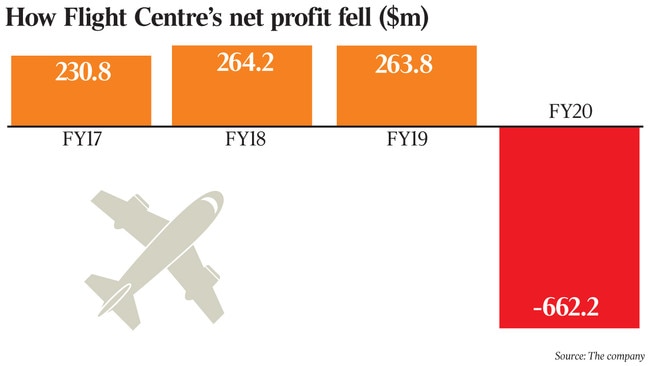

Flight Centre takes $849m loss amid COVID-19 shutdowns

Flight Centre has revealed plans to revamp its brand as it tries to bounce back from a huge $849m loss.

Flight Centre sustained an overall COVID-19 driven statutory pre tax loss of $849m for the year to June, a slight improvement on its recent guidance forecast of $875m in losses.

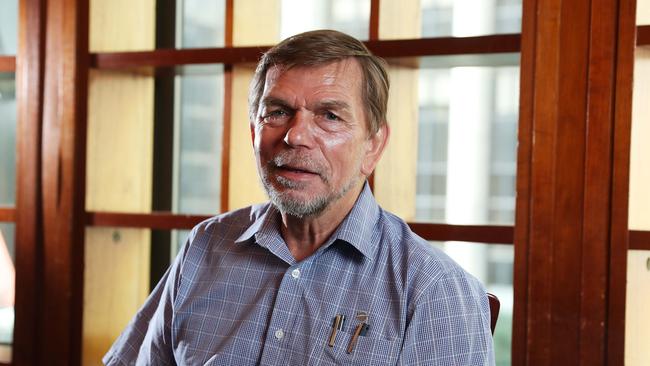

Managing director Graham Turner said 2020 had been the most challenging year in the travel agency’s 40 year-plus history, including the Gulf Wars, September 11, and the global recession in 2008-09 lamenting the fact that the travel agency can book domestic flights in South Africa, North America and Europe but practically no flights within Australia.

Mr Turner, who yesterday put his signature to a united call to the nation’s premiers and chief ministers to reopen borders, said it was difficult to operate without knowing when border restrictions would lift.

“It’s been shown in Victoria that lockdowns don’t work,” Mr Turner said, adding that “governments need to learn to live with the virus and ease the (border) restrictions”.

“It is not the coronavirus that is the big problem, it is government restrictions, governments have it in their power to ease the restrictions.”

But Mr Turner was pleased there are now signs of life in intra European travel.

He said Flight Centre has $1.9bn worth of cash and investments, helped by the recent sale of its Melbourne office and a $700m raising. It has also significantly reduced costs, closing more than half its retail stores and retrenching two-thirds of its global workforce.

It has received $30m in JobKeeper allowances to June 30 and expects a further $30m federal government allowance between July and September.

Flight Centre said corporate business was profitable but reported a $527m underlying loss due to a complete cancellation of all bookings in its leisure sector.

Flight Centre Leisure chief executive Melanie Waters-Ryan said the Flight Centre brand would be rejuvenated and was aiming to position it as one of the most distinctive premium luxury brands in the world.

Prior to COVID-19 Flight Centre had less than 1 per cent market share of the global corporate market but this sector is growing, with the company picking up corporate travel business through client referrals.

Mr Turner predicts government restrictions will start lifting and recovery will start in earnest in 2020-21.

North America was already leading the charge for its volume of leisure travel business while Flight Centre’s corporate business particularly in New Zealand was also doing quite well, the company said.

“We certainly expect to come back in the leisure and corporate travel sectors. It’s a bit uncertain what size we will be but we would be pretty disappointed that if by 2024 we weren’t back to the same extent in leisure (Flight Centre did $14bn worth of leisure travel business last year) as we were and had grown corporate.”

Flight Centre noted that other travel companies such as the failed Swiss owned STA, which initially launched in Australia, had been selling $1bn worth of travel globally just two year’s ago.

Flight Centre shares closed down 3c, or 0.2 per cent at $12.58.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout