The Chicago-based Erter, who is coming up to 12 months in the role, has dramatically pulled the pin on a major manufacturing factory that James Hardie was building in Melbourne’s western suburbs.

Construction on the plant was already 18 months in, with design and construction contracts in place. The exercise to shut down the project will be expensive although the sale of land may ease the financial hit.

The question is why was the new plant with an investment running into hundreds of millions of dollars involving extensive planning and all level of politics, given the green light in the first place. The investment would have been signed off at board level and surely would of have been backed by a rigorous businesses case.

Or has the housing market structurally changed so much that James Hardie is concerned about excess capacity? The plant would be designed for a multi-decade life, not a several-year cycle.

The factory, commissioned under previous boss Jack Truong who was dramatically forced out of the company earlier last year, was expected to generate as many as 200 full time jobs when it was up and running.

There was another 500 expected during peak construction. Some of these jobs will now go to Sydney under Erter’s preferred option that will see capacity expand at James Hardie’s existing operations near Parramatta and outside of Brisbane.

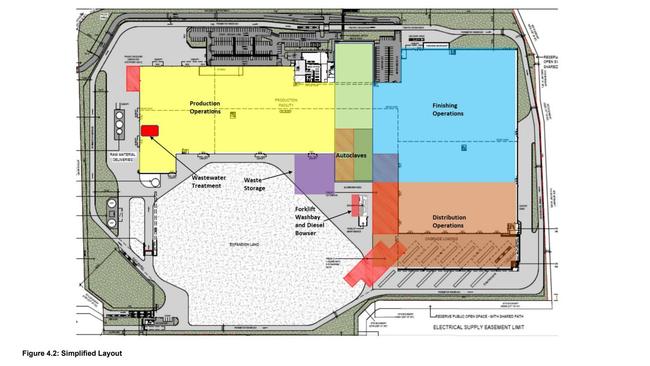

The new facility in the industrial suburb of Truganina outside of Melbourne had been designed to produce fibre cement for the local housing market and export markets and even a few months ago was still on track to be up and running by 2025.

Headquartered in Ireland, but today largely run out of Chicago, James Hardie is one of the world’s biggest makers of fibre cement and gypsum board used in construction and exterior cladding. The company’s biggest sales boost is coming from the renovation market, particularly in the US where the housing stock is rapidly ageing. James Hardie is also seeing to brand of choice, including marketing direct to homeowners.

Erter puts the Melbourne decision down to a shift in strategy and was careful to point out inflation or surging construction costs had “zero” impact on the cancellation.

“That did not compute, or we didn’t factor that in at all. As I came in, we took a look … at every single project. This (factory) is a major expenditure for us,” Erter said on a conference call.

Erter said brownfield – using existing operations – is now the preferred path when adding capacity to the company’s manufacturing network rather than a greenfields approach of the Melbourne plant.

“One of the most important things that we do is capital allocation and this was really looking at this, scrutinising this, you know, and just realising that, you know, we had other options here”.

James Hardie has been undergoing a major shift under Erter. Faced with being caught out with surging commodity prices, the company has aggressively pulled back spending and sought to protect profit margins over market share. Under Erter the mantra is “driving profitable growth”.

In the past year it has put through double-digit price rises. And while volumes are off profit is up. There are more price increases to come although at a slower pace as inflation for raw materials starts to cool.

The plant closure clearly an own goal for James Hardie, but it comes amid a backdrop of surging energy costs and a perception that its getting tougher to do business across Australia’s east coast.

BHP has publicly declared an investment strike in Queensland given surprise royalty hikes; there is a labour shortage in NSW; while additional Covid-debt related taxes and higher payroll fees in Dan Andrews’ Victoria have many in business shaking their heads.

It also represents a blow to the state’s economy, which in recent years has been riding a sugar hit of the Andrews government’s massive infrastructure spending spree. This will quickly start winding down on increasingly stretched state finances.

The James Hardies move too is a worrying sign of corporates paring back their longer-term risk appetite in the face of a slowing economy. Its easy to make shorter term cuts to keep investors onside while times are tough.

Business confidence returned to positive territory in July although, in trend terms, remains at below-average levels, according to the NAB Monthly Business survey released Tuesday. Labour costs growth and goods cost growth rose sharply in the month, the NAB figures showed.

Earlier Tuesday, James Hardie posted a better-than-expected 13 per cent surge in June quarter net profit to $US174.5m ($268m). The earnings jump was built on price rises and exiting lower margin lines, as sales slowed across North America, its biggest market, and Europe. Sales in Australia rose 5 per cent, although this too was mostly due to recent price rises, with overall volumes slowing 8 per cent as higher interest rates hit housing.

Erter warned of a tougher housing market for the rest of the financial year with sales volumes likely to slow as high cash rates there hit prices and consumer confidence. In Australia labour shortages continue to hamper the housing market which is also likely to weigh on local sales. Even so the profit boost send James Hardies shares up 15 per cent, their highest level in more than a year.

Myer hit

Hedge funds had been quietly moving into Myer’s shares over the past few months on the expectation that back-to-back interest rate rises would soon take its toll on the department store. Even under a major rebuild under outgoing boss John King, Myer felt the full hit as it confirmed the pace of sales growth was fast slowing. Investors have been quick to punish retailers given they the most vulnerable to a pull back in consumers spending.

Myer shares were sent 14.1 per cent lower back to the recent trough they hit in June. The selldown also marked a rare moment because it took place even as Myer substantially upgraded this year’s profit outlook by between 15 per cent to 21 per cent.

King and his team are doing commendable job keeping sales ahead the face of a tough market, but investors are looking over the horizon and fear more pain is inevitable as cash rates stay higher for longer. King’s warning of “ongoing uncertainty” in the outlook was all investors needed to sell.

For context Myer’s second half sales so far are up 0.4 per cent on the June half last year and up nearly 12 per cent in the June half of 2019 before the Covid pandemic upended retailing.

Myer today is much better position under King and for the first time in years the retailer is running with almost no debt on its balance sheet.

Meanwhile search firm Egon Zehnder has been appointed to find a replacement for King who recently said he intends to retire later next year. The transition to a new CEO in a brutal retail market represents another looming headache for investors. Myer is scheduled to release its full year accounts in September.

johnstone@theaustralian.com.au

Daniel Andrews’ Victoria is potentially one of the biggest victims so far of James Hardie’s newly found discipline under chief executive Aaron Erter.