Harvey Norman gets an offshore boost as Aussie housing market cools

Billionaire Gerry Harvey is reaching into Asia and Europe to fuel growth for his empire as the Australian housing market cools.

Billionaire Gerry Harvey is reaching into Asia and Europe to fuel growth for his bedding, furniture and whitegoods retailer Harvey Norman as a cooling housing market in Australia and intensified price competition begins to shave earnings at his flagship local operations.

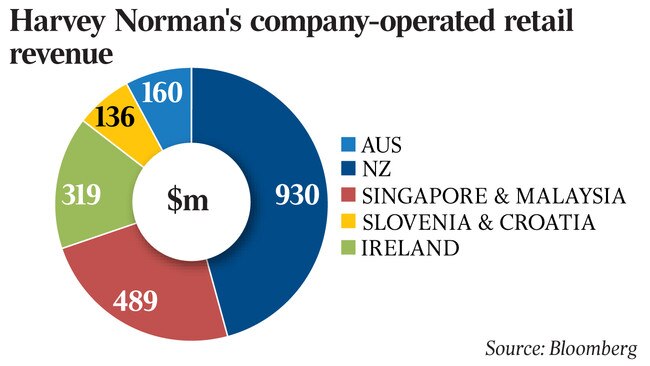

“Australia is more important but now 22 per cent of our profit comes from overseas, so I think Australia will flatline this year, and New Zealand may well do the same thing, but in all the other countries we are in we are looking at very good growth,’’ Mr Harvey said.

Harvey Norman suffered a 16 per cent dive in its full-year net profit to $380.05 million.

The profit slump was driven by slowing values for its swollen property portfolio and more than $70m in losses and impairments linked to its failed dairy venture.

The Australian stores suffered a 3 per cent decline in earnings in the first half, accelerating to a 12 per cent slide in the June half.

Sales for fiscal 2018 were up 8.8 per cent at $1.993bn.

Net profit before tax was down 17.1 per cent to $530.17m and underlying net profit — excluding the losses and impairments for its Coomboona dairy joint venture — was down by 0.96 per cent to $532.5m.

But while comparable store sales for Harvey Norman’s flagship Australian operations rose 2.2 per cent, there was an impressive 23.8 per cent growth in same-store sales in Slovenia and Croatia, 10.9 per cent in Ireland, 9.4 per cent in Singapore and 2.9 per cent in Malaysia.

“Just imagine if that had happened in Australia, but it happened in Singapore, Malaysia, Slovenia and Ireland — so all of those countries are seeing growth that we are not seeing here,’’ Mr Harvey said.

“It’s from a low base, but when it represents 22 per cent of your profit it is not insignificant and very few retailers in the history of this country have gone to overseas countries and made a success of it.’’

Mr Harvey said the Australian business was butting up against a subdued economy where it had become harder to ring up profit gains, especially in the face of flat wages growth and a slowing housing market.

“You have got a situation where it is difficult to get good increases on last year … it is not as if we are underperforming but we are flatlining at the moment.

“Business is not tough (but) it is not as buoyant as it has been in times gone by.’’

Harvey Norman also acted yesterday to repair its balance sheet and pay down debt, launching a renounceable pro rata entitlement offer to raise $163.85m at an offer price of $2.50 per share — a steep discount to a closing price on Thursday of $3.77.

The raising is being done through a one-for-17 rights offer.

Shares in Harvey Norman fell to as low as $3.47 yesterday before closing down 17c, or 4.5 per cent, at $3.60.

Mr Harvey said it was a prudent time to raise capital, and he also defended the steep discount of the offer, saying he had been burnt personally by companies he owned shares in — particularly the banks — when they did raisings during the GFC.

“My view is, I’ve got shares in lots of public companies and they often do (raisings) at a slight discount mostly to the share price and often some months later it’s down below that and I think, ‘why did I go in that?’

“In the GFC most of them (companies) including all the banks were all in strife overnight and they didn’t even let all their shareholders participate in most cases in the raising, because they didn’t have time, needed the money tomorrow, and I’m still shitty about the fact that I didn’t get any shares in a lot of those banks and companies.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout