How Nestle missed the chance to buy A2 Milk, the ‘Dyson of dairy’ on the cheap

The Swiss are known for their precision and excellent timing, but in the case of A2 Milk they’re more than a little bit off.

The Swiss are known for their precision and excellent timing, but in the case of A2 Milk they’re more than a little bit off.

It has taken a pandemic that’s belted the trans-Tasman dairy company’s share price for executives at Nestle, with their offices overlooking Lake Geneva, to finally start running a ruler over A2’s books.

The Australian’s DataRoom revealed on Monday that Nestle is understood to be mulling a takeover of A2, with plans to pounce after the dual ASX and NZX-listed company reports its results at the end of the month.

The news sent A2 Milk’s shares surging more than 12 per cent to close at $6.68 after trading as high as $6.84 on Monday, but the stock remains about two-thirds lower than the lofty heights achieved before Covid-19 struck.

A2’s market capitalisation – which at the start of last year was twice that of Qantas at $13bn – is now $4.43bn.

And that price is more palatable for the Swiss.

But The Australian can reveal that Nestle could have bought A2 for even less – a fraction of its Covid-rocked value – more than 20 years ago.

It is enough to make the freshest milk curdle in your mouth, but before A2 became an international dairy giant, its founders flew to Switzerland to meet with Nestle executives in the hope of striking a deal.

Nestle is the world’s biggest player in milk products and has partnerships around the world, and A2’s founder Corran McLachlan thought teaming up with the Swiss dairy giant was a great idea.

After all, Dr McLachlan learned that ordinary cows produce milk with different types of beta-casein proteins – A1 and A2 – in 2000, and discovered that the proteins affect people differently.

Dr McLachlan’s innovation and research, which includes genetic testing of cows, was quickly patented and remains protected in the US and elsewhere.

Dr McLachlan travelled to Switzerland with co-founder Sir Bob Elliott in an effort to convince Nestle executives of the validity of the science and see if they could strike a commercial arrangement. But after a month of intense scrutiny of the science, Nestle executives declined.

It wasn’t until years later, when A2 became the only dairy company to achieve significant year-on-year growth in a flat liquid milk market, and with Chinese parents lapping up its Platinum-branded infant formula in droves – sending A2’s shares past $20 – that Nestle and other companies began launching their own range of A2 copycat products.

But in the words of A2 chairman David Hearn, while imitation is the greatest form of flattery it doesn’t compare with the genuine article and he likes to call A2 the “Dyson of dairy”.

“Dyson invented the cyclonic vacuum cleaner.

“When he came along and invented that everybody else had what was seen as old technology.

“If you speed forward today, everybody has got a cyclonic vacuum cleaner at prices well below his and his business has never been better,” Mr Hearn said last August.

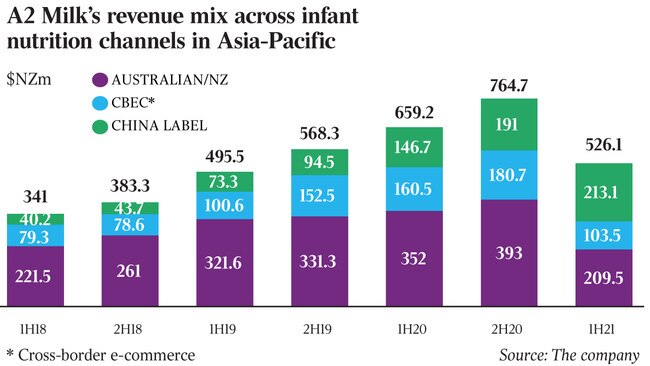

But Covid exposed a massive weakness in A2’s business model, which was also its greatest strength: the China “trusted shopper” market, or Chinese tourists and students buying products from Australian stores and sending them back to their homeland.

While this fed into A2’s capital-light structure, saving millions on distribution costs, it also meant that when international borders closed at the onset of the pandemic, so did the pipeline of cashed-up Chinese shoppers.

Now Nestle is looking to regain some of that Swiss precision timing and potentially lob a takeover before Covid travel restrictions ease and A2’s new chief executive David Bortolussi can fully implement his strategy to make the company less dependent on those Chinese shoppers.

While at this stage takeover talk is only the subject of informed market chatter, with Nestle yet to make any formal approaches to A2’s board, the trans-Tasman dairy company declined the opportunity to set the record straight.

“The A2 Milk Company does not comment on media speculation or rumours,” a spokesman said on Monday.

Instead, it has been focused on defending its intellectual property, including settling a copyright dispute with Oklahoma-based fast-food chain Braums, which claims to have the biggest A2 herd in the US.

And it is this IP – including A2’s patented test to separate A2-exclusive producing cows from regular dairy herds – that a global group like Nestle hopes to take to other supply chains and brands in other markets.

As one observer told DataRoom, if Nestle thinks it can be a differentiator in powdered milk or infant formula it will look at A2 – that is, the genuine A2 Milk.