Janus Henderson closing local equity funds with $490m under management

Janus Henderson is returning close to $500m to investors as it shutters a string of its Australian equities funds.

Global funds management giant Janus Henderson is joining the ranks of managers that are unwinding or have already closed their Australian equities funds, after running into performance woes or failing to gain enough traction locally.

The Australian revealed that London-headquartered Janus (JHG) would shut several Australian equities funds amounting to about $490 million under management. A spokesman confirmed the move on Wednesday afternoon.

“Janus Henderson Investors has confirmed that it has commenced the process of closing the Australian Equity (AEQ) investment desk and associated fund ranges,” he said.

“Over the past 18 months, the AEQ investment desk has found it challenging to meaningfully grow and diversify AUM (assets under management) and to develop long-term growth prospects.”

The changes are said to spell the end of the Australian equity fund for retail investors and a sister fund for institutional investors that hold a combined $180 million. It will also see the smaller high conviction equity fund — which manages $18m — shut, along with the total segregated mandates accounting for $292m.

The move by Janus in Australia will see the firm return the local equities money to investors. Several analysts are understood to be leaving immediately as a result, while head of Australian equities and portfolio manager Lee Mickelburough and fund manager Andrew Sutherland are on board until the end of February to liquidate the funds in an orderly way.

The move adds to a spate of funds management and wealth firms that have taken a similar path and shut down, overhauled or retreated from active equities management.

Commonwealth Bank’s Colonial has pulled back from its core Australian shares fund and last year agreed to sell its global asset management unit, while Concise Asset Management has shut its doors and Arnhem Investment Management is also winding down.

In late 2017, AMP Capital restructured its equities unit which saw it stop taking new money in eight of its funds but it was positioned as a move away from index-hugging active funds to a “higher active” style.

A local fund manager said on the basis of anonymity he expected further Australian equities funds to reconsider their future in 2019.

“There are obviously going to be more (exits from the industry). Fees are under pressure and a lot of firms are sub scale,” he said.

Sharemarket volatility in the latter half of 2018 put the funds management industry locally under even more pressure as performance at many firms floundered.

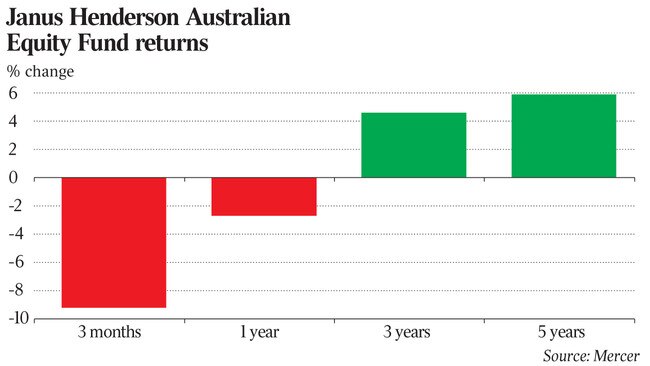

The Janus Henderson decision comes after a less than stellar performance from its equities funds in Australia in recent years.

The Janus Henderson Australian Equity Fund returned minus 2.7 per cent before fees in the year to December, in line with the benchmark S&P/ASX 200 Accumulation index.

Similarly, over five years it returned 5.9 per cent versus 5.6 per cent for the benchmark, giving it a 48th rank among its peers, according to the latest Mercer Investment Survey.

Janus Henderson is an independent global diversified asset manager with $41bn in AUM locally and $US380bn globally. Despite the decision to close its Australian equities funds, the company appears to be leaving the door open to returning to the space in the future.

“We remain committed to the Australian market, being one of five most important markets for Janus Henderson Investors,” the spokesman added.

“Locally we have four well regarded investment desks including two high quality and successful fixed interest investment desks (Janus Henderson Investors and Kapstream), global natural resources and diversified alternatives. These domestic offerings are complemented by our global suite of funds in Global Emerging Markets, Global Equity Income, Global Equity and Global Fixed Interest.”

In a note to clients earlier in January, analysts at Morgan Stanley said listed asset managers in Australia were cheap “for a reason”.

“The asset managers are cheap, but ongoing outflows mean a near-term re-rating is unlikely,” they said.

“Janus Henderson is the exception among the Australian listed stocks: while it looks cheap vs Australian peers, it is actually trading inline with global peers for its level of flows.”

Last year, Janus Henderson’s global head of distribution Phil Wagstaff and local boss Matt Gaden said the benefits of the merger between Janus and ASX-listed Henderson were “yet to be realised”.

Co-CEO Andrew Formica and Mr Wagstaff left the company in the latter half of 2018, after Dick Weil was named the asset manager’s sole CEO.