Hand sanitiser switch pays off for BWX, as profit jumps 60pc

Skin and hair care firm BWX flags higher earnings ahead after a 60pc rise in profit, as hand wash and sanitiser demand surges.

BWX has delivered a net profit up nearly 60 per cent on the prior year thanks to a pivot to hand sanitiser production and resilient demand for skincare products through the coronavirus crisis.

The skin and hair care company has flagged a 10 per cent lift in earnings for the year ahead as it booked a net profit after tax of $15.2m for the year through June, up 59 per cent.

It declared a final dividend of 2.6c a share fully franked, down from 2.7c in the prior year.

“Skincare demand is pretty resilient, we’re affordable which is good and we’re natural so we’re seeing good consumer demand across the majority of our products,” chief executive Dave Fenlon told The Australian.

“We saw an increase in demand for hand sanitiser and hand wash, that’s levelled off as people have filled their cupboards with that but overall, natural skincare has been pretty level.

“We’ve seen pretty consistent volumes.”

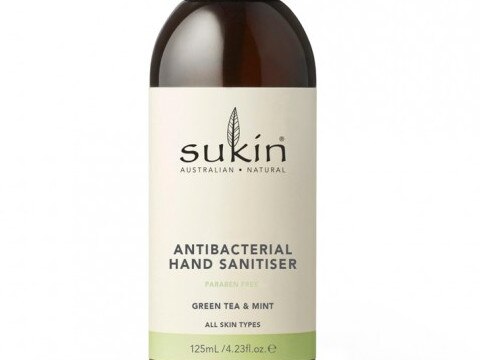

The company, which produces products under the Sukin, Mineral Fusion and Andalou brands, said it was well positioned for long-term, sustainable growth after the 2020 financial year provided a stable revenue base.

BWX started producing Sukin branded, natural hand sanitising gels and sprays through the COVID-19 pandemic. Demand for those products was likely to continue, Mr Fenlon said.

“It’s become a core staple of people’s shopping baskets,” he said. “I think it’s something we will continue to use.”

Citi analyst Sam Teeger said the bottom line was also boosted by a lower than expected tax rate.

Subject to market conditions BWX expects to achieve ongoing growth in revenue and earnings before interest, tax, depreciation and amortisation of at least 10 per cent in the current year.

“We remain confident that, in the long-term, we will experience growth upside across our select engine markets in Asia-Pacific; that demand will recover in North America; and new opportunities will emerge from the global economic recovery,” Mr Fenlon said.

“The work that we have completed in fiscal year 2020 put us in a good position to capitalise on these opportunities.”

BWX shares closed up 4 per cent on Friday at $4.44.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout