But if Marks can navigate the dense cultural maze and – just as importantly – the relationship with his hands-on chairman, Kim Williams, the ABC will emerge as an entirely different organisation by the end of the decade. And hopefully it will be one that is more relevant to its audience.

As boss of Nine Entertainment, Marks was very commercially driven, striking deals on gaming ads and long-term content. However, it was his big decisions in just five years as boss which fundamentally changed the shape of Nine.

Where media organisations globally have been forced to radically reinvent themselves after seeing revenues collapse through the onslaught of digital, the ABC has lacked the commercial pressure for cultural change. Its guaranteed funding model under which about $1bn heads its way each year has blunted its motivation to innovate, despite competing against those which do.

Marks’ experienced media management would be welcome at the ABC.

Marks pushed through one of the biggest upheaval in Australian media of recent decades with the $2.2bn buyout of Fairfax Media, timing the deal to use the high-priced Nine shares to fund it.

This delivered the much-needed cashflow to Nine from publishing assets, including The Sydney Morning Herald, The Age and The Financial Review, as well as the Domain listings business. It also gave him full control of the Stan streaming business that is central to Nine’s current growth narrative.

With Nine’s free-to-air broadcasting business now feeling the real financial pressure of the digital shift, the Fairfax deal has diversified Nine’s business. In contrast, arch rival Seven West Media is more exposed given its heavy reliance on free-to-air broadcasting.

Marks too was prepared to turn his back on tradition. The most significant was being prepared to walk away from Australian free-to-air cricket broadcast rights in 2018 when he thought the numbers didn’t stack up for Nine.

It was a big call: Cricket had been part of the Nine DNA for more than 40 years, driven in every part by former owner Kerry Packer.

This opened the way for Seven and Foxtel to snare the Cricket Australia broadcast rights, and both broadcasters now have them until 2031. It allowed Nine to pick up the Australian Open tennis rights, giving it an all-important summer sport.

More telling, he made good on his word to walk away from an affiliated broadcasting deal with long-time regional partner and shareholder Bruce Gordon’s WIN Corp. A year after Marks left, Nine returned to the fold with WIN under a seven-year deal.

And as part of the Fairfax deal, Marks was prepared to let go the old Fairfax family’s Rural Press regional titles, and he exited New Zealand.

Marks was arguably the lowest profile of the media bosses during his time running Nine, but quit abruptly in late 2020 after revealing he was in a relationship with a former senior executive at the network.

Some of the cultural issues that have bubbled up in Nine’s television business over the past year happened under his watch, which he will have to address coming into the new job.

Although Marks has run television production houses, the challenge for the former Nine boss is very limited news editorial experience. Like the BBC, the ABC’s managing director is also deemed the editor-in-chief of the entire organisation.

With a mandate for change, the combination of Marks and Williams are the best opportunity for the ABC to make the editor-in-chief role a strong full-time position reporting to the managing director.

The competing demands of running a cross-platform media organisation, technology, non-news production, education and drama services has seen editorial oversight lumped in with a range of competing demands. Many of the ABC’s own goals in recent years have come from a lack of editorial direction from the managing director.

Marks will seek to give taxpayers better value for money by getting ABC more closely aligned to its broadcasting charter. Expect Marks to carve new revenue streams, similar to the BBC, in licensing drama and powerhouse brands to offshore markets. This will take the pressure off the taxpayer.

No doubt, Marks will start the conversation around the eventual end to costly linear broadcasting and moving to an on-demand model. However, a full exit is some time away. If Marks can be the change agent of Nine, it will be a better ABC.

Myer’s big deal

Much of the future upside in Myer is likely to be more than the $30m in annual savings promised through the reverse takeover of the retailer by Solomon Lew’s Just Group of fashion brands.

For the first time, a value has been put on the value of the combination of Myer with Lew’s Just Group of brands (held by Premier Investments), with the merger of the two being engineered at a heavily discounted premium.

This shows Lew, who emerges as Myer’s single biggest shareholder, is betting on all the growth coming from his ability to help fix the department store’s notoriously skinny profit margins.

Many others are willing to take that bet. And before the buyout has been voted on they have already pushed Myer shares to a seven-year high of $1.20, giving the retailer a market value of more than $1.01bn.

The catch will be keeping this share price above the all-important $1 mark for the merger to retain value for Myer investors.

Independent expert Kroll has put a value on Just Group’s brands of Portmans, Dotti and Jay Jays being folded into Myer in the range of $848.3m to $946.3m, including the retained cash in the business. The value of the beefed up Myer shares that will used to pay for the Lew businesses is estimated in the range of $823.7m to $1.06bn.

This crossover is enough for Kroll to declare the combination of the two businesses including the issuance of Myer shares to Premier to be “fair and reasonable” to those outside the Lew camp not associated with the deal.

The “fairness” conclusion also held after Kroll considered whether there was selective treatment of any shareholder, including Lew who – like other Premier shareholders – will become a direct holder of Myer.

Following the deal, Myer shareholders will have 48.5 per cent of shares in the enlarged retailer while Premier shareholders will own 51.5 per cent through a direct distribution.

After the merger, Lew’s privately-held Century Plaza Group will have 26.8 per cent of the retailing group.

Kroll puts the combined merger value at between 95c a share and $1.22. However, if Myer were to continue on a stand-alone basis its shares would trade back between 62c and 71c.

“As the value of a combined Myer Group share exceeds the value of a Myer share on a stand-alone basis, non-associated Myer shareholders will be better off if the combination proceeds than if it does not,” Kroll says.

If Myer falls below $1.06 each, the deal starts losing its “fairness” lustre.

Kroll calculates the implied multiple for the deal is 7.2 times to 8 times current year earnings, which is below the trading multiples for all of the Australian retailers, and well below Premier’s trading multiple 16 times to 10.2 times before the deal was announced.

But it’s the combination of Lew’s retailing skills (the billionaire will sit on the Myer board), the rollout of the MyerOne loyalty scheme across the apparel brands and the expertise in design, sourcing, warehousing and distributions which is harder to put a value on.

And this is where the market is lining up to make its call. Myer shareholders will vote on deal on January 23.

eric.johnston@news.com.au

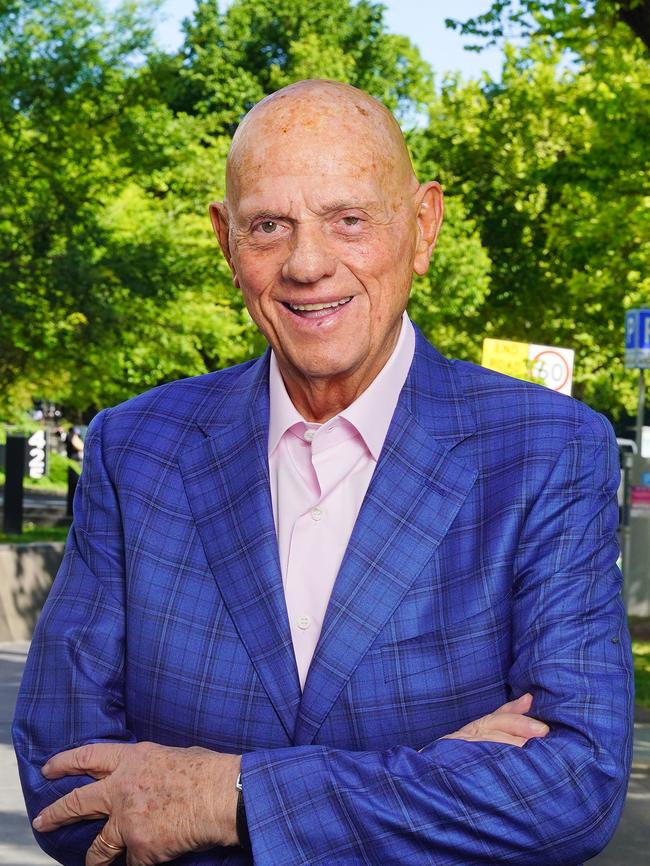

After a lifelong career in commercial media, former Nine Entertainment boss Hugh Marks is about to step into a very different world of public broadcasting.