Engineering group Arcadis says construction costs will blow out as labour shortages bite

Industry veterans say construction costs will surge by nearly 40 per cent in some cities, putting affordable housing projects at risk.

Building costs could skyrocket by more than 30 per cent in some cities over the coming four years as strong demand fuelled by government spending compounds the pressures of rising wages and continued labour shortages.

Industry experts say high costs will make it hard to build affordable housing, and that conditions are unlikely to change for several years given the Labor government’s aim to build 1.2 million homes by 2030.

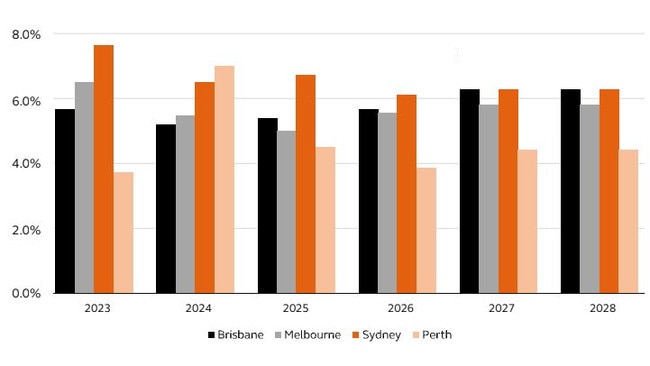

Data from engineering group Arcadis shows that building costs are expected to increase by 28 per cent in Perth, 34.1 per cent in Melbourne and upwards of 39 per cent in Sydney between 2023 and 2028, while Brisbane is tipped to see costs rise 34.4 per cent after registering the strongest growth this year amid above-inflation wage increases.

The forward pipeline across most states remains relatively strong, with the lion’s share of this coming from the public sector, according to Arcadis.

Arcadis national director for cost and commercial Matthew Mackey told The Australian that labour costs had surged substantially over the decade, with 17 per cent of contractors surveyed struggling to secure labour to meet demand.

“We just simply do not have the bodies and the number of people that we need to actually deliver that pipeline, which is being driven by the public sector, or government-led projects,” he said.

“Regardless of labour costs going up and contractors being able to charge more, there’s still a lot of risk in the industry. And we are seeing levels of contractual insolvency and construction business insolvency significantly higher than the long-term trend, right when there is a pipeline of projects.”

The Australian Bureau of Statistics reported that the total number of dwellings approved was up 5.5 per cent in May, which took the 12-month increase to 163,759 – far less than the 240,000 dwelling target set by the federal government.

Hutchinson Builders chairman Scott Hutchinson said productivity had gone to the floor, with projects taking longer to be completed, adding that it came as materials continued to be expensive.

“Rising costs will mean less private work is done. No units will be built unless they are very expensive like $25,000 a square metre, which means nothing in lower price brackets,” Mr Hutchinson said.

“The lack of productivity is driving prices up. We just need less demand in the market – people need to just stop building.”

Mr Hutchinson said the pipeline would not weaken given ambitious housing targets to cater for strong population growth, which meant rising costs would not ease for some time. He said rising costs would result in more insolvencies as many builders, including his own, struggled to make money.

“We didn’t make any money last year. We won’t make any money this financial year even though there are still jobs going. We’ve got heaps of property and we’re just not going to make good money in this current climate,” Mr Hutchinson said.

More broadly, Arcadis’s report found that overall construction industry sentiment levels were starting to decline.

Mr Mackey said while this would generally favour the client as construction costs fell to reflect a competitive environment, this was not the case this time.

“This is far from the case as the industry continues to battle with several challenges that have been in place since the pandemic,” he said.

“Contractors and their supply chain are also being very selective in their project pursuits and risk averse in their pricing strategies.

“Dismal order books are more likely to trigger further contractor consolidation rather than it resulting in overly competitive bid pricing.”

Of the cities covered by Arcadis’s Market View report, Brisbane has experienced the highest level of escalation during the first quarter at 1.84 per cent, which would result in escalation capping out at more than 7 per cent for 2024. The firm expects activity to slow to 5.2 per cent because of the Queensland election in October.

It comes after new enterprise agreements in the state will result in wages increasing in the sector by 26 per cent between 2023 and 2027. NSW was also expected to see a sharp rise in labour costs, with trade unions wanting a 28 per cent wage rise over three years and 8 per cent upfront, which Arcadis said would affect already-priced projects. Negotiations in Victoria were expected to see similar results to NSW.

Master Builders Queensland chief executive Paul Bidwell said there would be no sign of relief on rising construction costs until productivity, which was tied into the lack of sufficient skills across the sector, could be improved.

“Materials prices are less of an issue although those costs are not going backwards,” Mr Bidwell said. “We can’t manufacture new people. There is a lot of effort going into free apprenticeships, encouraging young people to go into apprenticeships, but it is going to take some time before you start to see an increase in the numbers on the job.”

Mr Bidwell said industrial laws such as the Queensland government’s Best Practice Industry Conditions policy – dubbed the “CFMEU tax” – needed greater flexibility in order to boost productivity.

“What we want is for some agreement or a recognition that we need to get more productive without cutting corners on safety or workers’ conditions,” he said.

“(Construction workers are) well paid and they need to be, but it’s how we can get five days a week of work. Now sometimes if it’s pouring rain you can’t work, but there has to be some latitude in the way that they operate and that’s all we’re after on that one.”

The BPIC forces contractors tendering for major government-funded projects in Queensland to negotiate agreements with unions and sets a high floor on conditions, including double pay when it rains and up to $1000 a week for workers who travel more than 50km to a site.

Figures from the Australian Securities & Investments Commission show that construction had the highest number of insolvencies on record at 313 in May, taking the total number over the financial year to 2712.

KPMG chief economist Brendan Rynne said insolvencies would continue to worsen over the next 18 months as higher inflation and interest rates bit directly, which would both help and worsen the labour market.

“Help in a sense that skilled labour currently employed in zombie firms will get freed up and able to move to more viable firms; but hinder in a sense that those poorly skilled workers currently working in zombie firms are going to find it difficult to get re-employed as labour supply expands,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout