How Paul Perreault plans to make Vifor the jewel in CSL’s crown

Paul Perreault says Vifor Pharma, which it bought for $16.4bn this year, has huge opportunities as a global leader in the treatment of iron deficiency.

CSL says it expects the newly acquired Vifor business to generate a profit of up to $US330m ($529m) this year, but warns a slump in the Australian dollar will wipe $200m off the company’s bottom line.

In an update, CSL chief executive Paul Perreault said the acquisition, since rebadged CSL Vifor, had established itself as the global leader in the treatment of iron deficiency, and it was this technology that would become the “jewel in the crown” of the company.

“The sheer incidence of the disease and the opportunities available are huge – really big opportunities for us to have an impact in a positive way on patients,” Mr Perreault said on Monday.

In constant currency terms, the company’s net profit was expected to grow, surging 18 per cent to $2.8bn this year, CSL told shareholders. Some investors had questioned the rationale behind the Vifor purchase, given the lack of clear overlap with CSL’s products and expertise – the company is targeting $75m in synergies in the next three years – and that patents for its flagship products expire during the next six years.

“Perfect companies aren’t typically for sale – in fact, I’d say no company that you would acquire will be perfect,” Mr Perreault said.

“CSL Vifor’s iron business is the jewel of the business – yet people have been asking me – ‘but what things like cliffs with intellectual property and loss of exclusivity’.

“There is a lot more to this business than just viewing it as an earnings erosion story following loss of exclusivity. There are enormous opportunities to really grow the iron franchise – to drive new indications – expand into new geographies and improve access. Heart failure is a significant opportunity for the iron business.

“On the commercial front, CSL Vifor is only in about 20 countries and they haven’t launched every product in 20 countries just like CSL Behring is in 102 countries and we don’t have all products there. There’s plenty of room for growth and expansion to service patients in many countries.”

But Mr Perreault said it wasn’t without its complexities.

“I thought plasma manufacturing was hard and people ask me well, how does this fit with the plasma business,” he said.

“Iron is actually harder – when I say hard, it’s hard as rock – and many of you know iron ore in this country and it does start with iron ore when we manufacture iron. It is a very difficult process.”

One of the biggest opportunities in CSL Vifor’s iron business is the potential US expansion of its drug Ferinject or Injectafer to treat heart failure, CSL Vifor general manager Herve Gisserot said.

“A large body of evidence has demonstrated in heart failure patients that Ferinject treatment not only significantly improved function, reduced symptoms and improved quality of life, but was also associated with reduced hospitalisations,” Mr Gisserot said.

“This also gives us great potential to maximise our penetration in the US. A supplemental new drug application for the expanded indication of Injectafer for heart failure patients is currently in review with the (Food and Drug Administration).

“If approved, the label change will support efforts to build greater awareness of Injectafer among heart failure specialists. It will further help us to raise awareness of the treatment in the US and help capitalise on the tremendous growth opportunity.”

A decision from the FDA is expected in February.

CSL chief financial officer Joy Linton told investors that the company expected to lift its revenue by up to 30 per cent this year in constant currency terms, while net profits should grow by 13 per cent to18 per cent to some $2.8bn.

“Who knows what will happen to exchange rates, but I do note that if the (foreign exchange) rates as at the end of September held for the balance of the financial year, all else being equal, we would have a circa $200m headwind at NPAT, primarily reflecting the non-US dollar denominated revenue in our CSL Behring business.”

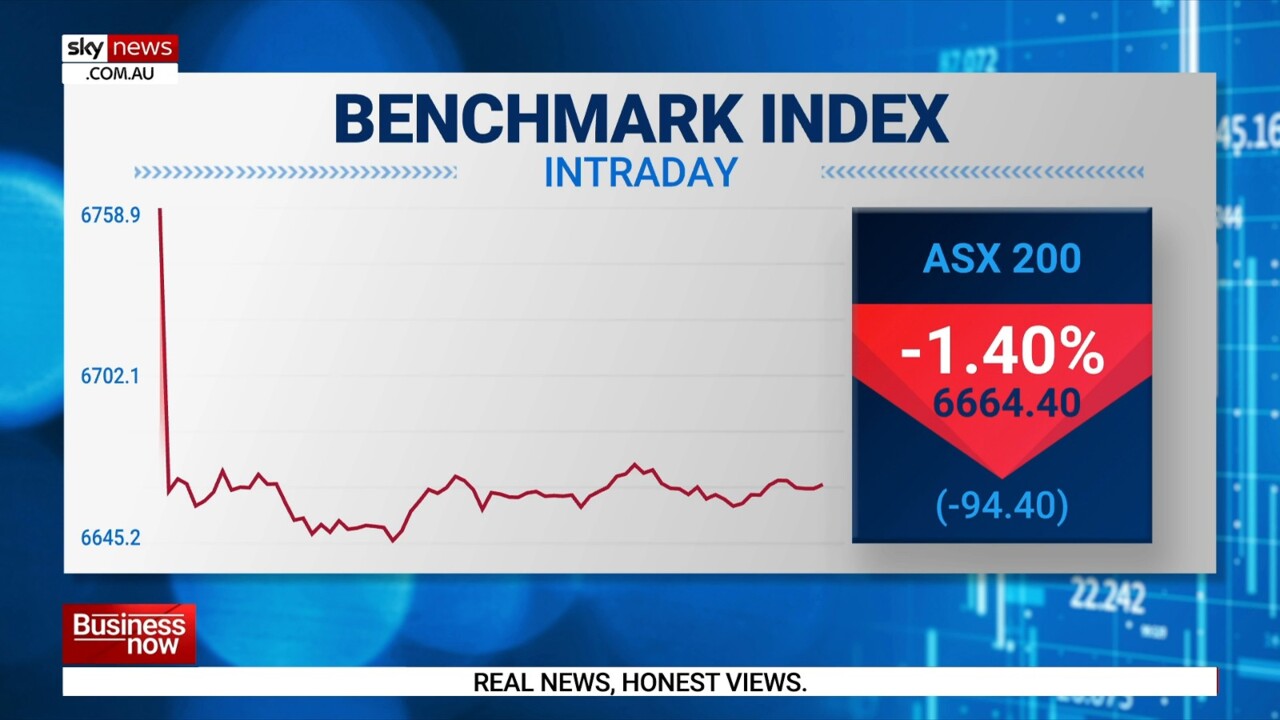

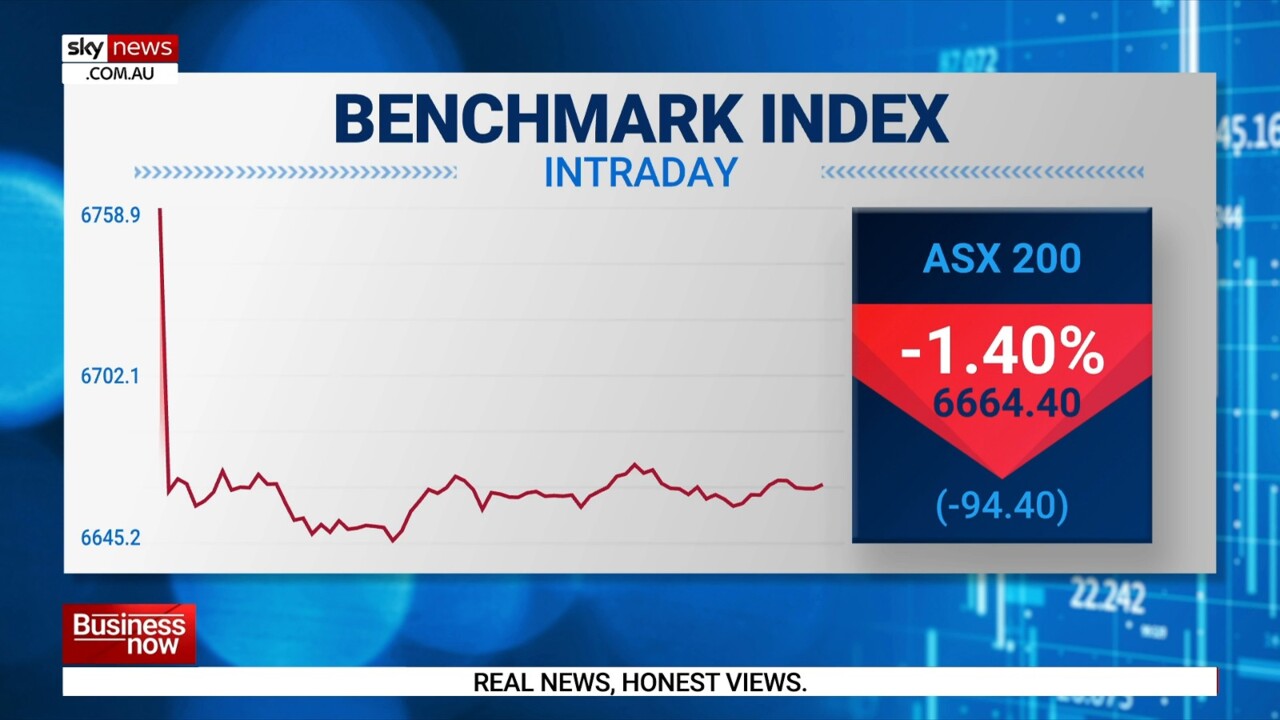

CSL shares fell 1.3 per cent to $276.83 – in line with a 1.4 per cent slide across the broader market.

Wilsons analyst Shane Storey said the earnings update was “consistent with our view that initially CSL would change very little, fundamentally, in Vifor, other than pursue indication breadth and jurisdictional expansion”.

“Longer term, this acquisition may de-risk how key CSL R&D (research and development) pipeline assets directed at cardiovascular and nephrology indications are operationalised,” Dr Storey, adding he maintained an overweight rating with a $342.55 price target.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout