Infant formula brand Nuchev snaps up White Ice to woo Chinese mums

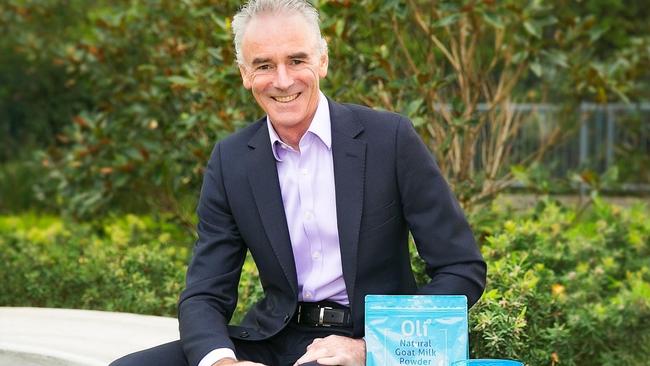

Goat milk-based infant formula brand Nuchev is looking to Chinese superstars as it forecasts a near doubling of full-year revenue growth.

Listed infant formula brand Nuchev has its own secret weapon to keep Chinese mums happy after rival Bubs rolled out Jennifer Hawkins as its global brand ambassador.

Nuchev, which like Bubs is a goat milk-based infant formula brand, has secured White Ice to be the face of its range in China. And before anyone conjures up Breaking Bad-like connotations, its influencer is 100 per cent legitimate.

White Ice, also known as Bai Bing or Michelle Bai, is a well-known actress and musician, and a participant on the talent show Sisters Who Make Waves — the highest rating TV program in China.

“We always do our thing,” Nuchev chief executive Ben Dingle said. “The same day Bubs announced they’d signed Jen Hawkins, we kicked off a campaign on a very important platform in China called Little Red Book, and it’s speared by Bai Bing.

“She’s a celebrity influencer and she’s currently doing really well on a talent show in China. It demonstrates that we’re very focused on our marketing investment making sure we get penetration to China mums.”

But Mr Dingle said the company was not pinning its entire hopes on China, saying Nuchev was “agnostic about its end consumers” and “stood by all mums”.

The comments are important given tensions that erupted on Australian supermarket shelves four years ago when the daigou shoppers — or trusted Chinese buyers — bought huge volumes of infant formula to send to China, leading to shortages of popular brands, including A2 Platinum and Bellamy’s Organic.

Sensitivities are still raw among parents amid the COVID-19 pandemic, with stage four restrictions in Melbourne announced on Sunday leading to a fresh wave of panic buying of essential items.

But the daigou market appears to have cooled in past months amid global travel restrictions targeted at quashing the coronavirus. Bubs’ revenue fell 5 per cent to $13m in the three months to June 30, with chief executive Kristy Carr saying the daigou market “remains constrained as a result of significant reduction in Chinese students and tourists and lack of passenger planes”.

Despite Nuchev quarterly jumping 25 per cent to $4.8m, in line with prospectus forecasts, Mr Dingle said they’d also experienced a daigou slowdown.

“The demand has shifted across the platforms in China as a general rule and the fact there are less students here and less planes has just sped up that transition,” he said.

“Ever since the daigou market became a thing it has always evolved and developed. It’s never stopped doing that. But over a number of years there has been consolidation in what we term corporate daigou players and they have seen this evolution happening and a general sense that everyone has recognised that the traditional pack and send from Australia is transitioning to mums purchasing closer to home in China off the platforms and of informal friends and family networks like WeChat sales.”

Mr Dingle said this had led to many corporate daigous shifting their operations to China and Hong Kong.

Bubs also benefited from the daigou shift, reporting a 26 per cent increase in China direct sales for the quarter, which comprised 22 per cent of total revenue.

Mr Dingle said he expected Nuchev to report FY20 net revenue growth of 98 per cent compared with last year, equating to 99 per cent of prospectus forecast for net revenue. As of June 30, the company had $9.4m available cash, with no debt.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout