Investors cool on Ardent’s US deal

Ardent Leisure’s $US80m sale of a stake in its US-based Main Event Entertainment business went down poorly, with shares falling 7.1 per cent.

Ardent Leisure’s $US80m ($117.6m) deal to sell a stake in its US-based Main Event Entertainment business has received a cool reception from investors as the company battles the coronavirus crisis.

The deal will help smooth the path back to normal operations for Ardent as it prepares for a reopening of its Queensland theme park Dreamworld.

But Ardent’s shares dropped by 7.1 per cent to close at 45.5c on Monday after an initially positive response.

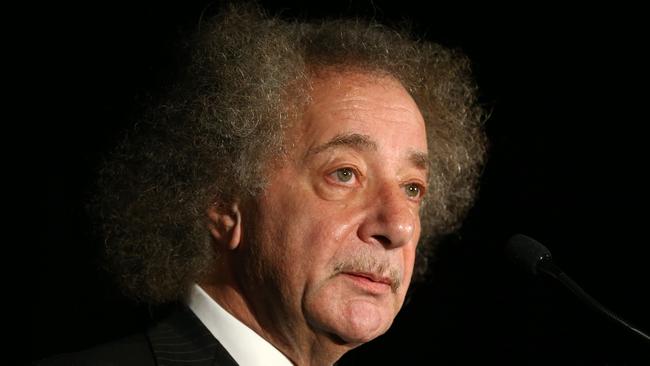

The listed entertainment company, chaired by corporate raider Gary Weiss, struck up the new US partnership with private investment firm RedBird Capital Partners, which has pledged to help expand the Main Event operation.

Ardent has been hit hard by the closure of its Queensland property and has just reopened a swag of the US venues after they were closed because of the coronavirus crisis.

RedBird will take a 24.2 per cent preferred equity interest in Main Event, valuing the business at an implied enterprise value of $US424m, putting it on an eight times earnings multiple.

RedBird has also been granted an option to acquire an additional 26.8 per cent interest in Main Event from Ardent, exercisable between July 2022 and July 2024, which could give it majority control if taken up.

The value is a far cry from the plan advanced in 2017 to rescue Ardent and build up Main Event into an expansive network before pursuing a trade sale or initial public offering.

The bowling-anchored entertainment business in the US has about 43 centres in places including Texas, Arizona, Georgia, Illinois and Kentucky.

Main Event was promoted at the time as a $600m potential opportunity with $425m from rolling out 24 centres and another $175m from turning around underperforming venues.

The initial board will consist of Main Event chief executive Chris Morris, Ardent directors Dr Weiss and Brad Richmond, and RedBird Partners Andrew Lauck and Dan Swift.

Dr Weiss said the partnership with RedBird reinforced Main Event’s financial strength and liquidity and gave it a “value-added strategic partner” who could help drive the company’s growth and expansion plans in the US.

“We have a first-class management team in place at Main Event,” he said.

RedBird managing partner Gerry Cardinale said the company had operations in Dallas, Texas. It focuses on building high-growth sports and entertainment companies.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout