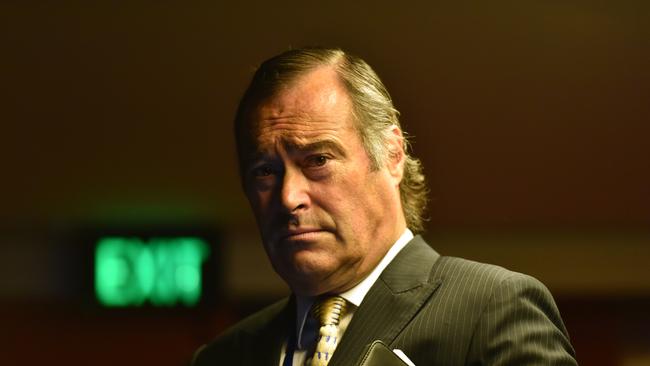

Humm: Former chair Abercrombie lifts his stake in company to 20.7pc

Andrew Abercrombie has raised his stake in Humm to 20.7pc as he ramps up attack on chairman Christine Christian over plans to sell part of the business to Latitude Financial.

Former Humm chairman Andrew Abercrombie has spent about $2m buying shares in the company, which he is already the largest investor in, as he ramps up his attack on its current chairman over plans to sell part of the business to Latitude Financial.

In a notice to the ASX on Monday, Mr Abercrombie said his vehicle Tefig had purchased 2.7 million Humm shares, taking his holding in the company from 19.66 per cent to 20.73 per cent.

Separately, Mr Abercrombie said he had supported the same plan for the company’s future as chairman Christine Christian at an annual meeting last year.

Since then, Humm has signed a deal to sell its consumer finance business to Latitude for some $300m – 150 million Latitude shares and $35m in cash.

“This begs the question: why does the chair not support improving the deal for Humm shareholders?” Mr Abercrombie said of Ms Christian.

“I believe that hummgroup consumer finance is a solid business with more value than is on the table. That is why I think shareholders should oppose this deal unless they are paid more for the business, which belongs to them,” he added.

Last week, Mr Abercrombie wrote to shareholders describing the deal was “seriously flawed”.

On Monday, The Australian reported that Ms Christian had accused Mr Abercrombie of “stringing shareholders along” for his own gain.

“So far, he has provided no plan on how Humm should respond to the substantial deterioration in non-bank consumer finance sector economics,” Mr Christian said. “He is also telling shareholders that Humm would be a consolidator in the sector – but he has not provided any plan for how Humm would realistically seek to fund these consolidation plans and create shareholder value.

“He is stringing shareholders along for his own purposes. He must stop trafficking in colourful, emotive language and concern himself with the facts.”

In an extraordinary move, the Humm majority board last Monday warned its buy now, pay later unit had been unprofitable in the four months to April 30, and urged shareholders to accept Latitiude’s takeover offer.

Humm shareholders will vote on the sale on June 23. To succeed, the deal needs the approval of more than 50 per cent of shareholder votes cast.

The combined Humm consumer finance and Latitude businesses would be the largest of their kind in Australia and would have gross receivables of $8.4bn, some five million customers and around 82,000 merchants.

The Humm buy now, pay later platform – which is to be sold to Latitude – was created in 2019 through the merger of two legacy platforms called Certegy EziPay and Oxipay. Humm will be renamed Flexi Capital Group and retain flexicommercial.

Humm shares have fallen 12 per cent since December 31.