Hills, once an Australian manufacturing powerhouse, has been brought to its knees

Hills once turned out millions of its iconic Hills Hoists, becoming a manufacturing giant in the process. The company is now a shell of its former self and fighting to survive.

At the closing ceremony of the Sydney 2000 Olympics, as Vanessa Amorosi belted out her hit Absolutely Everybody and Australians the nation over rapturously celebrated “the best Olympic Games ever”, silver-clad robotic performers on stilts teetered around with life-size Hills Hoists strapped to their backs.

The significance of the silver robots - if any - is probably lost to time - but Aussies were under no illusions as to why the Hoist was centre stage.

Along with Vegemite, John Farnham and telling visiting tourists to watch out for drop bears, the Hoist, until perhaps recently, has been part of our cultural DNA.

For decades the Hills Hoist was - and remains - a central part of suburban life, a literal icon of the Australian suburbs, planted smack bang in the middle of the backyard on your quarter acre block.

It was also a symbol of Australian innovation and manufacturing success, the key product around which the Hill and Ling families built South Australian-based company Hills Industries, with early versions of the hoist sold from the backyard of Lance Hill’s Glenunga home.

But Hills has sadly become something of a case study in recent years of the perils of failing to adapt to market conditions, its market share particularly in its once-core manufacturing sector devoured by competitors from China.

The company attempted to pivot, but sadly, the firm hailed as a “giant”, with more than $1bn in revenue just 15 years ago, has now been brought to its knees, and late on Friday, was placed in administration.

The company’s shares last traded at just 2.3c apiece, valuing the entire outfit, now based in Lidcombe, NSW, ironically just next to Sydney’s Olympic Park, at a meagre $12.3m.

The firm, now focused on technology products for the health sector, had been trying to find a way forward after losing a court battle with a $5.48m payout attached.

It is a long way from the glory days of the mighty firm which first listed on the Australian Securities Exchange in 1962, and sold literally millions of Hills Hoists to Australian households over many decades.

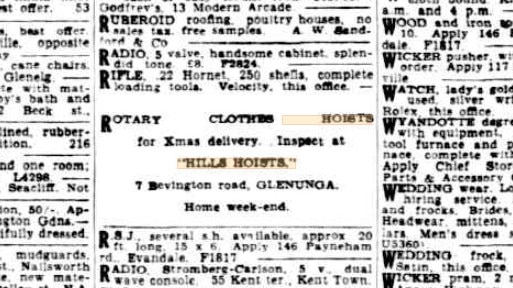

There was a small advertisement in the Adelaide Advertiser on Saturday December 1, 1945, that presages what would become a national manufacturing phenomenon.

“Rotary clothes hoists for Xmas delivery. Inspect at ‘Hills Hoists’, 7 Bevington Road, Glenunga. Home weekend.’’

Lance Hill, the patriarch of the Hills empire, did not invent the Hills Hoist - that honour arguably goes to Geelong blacksmith Gilbert Toyne whose Aeroplane Clothes Hoist Company was selling rotary clothes hoists prior to the first World War.

However with Toyne’s invention out of patent by the early 1940s, and Lance’s wife Sherry wanting a better way to dry her laundry, Lance built a rotary clothes line out of scrap metal, and the business was born.

Hill teamed up with his brother in law Harold Ling, and the business took off, quickly moving from the family yard to larger premises, and by the mid-1950s it was producing hundreds of hoists per week, even offering one as a - declined - gift to the queen at one stage

Hills expanded to New Zealand and the UK in the late 1950s, started producing numerous other products and also became Australia’s largest manufacturer of television antennas.

Over the decades the company diversified into areas such as automotive parts manufacture, bought almost half of Adelaide-based industrial products company Korvest, and in about the mid-1980s began investing in the technology sector, buying into the security and surveillance business.

In the mid 2000s Hills was still going from strength to strength. A five year summary contained in the company’s 2004 annual report shows revenue and net profit soaring year on year, and the dividends were flowing.

And while revenue would top $1bn per year before the end of the decade - with 16 consecutive years of record profits posted by 2008 - worrying signs were starting to emerge, particularly in the company’s core “home and hardware” division which made the Hoist.

During the noughties the manufacture of more and more Hills products - clotheslines, ladders, wheelbarrows, children’s play equipment - moved to Asia.

The company also had to move to protect itself legally, with offshore manufacturers copying its products.

In 2005 then managing director David Simmons, who presided over the company’s dream run during this time, said Hills Hoists would continue to be made at the company’s now long-shuttered Edwardstown factory “even if I have to knock it together myself.’’

In 2007-08 the company made a pre-tax profit of $87m on sales of $1.2bn and employed about 3000 people and about 600 contractors.

But things were soon to take a turn for the worse, not helped by the Global Financial Crisis which was sweeping the world at the time.

In early 2009 the company told the ASX its profit would be 30 per cent lower than the previous year. In May that guidance was updated to a 40 per cent drop.

The company also advised at the time it was restructuring its Home Hardware and Eco division “to match current market demand for its products”, which was code for writedowns and redundancies.

The net profit that year came dipped sharply - the first time they had not hit a record high in more than a decade - but the company still had some strong performers, with Korvest hitting record numbers and the Hills building and industrial products business turning over more than $600m.

By now the Home Hardware division was the smallest of the company’s three divisions, and delivered results which were “most disappointing and well below our expectations’’.

Things took a turn for the worse again in 2010, as its Orrcon steel products business struggled, and in May 2011, Hills would announce the closure of Orrcon’s Unanderra manufacturing site in NSW, with the business shuttering its manufacturing operations completely, and moving to an import-only model.

In 2010 the company changed its name to Hills Holdings, reflecting its progressive move away from its traditional manufacturing base, and again changed it in late 2013 to Hills Limited.

The vision articulated in 2012, was to shift the company towards the burgeoning tech sector - areas such as health, home automation and security, while managing the decline of the traditional businesses.

“The intent is that by 2015, over 75 per cent of total group revenues will come from non-steel activities and the company’s return on equity and trading valuation will be above the midpoint of Hills’ peer group,’’ the company told the ASX.

Turnover was still more than $1bn per year, and dividends were still being paid.

But in 2015 the company made a net loss of $85.9m, including $94m in writedowns, while on an underlying basis it made $11m, down from $27.3m.

It also paid its last dividend, of 2.1c per share.

The next year it lost $68.3m on revenue of $328.9m, with the underlying result an $800,000 loss.

Then in 2017 the unthinkable happened - the Hills Home Living division, which owned the rights to the Hoist - which was by now being manufactured offshore - was sold to US-owned business AMES Australasia.

The Hills Hoist is still manufactured by Ames Australasia and is not affected by the issues affecting the listed Hills entity, with the businesses not related in any way.

In FY18 Hills eked out a $400,000 net profit, but has not made a profit on a statutory basis since then.

Last financial year, it made a loss of $24m on revenue of just $47.3m and a loss after tax from continuing operations of $8.3m.

The business has now shrunk to a focus mainly on healthcare IT solutions and NBN installations.

And now, a commercial dispute over a contract to provide technology solutions to a hospital in western Sydney has forced the company into administration.

Hills initially succeeded in having the case dismissed in February 2022, however the plaintiff Stellar Vision Operations appealed that decision and won, and was awarded $5.48m.

Hills asked the ASX to suspend its shares from trade this week “pending resolution and an announcement by the company in relation to ongoing settlement negotiations between the parties and other stakeholders, including the financier, which, if not satisfactorily resolved, have the potential to have a significant impact on the company’s financial condition’’.

Hills was expecting the suspension to remain in place until June 5, but late on Friday the company was placed in administration.

Also on Monday non-executive directors Harley Whitcombe and Gunalan Jeganathan resigned from the company’s board.

Both of those directors were appointed to the board in early May as representatives of Historical Holdings, which is a substantial shareholder in the company after investing $900,000 recently at 3c per share.

Hills had a cash balance of $2.8m at the end of the March quarter, however also completed an entitlement offer on April 20, raising $6.4m.

Its net cash outflow for the March quarter was $211,000.

At annual meetings held in Adelaide in the mid-2000s then-chairman Bob Hill-Ling would take the stage and invariably tell two or three groan-inducing dad jokes which the longstanding mum and dad shareholders would cheerfully endure.

They’d been safe in the knowledge for years that their money was safe with Hills, and were likely there as much for the wine and food the company would put on after the AGM as for the business update itself.

Most would have been hoping the company could still right the ship, but sadly that wasn’t to be.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout