Jobs go in latest Treasury Wine Estates shake-up

The executive upheaval within Treasury Wine Estates’ management ranks has stepped up.

The executive upheaval within Treasury Wine Estates’ senior management ranks has continued, with the winemaker triggering a restructure of its global human resources and finance operations to move more of the decision-making and power to its Melbourne head office.

The restructure will see some job losses in both the finance and HR departments at Treasury, whose wines include Penfolds, Wolf Blass and Beringer.

The news comes Treasury Wine revealed on Monday night that its chief executive Michael Clarke has sold almost half his allocation of 72,366 shares issued to him as part of his short term incentives, raising more than $641,000.

Mr Clarke sold the 34,012 shares to cover tax bills, the company said, which equated to 47 per cent of his allocation of 72,366 shares under the incentive plan.

In May Mr Clarke sold 400,000 shares in the company in an on-market trade to net him $6.88 million. In August he sold another parcel of stock to raise more than $3.6 million, which was also disposed of to settle tax obligations.

Meanwhile, the changes to the winemaker’s structure continues. Under the latest changes Treasury Wine’s regional outposts — spread across Asia, Europe and North America — will still have some local responsibility but the latest change marks a greater concentration of power at the company’s Melbourne head office.

Under the changes more of the responsibilities and decisions for HR, which covers people, talent and other recruitment roles — will be ceded to Melbourne. Less than half a dozen jobs will be lost in the process, Treasury Wine claim.

The news comes after major upheavals at Treasury Wine in the last year that has caused some discomfort among investors as the head office and key overseas operations face a revolving door or managers.

That pace of senior executives walk outs has accelerated in the last few months, with company veteran and global head of marketing, Michelle Terry, walking out of the business in a shock departure.

Victoria Snyder, president of the Americas and a 14 year veteran at the winemaker, has also left. Only last year former global head of marketing Simon Marton, who Ms Terry replaced, quit the company. Since 2013 Treasury Wine has also had four chief financial officers.

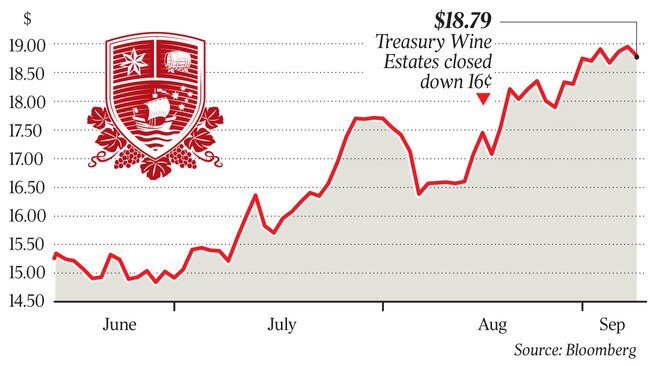

Last month Treasury Wine posted a 16 per cent lift in net profit to $419.5 million as sales rose 17 per cent to $2.831 billion.

A spokeswoman for Treasury Wine said that over the past three to four years the winemaker had “deliberately carried additional senior managers” so that had the resources for “fixing and strengthening” its business.

“The way we achieved this was to have a head of function and deputy, and a head of region and a deputy. As we’ve come to the end of fixing and strengthening phase, we have only required one head of a function and one head of a region — this has resulted in some senior executives moving on, while some have remained and gone into other roles.”

The shifting of the highly successful Mr McPherson from his leadership role of Australia and New Zealand — a business unit that in fiscal 2019 generated almost 25 per cent of group earnings — to a new role in the US was part of that reworking.

“The last of these moves was Angus McPherson moving to the Americas to run this business, and the role he vacated overseeing Australia, Southeast Asia, Middle East, Africa and Europe has not needed to be replaced, with strong leaders overseeing these regions. “We no longer have or require deputies of functions or regions going forward.

The spokeswoman said this was done as a process on simplifying the way Treasury Wine operate the business was executed to help reduce the workload and bureaucracy to facilitate growth at the winemaker.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout