HCF and Healthscope strike last minute deal in funding dispute, saving patients hundreds of dollars in extra costs

Australia’s second-biggest private hospital operator and largest not-for-profit health fund have ended a bitter feud that would have led to patients paying an extra $1000 in out-of-pocket costs.

Australia’s second-biggest private hospital operator, Healthscope, has signed a two-year funding deal with HCF at the 11th hour and sparing patients steep extra out-of-pocket costs.

Healthscope’s existing contract with HCF, Australia’s biggest not for profit health fund, expired on Wednesday after the pair hit in a stalemate over funding increases for the past three months.

If they hadn’t reached a new agreement, HCF’s 1.7 million members would have been forced to pay about an extra $1000 in out-of-pocket costs if they were treated at a Healthscope hospital.

It comes after the pair were locked in mediation as late as Monday. The deal is less than half the length of the five-year funding contracts HCF secured with Healthe and Adventist Healthcare last week. HCF also has a five-year contract with Australia’s biggest private hospital operator, Ramsay Healthcare, which it struck last year.

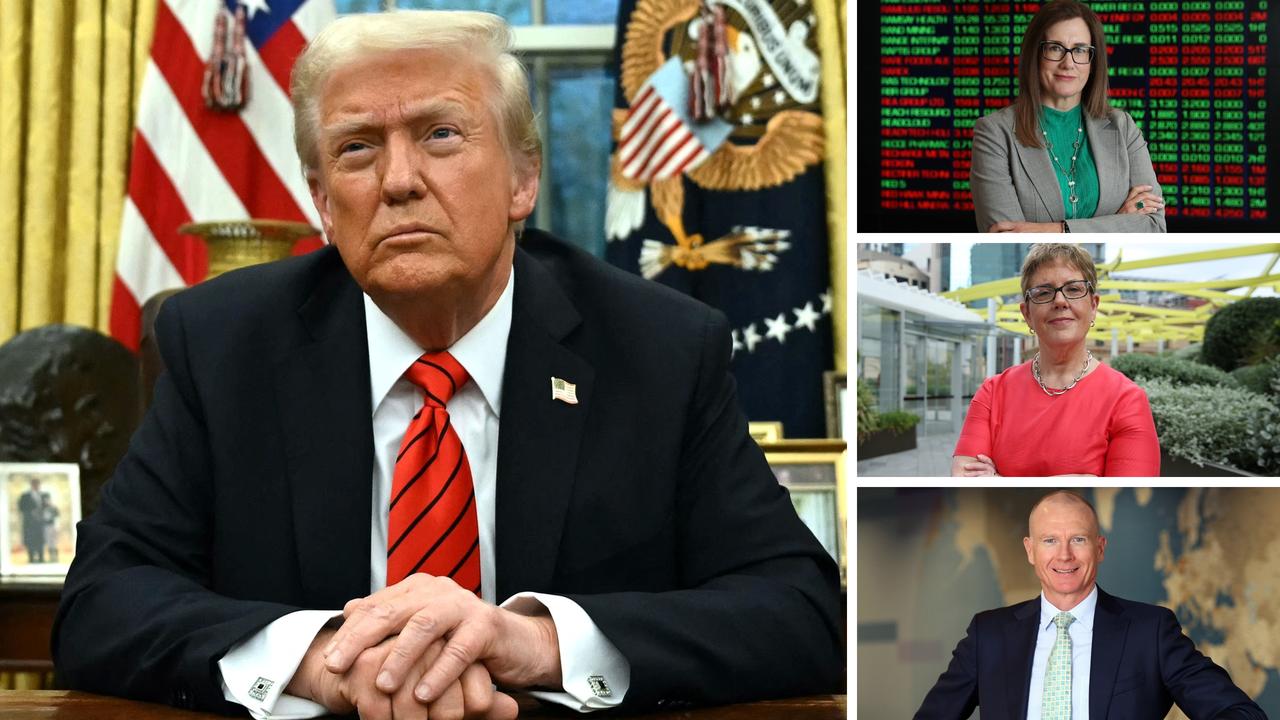

But Greg Horan, chief executive of Healthscope – which Canadian private equity giant Brookfield took over for $4.4bn in mid 2019, said he was pleased the hospital group and HCF have secured an agreement which “fairly recognises the cost inflation” and is “commercially viable and sustainable for both parties”.

“We are delighted to be continuing our longstanding agreement with HCF,” Mr Horan said.

“We acknowledge that the recent negotiation process has created uncertainty for HCF members and patients. I’m pleased this new agreement means HCF members can continue to be treated in our hospitals with no additional out-of-pocket charges.”

A HCF spokesman said the fund’s members will have continued access to reduced gap or no-gap treatment included in their cover at Healthscope hospitals.

“In achieving this agreement, we have remained committed to putting health before profit by keeping the cost of health services and premiums affordable and accessible to more members,” he said.

The agreement comes after Healthscope terminated its contract with HCF in November, citing pandemic cost pressures and inflation reaching its highest rate in 30 years.

HCF – which pays for about 76,000 claims a year through Healthscope – accused the hospital group of pursuing the recovery of lost profit margin from the pandemic ahead of patients.

Meanwhile, the Australian Medical Association called for the establishment of an independent umpire to oversee negotiations between health insurers and hospitals, branding contract termination as a “hardball tactic” that has become increasingly common.

Ramsay terminated its contract with Bupa last August amid a high profile dispute between the pair over indexation. They eventually salvaged their agreement, like Healthscope and HCF, after its expiry, sparing patients higher out-of-pocket costs.

Healthscope also adopted a similar negotiation tactic in mid 2020 during a dispute with the Australian Health Services Alliance – a peak not-for-profit body which negotiates funding agreements on behalf of the smaller insurers – prompting Australia’s Private Health Insurance Ombudsman to intervene.

The feuds between hospital group’s and funds have created a potential headache for federal Health Minister Mark Butler, who determines how much health insurance premiums will rise.

The health insurance lobby warned last year that if funds capitulate to hospital demands to recover cost increases of about 7 per cent that Australians will face double-digit premium increases.

Such a scenario would create a rude shock to many Australians after most health funds froze premium rises during the pandemic.

It would also spark an acceleration of the return of the pre-pandemic trend of Australians, mostly young and healthy, withdrawing from private health insurance given the expense and lack of perceived value.

Despite its disagreements with not-for-profit funds, Healthscope agreed to a new funding contract with Australia’s biggest health insurer Medibank last year.