German discount giants Aldi and Kaufland losing potency: report

A less aggressive rollout of Aldi and Kaufland stores has eased pressure in the sector, says Morgan Stanley.

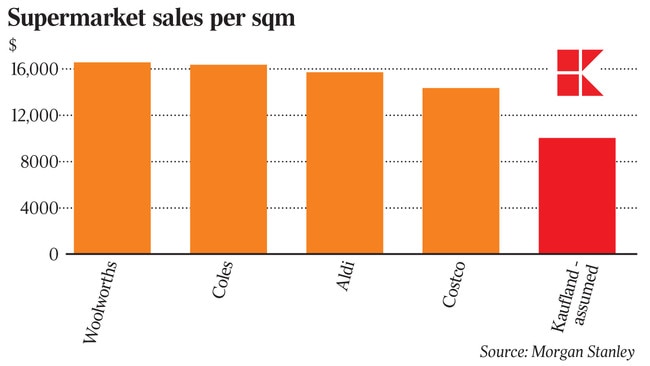

The twin German threats to the nation’s $90 billion grocery sector, discounters Aldi and Kaufland, could be losing some of their potency which could allow a fightback by the domestic players Woolworths, Coles and the independents.

German discount supermarket chain Kaufland is progressing with a slower than expected rollout of its launch in Australia, according to retail analyst Thomas Kierath from Morgan Stanley, while Aldi’s growth appears to be moderating.

In a report to his clients this morning, Mr Kierath said the outlook for the Australian supermarket sector was improving, but it was “far from rosy” with margins for all the key chains likely to remain under pressure from Amazon, the looming arrival of Kaufland and intense competition in online groceries with both Coles and Woolworths investing heavily in their website platforms.

Mr Kierath now believes that the launch and roll out of Kaufland could be slower than was first anticipated as the owners of the German group, the world’s fourth biggest retail company, search Australia for suitable sites.

Kaufland’s burgeoning Australian operations have so far received $325 million in capital from its German parent, the Schwarz Group, and are currently focused on their first six sites in Melbourne followed by a likely national roll out.

Matching the German incursion is Aldi, which in 2017 unveiled a $500m refurbishment plan that would see every Aldi store in the country upgraded to a new format as it pushes out its portfolio to 500 stores in Australia.

Both discounters represent a huge threat to incumbents Woolworths and Coles.

But their competitive threat could now be waning.

“Kaufland’s progress in Australia has been slower than we first expected here and Aldi’s growth appears to be moderating,’’ Mr Kierath said.

“We push back our forecast Kaufland launch to fiscal 2021 (versus fiscal 2020) to reflect the Melbourne distribution centre build in 2020. LinkedIn shows Kaufland Australia has more than 100 employees across the country with the majority located in Melbourne currently engaged in real estate/purchasing functions.

“The delay in Kaufland opening stores reduces our fiscal 2023 sales forecasts falling to $1.1bn from around $2bn. We push out our Aldi new store forecasts such that fiscal 2023 stores reduce from 663 to 618 and sales from $15bn to around $14bn.”

Kaufland, whether it is slower to launch or not, is still viewed as a large competitive challenge to the incumbent supermarkets. A typical Kaufland store is vastly different to small-format German discount stores Aldi or Lidl. It is run out of large warehouses that can be four or five times the size of a standard Coles or Woolworths store with as many as 60,000 products across a wide range of categories such as groceries, fresh food, meat and seafood, general merchandise, clothing, toys, housewares and hardware.

Aldi has captured at least a 10 per cent market share in Australia since its launch more than 15 years ago, but Mr Kierath said its investment in lower prices recently has been less aggressive.

“AlphaWise analysis of price changes on like-for-like items at Aldi shows prices declined on average 41 basis points in March, down from a peak of 240 basis points in August 2018. We think the industry price competition remains benign.’’

But this doesn’t mean all is perfect for the supermarket sector.

“The supermarket outlook has improved, but it’s far from rosy, in our view. Our revised Kaufland launch and a less aggressive Aldi are undoubtedly near term incremental positives. However, industry capex has recently increased and looks set to accelerate as both Coles and Woolworths have invested in their online businesses as these continue to account for around 30 per cent of sales growth and invested in modernising their supply chains, and Aldi has refurbished its stores and enhanced its fresh offer.

“As the industry gets a new entrant in Kaufland and Amazon continues to encroach in certain categories we expect margin expansion to remain limited.”