman said it was willing to part with some of its shares and was interested in retaining scrip in a KKR-controlled entity.

“PRF notes that the terms of the indicative offer would allow PRF the opportunity to retain an interest in the business built by its founder, Mr Paul Ramsay, by taking some scrip in the bid entity,” a foundation spokeswoman said at the time.

“Assessment of any conditional indicative offer is up to the board of RHC. However, should an offer materialise along the lines canvassed in RHC’s ASX Announcement, PRF would support such an offer being put to shareholders.”

Mr Ramsay established Ramsay Health Care in 1964 when he purchased a guesthouse on Sydney’s north shore and converted it into a psychiatric hospital. The company now owns 72 private hospitals in Australia and also has extensive operations in the UK and Europe. Its global network extends across 10 countries, with over eight million admissions/patient visits to its facilities in more than 32 locations.