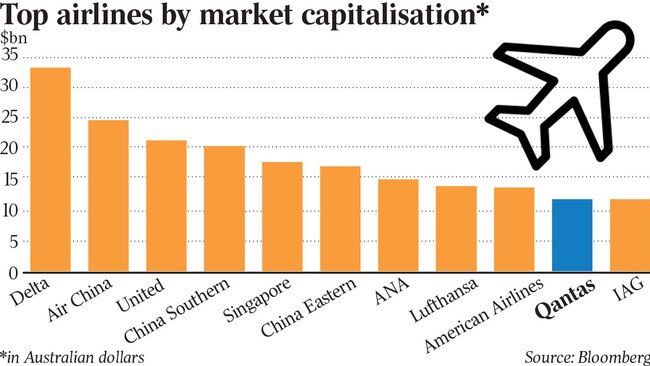

At $11.7bn it passed Air France-KLM months ago and in recent weeks overtook one-time East Asian powerhouse Cathay Pacific. Now it is equal 10th with International Airline Group ($11.7bn), the owner of twin brands British Airways and Spain’s Iberia. The next targets on Joyce’s list are American Airlines ($13.6bn) and Europe’s biggest carrier Lufthansa ($13.8bn). Another profit upgrade in the coming months or, as expected, a new share buyback round could – at a stretch – knock off Japan’s ANA ($14.9bn), putting it just outside the top five.

On Wednesday, Qantas issued its third profit upgrade in just three months, if you include the upbeat outlook issued during the August results presentation. The airline is now targeting an underlying profit of $1.35bn-$1.45bn this financial year, as much as $250m higher than the previous range given last month.

Where the airline was just at the start of the year in a net negative asset position, it has rapidly paid down debt and is now spitting out cash. Debt at the end of the year is expected to be down another $900m, putting it comfortably in its normal operating range.

As well as cost-cutting, the travelling public have contributed to the improvement in financial performance. Despite the airport chaos, delays and cancellations at the start of the year, Australians continue to fly in force and are paying up for the opportunity. Any disruption through the coming Christmas period will hit Qantas’s reputation twice as hard with passengers having one eye on the booming profits.

Surging profits also makes it harder for Joyce to convince more than half of his workforce to lock in a new enterprise agreement without undermining his $1bn annual cost savings target.

This week Qantas has secured an in-principle agreement with the powerful Transport Workers Union that will see a 9 per cent pay rise delivered over three years for its ground crew. That is non-flying staff involved in getting planes ready to fly, including aerobridges, passenger handling and some supervision of baggage services.

Airlines across much of the world are facing a much slower rebound from the Covid pandemic, particularly in Europe and around international routes. Qantas’s recovery also highlights how the local aviation market has shifted.

Both Qantas and Virgin, for years at loggerheads for dominance in the sky, have settled into a cosy market. The two are no longer chasing market share for the sake of it, rather each flight is designed to maximise earnings. The disrupter to this is regional player Rex, although it has a limited balance sheet to expand.

Qantas pointed out that even with elevated prices, customers continue to put a high priority on travel ahead of other spending categories, and limits on international capacity are driving more domestic leisure demand.

The multiple Qantas profit upgrades and massive cash generation bode well for Virgin, which was rescued from bankruptcy by private equity player Bain Capital for $3.5bn, including debt. At this rate, Virgin is set to become the model turnaround story for Bain, which has insisted it remains a long-term, committed investor.

Virgin boss Jayne Hrdlicka recently told staff she wasn’t surprised about the Qantas profit upgrades because her airline was seeing similar experience in terms of demand for flights. Given Virgin is owned by private equity, it is difficult to get a full financial picture of the airline. But with nearly all Virgin’s operations focused on the domestic market, it is getting a boost from a surge in demand for local travel.

For its part, Virgin still has international ambitions. It has resumed flying to Queenstown in New Zealand and also flies to Bali and Fiji. Virgin still has valuable landing slots at Japan’s Haneda airport and in coming weeks is expected to announce that it plans to resume flights to Tokyo.

Qantas’s Joyce needs to run his airline at full speed in the short window he has before the aviation market shifts again. International is not yet fully firing, with capacity at about 30 per cent below pre-Covid levels. As Europe recovers, more airlines, including the Middle Eastern majors, will resume capacity on Qantas’s lucrative international routes and put pressure on prices. At the same time, rising interest rates will soon force some passengers to stay home all together, and businesses are looking for ways to trim costs. Virgin also has a temptation to rebuild market share to prove to future investors it’s a bigger airline.

Fortescue wheels turn

In late August, former Reserve Bank deputy governor Guy Debelle came off his bike.

The accident, which resulted in a broken pelvis and several busted ribs, came just months after he made the monumental jump onto Andrew Forrest’s green hydrogen show. The heavy crash put him out of action, forcing him to miss a major investor briefing.

At the time Forrest said Debelle’s accident was “recoverable” and no car was involved. It has since been a long slow recovery for the former RBA official, who came off crutches in mid-October.

Although Debelle has been on the indoor trainer several times since the crash, last week he got back on the bike to try his first outside ride with a few laps of Sydney’s Centennial Park. As most Sydney riders know, Centennial is about as flat as you can get in the hilly city and the right wind can make it all the more easier. Debelle told friends after the ride the rehab was going well and it was good to be back for an outside ride.

After appearing on stage at several conferences this month on behalf of Fortescue’s green hydrogen arm, including UBS and ASIC and another scheduled on Friday in Adelaide, Debelle has taken a major step back.

On Wednesday he moved from the chief financial officer role of Fortescue Future Industries to the board of the same organisation so he can fully focus on his recovery.

“I am sadly not in a position to give this role everything I know it deserves right now. It is a critical time for the green energy transition, and we cannot slow down,” Debelle said.

The new role will see Debelle focus on policy, regulatory and financial advisory, something that sits more comfortably with his previous position at the RBA rather than chief financial officer reporting to a chief executive.

The problem is the shuffling of positions, albeit for health reasons, reinforces the perception of lack of stability inside FFI, which has been marked by rapid staff turnover inside the Fortescue empire.

More recently Andrew Hagger suddenly left Forrest’s private company Tattarang and its philanthropic arm Minderoo after four years heading up both organisations. Forrest’s trusted Fortescue chief executive Elizabeth Gaines retired early this year, although she has moved to the mining company’s main board. But this exit forced Forrest to resume executive duties at Fortescue as recruitment of a new CEO stalled while the role was overhauled.

Former GE senior executive Mark Hutchinson was appointed to the CEO role of FFI in July and played a key role in presenting at Fortescue’s annual meeting earlier this week.

Forrest was in full sales mode at the Fortescue annual meeting where he was mapping the company’s major shift to green hydrogen.

“So many people now believe that a mining company can also be the most responsible climate company in the world,” Forrest told shareholders. “We are the company that understands that 10 per cent inspiration 90 per cent perspiration is what it takes”.

johnstone@theaustralian.com.au

Despite the headlines at home, Alan Joyce’s Qantas quietly passed another milestone as it moved into the top 10 of global airlines by size.