How paranoia saved Seek’s skin

Job site CEO Andrew Bassat has revealed just how close the online employment group came to disaster.

Seek chief executive Andrew Bassat has revealed just how close the online employment group came to disaster six years ago due to a “period of complacency” that left its key competitors such as US behemoth LinkedIn “miles in front” and proved the adage that “no tech company is king for too long”.

In a wide-ranging interview to mark 20 years since the founding of Seek with his brother Paul Bassat and friend Matthew Rockman, Bassat says Seek would be “really struggling right now” if it had not received a “massive wake-up call” realising how much progress players LinkedIn and Indeed had made in Australia.

“From about 2009 we had been seeing these guys run over the job boards such as Monster and CareerBuilder in the US but until 2011 had not taken this anywhere near seriously enough here,” Bassat tells The Weekend Australian.

“There is no doubt that we had a period of complacency driven by the fact that we had (won) our previous battles so well and had such a strong lead in Australia and perhaps also distracted by our efforts to build an international and education business.

“After three tough years as we played catch up, we now feel we are world class in areas we had been poor in, and have seen strong market share and revenue growth since 2014, driven by our investments.

“I am convinced that if we had not reacted as we did, and with the required urgency, we would be seriously struggling right now and this is supported by recent fire sales of each of Monster and CareerBuilder.”

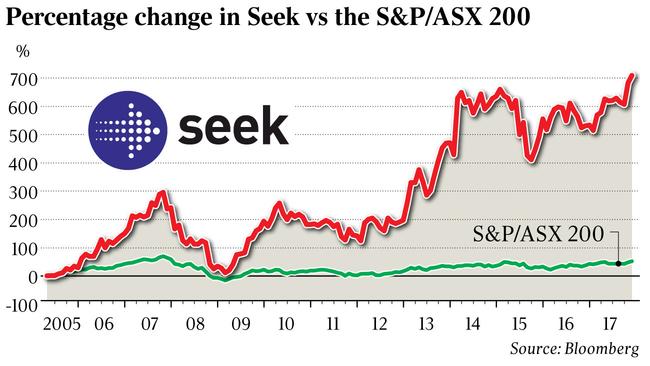

Seek went public on the Australian Stock Exchange in April 2005 with the backing of James Packer’s Publishing and Broadcasting after the then Fred Hilmer-run John Fairfax Holdings — now Fairfax Media — rebuffed an offer to invest in the online job classifieds business.

Seek was then chaired by Packer, who replaced Rockman’s father, Irvin.

After being founded as a cash-strapped start-up in 1997, Seek was jointly run by the Bassat brothers until October 2010, when Paul Bassat announced he planned to leave the company the following June.

Andrew Bassat says Seek realised only in early 2011 that US jobs site Indeed had more job ads in Australia than Seek and that LinkedIn had both more people through its professional network and more information about those people.

“All of our defensibility at the time was built around the fact that it was hard to get all the ads without people and vice versa but by 2011, these defensive walls had been well and truly breached.

“And these guys were miles in front of us in areas like product, tech and data, which we had come to recognise would be the key battleground going forward.”

He says Seek then resolved to change everything across the company, multiplying its product, data and tech team by six times in size and lifting capabilities.

Three years later, Seek made its biggest foray into the $8 billion job placement market when it launched a premium placements strategy, including a tool tailoring a product for hirers who wanted to search Seek’s talent database. It proved to be a turning point for the company.

“The biggest lesson learnt from this time was that a sense of urgency needs to be an ever-present thing and we must always strive, challenge and remain productively paranoid,’’ Bassat says.

“No tech company is king for too long. If you are standing still, you will be overtaken. Being in front isn’t enough. You need to be running faster than everyone else and in the right direction to have any chance of prospering over the longer term.”

Long-term Seek investor Yarra Capital’s Dion Hershan says the DNA of the organisation is “very unique, particularly by Australian listed company standards”.

“It is very strategic, innovative, very willing to take calculated risks and at all times is focused on long-term outcomes for clients, the business and shareholders,” he says.

“Seek carries a healthy paranoia and has managed to navigate through economic cycles, intense competition at times from the likes of LinkedIn or Indeed and major regulatory changes (in education).”

Another long-term backer, Hyperion Asset Management’s Tim Samway, says Seek’s management team has demonstrated it is a good allocator of capital and invests for the long term.

“In addition to investing in product and service, the company has sought to gain early exposure to leading international online classifieds businesses and technology companies, providing the management team with learnings from other markets,’’ he says.

Seek is going through another wave of early stage investments, increasing its stakes in the likes of Melbourne employment marketplace Sidekicker, job application tracking and client relationship start-up JobAdder, worldwide job search aggregator Jora, Brazil’s Catho Education and Malaysia’s JobStreet Education. Critics want them to start producing some winners sooner rather than later.

But Bassat remains focused on the long term. The success of Seek’s move into China is a case in point.

Early last month, Seek announced the completion of the privatisation and delisting from the New York Stock Exchange of Zhaopin, its 60 per cent owned career platform in China, with the support of private equity firms Hillhouse Capital Management and FountainVest Partners.

Over the previous 10 years, Seek had grown the value of its investment in Zhaopin by about 10 times since it first invested $20m in 2006 for a 20 per cent stake in the then $US100m, loss-making business.

Back then, the Bassat brothers told the Seek board there was a 30 to 40 per cent chance they would lose the entire investment.

But Zhaopin has since become one of corporate Australia’s genuine international success stories, as remarked last month by Packer.

About 60 per cent of Seek’s revenue is now generated offshore in Asia, Brazil, Mexico and China.

Andrew Bassat says Seek’s success in China and other international markets comes back to its willingness to have a go and persevere through tough challenges.

“We made no end of mistakes and met no end of challenges especially early but persevered through them and have now started to get the benefits,’’ he says.

“We have always taken the view that the local team knows more than us about operating in a particular countries, so we have always empowered the local team to run the business with Seek providing guidance at the strategic level or extra services when our international businesses could clearly see the benefit of what we could provide.”

But international headwinds for Seek remain. Over the past 12 months, the company’s Brazil operations have struggled due to a weak economy and growth in its southeast Asian markets has remained slow. Back at home, Citigroup has also warned about Seek’s exposure to a projected downturn in the Australian construction industry.

Yet the move in Seek’s share price back over $19 this week compared to below $16.50 early last month reflects Andrew Bassat’s optimism.

The company cracked the $1bn revenue milestone for the first time in the 2016-17 financial year and now has a market capitalisation of more than $6.5bn.

Another Seek loyalist, Wavestone Capital’s Catherine Allfrey, says Seek’s management has long “put the customers (jobseekers and hirers) and their staff at the centre of what they do and created a growing and powerful network”.

Indeed, the dynamic between Seek’s three founding managers laid the platform for its early and subsequent success.

“We were extremely fortunate to have a brilliant partnership. Each of us totally committed to each other and the functions we were operating. Me sales, Andrew strategy and traffic, Paul finance, product and operations. It was an unusual structure which completely worked,’’ says Matthew Rockman.

Paul Bassat, who is now one of the co-founders of venture capital firm Square Peg Capital, says his new career as a venture capitalist has given him a new appreciation of Seek’s early days.

“I now have a better sense of how hard it is to build a company from an idea into a really large independent business,” he says.

“There are so many things that can go wrong and you need a lot of things to go right at the same time to be successful. That is why so few companies evolve from start-ups into really important businesses.

“You need a great team, a product that meets an important market need, the timing needs to be right and you need a good dose of luck on your side. We had each of these elements at Seek.”

And his brother, who investors speculate may step away from the business in coming years, will never forget the lessons of half a decade ago.

“Since that wake-up call, we are moving faster and rolling out products at great speed, capturing and analysing huge amounts of data,’’ he says. “The pace at which we’ve responded since 2011 gives us confidence that we are uniquely placed and should be lifting our sights ever higher. We are now more focused on opportunities than threats but we have learned we can never again take our eyes off the threats.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout