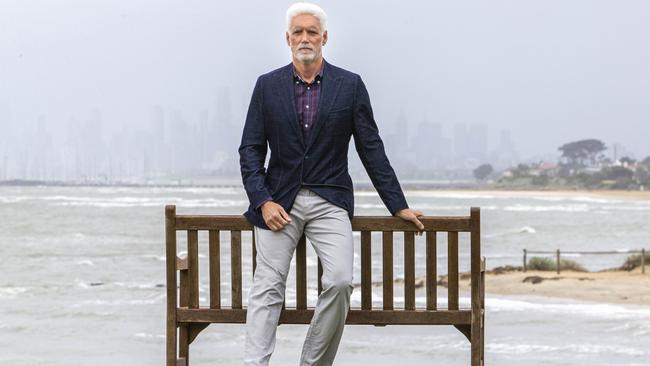

Higher costs take toll at Transurban as Scott Charlton reinvests for growth

Guidance on dividends for 2023 from the major toll road builder and operator came in below market assumptions and was the main factor in a 3.4 per cent slide in the share price.

Transurban chief executive Scott Charlton acknowledges a miss around the cost base was one reason for the dividend miss, with total proportional costs up 11 per cent over the previous year.

He says while revenue performed broadly in line with expectations, there was a volume increase in costs.

“That comes back to us having additional assets coming online and the operating costs for those, as well as further investing in our technology customer experience and development activities,” he tells The Australian.

A second factor is that an additional 10c that investors might have thought was coming their way is instead to be reinvested into the business for future growth. That 10c comes from capital releases, which Transurban gets from its road projects.

“We understand the market is disappointed, but there is real strength of cash flow in the growth of the business,” says Charlton.

Charlton makes a fair point: the fact the board even has the confidence to give distribution guidance for a year is in contrast to many other companies this season. Look no further than Origin Energy, wrestling with uncertainty, which also reported on Thursday.

Sitting beside Charlton, chairman Lindsay Maxsted is keen to remind investors of a conscious decision by the board when the Covid-19 pandemic hit in 2020 to change its position on capital releases – something which perhaps has not sunk in.

“We announced to the market at that same time that distributions in the immediate future would not include capital releases, with a minor exception to that in the WestConnex equity raise,” Maxsted says. “That was a big change. We wanted to do that at the time to protect and strengthen the balance sheet,” he adds.

The chairman says – in talking to investors since then – that the board has become more comfortable with its message: the better use of capital releases is to fund the development pipeline rather than flow into dividends. This avoids having to go back to the market every time funding is needed for even a minor project.

“All of that makes sense then, makes sense now, but I suspect in terms of the immediate response today that nuance has not been picked up,” says Maxsted. “It will be up to the new chair Craig (Drummond) and the board going forward as to whether they continue down that path, whether there is some sort of hybrid in how capital releases are used.”

Whether the dividend decision was on the conservative side, Charlton insists he is not allowed to say, but stresses that free cash flow is higher than it was pre-pandemic and the 2023 dividend is 30 per cent up on this year.

Market analysts at UBS and Ord Minnett, disappointed by the dividend guidance, cited operating and corporate costs but also a softer assumed recovery in traffic in Melbourne and North America.

It is worth noting that in the cost of living crisis, tolls are well down the list of soaring prices for consumers. Power, food, petrol and mortgages are much bigger concerns for households.

As a business, Transurban actually benefits from inflation because of the long-term tenure of its debt and its hedging policy, while its tolls are for the most part inflation-linked.

“Our debt book is hedged around 98 per cent so in the near term we have very little debt to refinance, and yet we get the benefit of inflation through about 70 per cent of our concessions. So the near-term inflation is actually a positive outcome financially for the company,” says Charlton.

Both Charlton and Drummond expect high inflation to be short-term. “Look at the US. It looks like things are starting to moderate a little. Certainly what the yield curves are suggesting is that inflation and rates are likely to come under control through 2023 – but none of us have a crystal ball,” says Drummond.

As to rising construction costs, Transurban’s business model is designed largely to protect it from blowouts. Agreements with governments mean the increased costs are paid for by the infrastructure, ergo the road users.

One big issue remains the dearth of workers.

Asked if he has any hopes for the government’s Jobs and Skills Summit, Charlton welcomes a discussion on skilled migration and efficiencies around the construction sector.

“Obviously with the abolition of the building commission, the ABCC, how that is going to be managed and IR going forward – it is critically important that we get some more productivity out of the economy as well as giving wages increases,” he says.

Thursday was a reality check for Transurban investors expecting some good news as toll roads return to post-pandemic normal.