Wynn exit from $10bn merger talks raises Crown stakes

Crown shares have slumped after Wynn walked away from a $10bn bid after talks leaked.

James Packer’s Crown Resorts has been left reeling after $10 billion merger talks with Las Vegas gambling major Wynn Resorts collapsed, in a move that is expected to force the under-pressure Australian casino major to reassess its strategy.

Wynn Resorts has walked away from its takeover talks with Crown Resorts because of the “premature disclosure” of the discussion.

The Nasdaq-listed company had been in confidential talks with the Australian-listed casino company but an agreed bid had not been finalised.

The US giant had wanted to keep the discussions secret for longer.

But Crown disclosed to the Australian market on Tuesday that it had been in discussion with Wynn about a “change of control transaction”, which would have seen Mr Packer — who has a 46.1 per cent stake in Crown — walk away with about $2bn and a 10 per cent stake in Wynn Resorts.

But Wynn Resorts early Wednesday ended those talks.

“Following the premature disclosure of preliminary discussions, Wynn Resorts has terminated all discussions with Crown Resorts concerning any transaction,” Wynn said in a statement sent to The Australian.

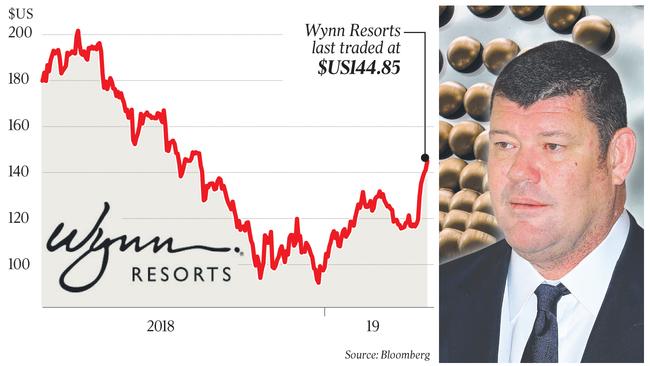

Wynn Resorts shares fell 3.9 per cent after it pulled the plug on discussions with Crown.

After rising 20 per cent on news of the talks yesterday, Crown shares this morning fell as much as 11 per cent in early trade before recovering slightly to be down 9 per cent at $12.85 at 10.20am (AEST).

The Wall St Journal quoted a person familiar with the matter as saying that Wynn executives were caught off-guard by the Crown announcement.

“I was surprised and the US folks were surprised,” the person said.

Some analysts believe Wynn was angered by Crown’s announcement seeing it as an attempt by the Australian casino giant to attract other potential bidders to the table.

“They (Wynn) were looking to do a transaction, not get involved in a bidding war,” Trip Miller, managing partner of Gullane Capital Partners told the WSJ. The firm manages around $US70 million in assets, with roughly 18 per cent invested in Wynn Resorts.

The talks between Crown and Wynn were believed to have been ongoing for sometime and involved a previous offer. Earlier Tuesday Crown said its board had not yet considered the “most recent” proposal from Wynn.

“The proposal contemplates an acquisition of Crown by Wynn via scheme of arrangement for a combination of cash and Wynn shares,” Crown said in a statement to the Australian market yesterday.

Crown said that it was in discussions with Wynn about a “change of control transaction”, which would have see Mr Packer — who has a 46.1 per cent stake in Crown — walk away with about $2bn and a 10 per cent stake in Wynn Resorts.

The proposal, which Crown said was “preliminary”, would have involved the acquisition of the Australian casino operator by Wynn by the way of a scheme of arrangement for a combination of cash and Wynn shares.

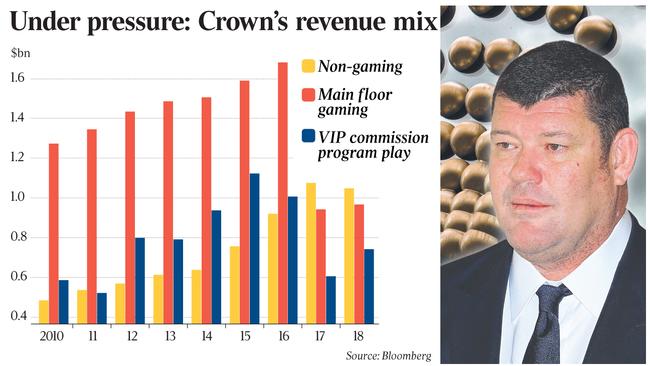

The move comes at a critical time for Crown, which is coming under pressure in its higher-roller business at its flagship casinos in Melbourne and Perth. At the same time it has placed a $2.1 billion bet on the development of Sydney’s Barangaroo casino.

Following the Crown disclosure Wynn told US investors that it was in preliminary discussions with Crown, but there was “no assurance” that the talks will result in a deal.

“No agreement has been reached between the parties in relation to the structure, value or terms of a transaction,” Wynn said in a statement.

Earlier Tuesday Crown said in a statement to the ASX that Wynn had approached it, but investors had suggested Crown could have been the one seeking a suitor to buy out the company as it came under pressure on several fronts.

The deal, which if executed would represent Australia’s biggest M&A deal so far this year, has an implied value of $14.75 a share — a 26 per cent premium to Crown’s share price before the bid was announced. Shares in Crown closed 19.7 per cent higher at $14.05 yesterday on news of the deal.

While Mr Packer would have the single biggest stake in the enlarged Wynn casino business, other large institutional shareholders would substantially limit his influence.

Even so any deal would see Mr Packer realise his long-held dream of having an interest in a successful Las Vegas casino and he would also re-enter the Macau market.

Crown said Tuesday its board had not yet considered the “most recent” proposal from Wynn.

“The discussions between Crown and Wynn are at a preliminary stage and no agreement has been reached between the parties in relation to the structure, value or terms of a transaction,” Crown said.

“There is no certainty that these discussions will result in a transaction.”

The Nasdaq-listed Wynn Resorts is capitalised at $US15.7bn ($22bn) and last calendar year posted operating revenue of $US6.72bn and a net profit of $US803 million. It operates casinos in Las Vegas and Macau and is planning to open a new casino in Massachusetts. Macquarie Equity gaming analysts said the timing of the proposal and subsequent implied multiple of the bid price was a surprise and should be well received by Crown Resorts’ shareholders.

They said the bid implied a significantly higher multiple than the traditional trading ranges for Australian casinos.

Macquarie said given that no Crown and Wynn assets were co-located geographically, the ability to generate synergies was most likely related to corporate cost benefits and the VIP market.

“We would also highlight that Crown Resorts’ Australian casinos are efficiently run given recent cost-out initiatives, so improved operational performance domestically may also be hard to justify,” the analysts said.

Macquarie said probity and regulatory approvals were unlikely to be a concern if the Wynn offer was finalised. The investment bank’s team added that Australia’s operating environment was challenging across both the domestic and VIP markets for Crown Resorts.

Crown noted Wynn’s proposal was subject to several conditions including due diligence, Wynn obtaining all regulatory approvals and backing by the Crown board.

The deal talks are said to still be in the early stages with details to be ironed out, but it is likely that the Crown brand would be retained in the Australian market given its local recognition.

The two men who started Crown and Wynn are no longer at the helm. Mr Packer stood down from the Crown board in March 2018 citing mental health reasons. He had previously stepped down from the Crown board at the end of 2015, returning in August 2017.

Wynn founder Steve Wynn resigned as CEO in February last year and then sold out of the company the following month, offloading his 11.8 per cent stake for $US2.1bn. The 77-year-old exited the company following sexual misconduct allegations. Mr Wynn has denied the accusations.

In late 2016 Crown sold its Las Vegas asset, a 14ha vacant site on Las Vegas Boulevard, to a subsidiary of Wynn Resorts for $US300m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout