On the heels of this week’s Chubb review calling for improvements to restoring credibility to Australia’s carbon credit scheme, Bowen has unveiled his plan for tougher targets for big carbon.

Given the Albanese government’s panicked policy last month of coal and gas price caps unnerved energy players, more fundamental reform around the treatment of carbon emissions from big emitters had the potential to open another negative front for business. But planned changes, which the big carbon emitters were well aware had been in the works for six months, are more muted than feared.

Still, the program puts intense pressure on all big emitters to move quicker in the decarbonisation race so Australia can hit Labor’s ambition of an emissions reduction target of 43 per cent by the end of the decade.

A tougher Safeguard Mechanism policy seeks to cut emissions output across the 215 biggest emitters by 30 per cent by the end of the decade. The new target is part of a shake-up to the existing scheme which critics say wasn’t providing enough incentives for companies to cut emissions.

This means the big polluters would need to cut emissions by at least 4.9 per cent a year and in the process generate about 205 million tonnes of emissions abatements. This is equivalent to taking about two-thirds of Australia’s car fleet off the road by 2030.

The former Coalition government’s complex Safeguard Mechanism program has been in place for eight years covering around 28 per cent of national emissions so this was always going to be obvious area for Canberra to get some lower hanging fruit for carbon reduction.

Business buy-in

Bowen knows much is at stake and steering through the changes he needs to have the buy-in from the big emitters. The combination of a carrot and stick approach is going to be more effective than the big stick of punishment alone.

He has given some ground by allowing a staggered shift in applying specific targets for individual operating sites and moving – as widely expected – to an industry average, including for commodity exporters.

Industry-average benchmarks would hold all facilities making the same product to a common standard and are seen to provide a relative advantage to lower-emissions producers. But the proposals take a hybrid path that lets big emitters keep the site-by-site approach but transition over time. By 2030 baseline targets are expected to be based on an industry average emissions intensity.

This is seen as giving big emitters such as LNG plants more time to plan and put in place emissions reduction projects using developing technology such as carbon capture storage that is expected to play a bigger role in lowering emissions by the end of the decade. It also avoids large players from having heavy upfront costs as they move to 2030.

However this relief only applies to existing facilities with new mining, manufacturing and gas projects expected to operate under the industry average from day one, with the argument from Bowen being it sends a strong signal to investors that Australia is serious about achieving net zero by 2050.

The muted acknowledgment of the changes and from the peak oil and gas industry body APPEA chief executive Samantha McCulloch spoke volumes about the relief the sector was privately feeling.

“We have a long commitment to net zero while we maintain the international competitiveness of our world-leading export industry and ensure an open and competitive domestic market,” McCulloch says.

Coal exporter Glencore for example highlighted that site-specific measures were important particularly so it didn’t unfairly penalise exporters. The miner noted that a sector-wide approach doesn’t take into account the significant variability in the characteristics of individual facilities that operate within a sector, and has the potential to create significant winners and losers within each sector covered by the Safeguard Mechanism.

Even so, banks have already been leading the charge for putting pressure on sector-wide emissions intensity targets. This pressure will only get more intense from other funding providers, shareholders and even trading partners.

A pressure point will come from trade-exposed companies that are unfairly disadvantaged or face higher costs under the proposed changes can apply for funds under the $600m relief fund, or at least apply for lower baseline decline rates. This could be a political vulnerability with the prospect of funds going to the likes of Woodside, Glencore, Rio Tinto or BHP. The funds in theory are also designed to provide a cushion to protect high intensive emissions production from heading offshore.

Also on the table is the creation of new Safeguard Mechanism credits generated when players beat their baseline targets and can be traded as credits for big emitters missing baseline targets.

Critically the credits are designed to work with the existing carbon credit scheme, itself a program where the integrity needs to be sorely bolstered. Big emitters can buy additional ACCU credits to help meet targets but the safeguard credits can only be traded between big emitters.

Bowen this week said the government intended to adopt all the recommendations of the Chubb review into the carbon credit scheme following a long overdue look at the program. Business needs to have confidence that in lowering emissions the currency of the credits program is real.

Some ASX-listed companies captured by the big emitter baseline program such as Fortescue, Rio Tinto, CSL and pipeline operator APA, are already setting their own 30 per cent emission reduction targets by 2030. Even big players such as Woodside, Santos, BHP and Origin Group are within reach of hitting 30 per cent reduction by 2030.

The real test is whether Bowen can secure Greens and crossbench support in getting the package through the Senate.

Inflation watch

For inflation watchers there’s good and bad news.

First the bad. WD-40, the San Diego-based company that makes industrial lubrication products with the signature blue and yellow cans, says there are more price rises coming in the first half of this calendar year across Australia and parts of Asia.

The good news is that inflation, and therefore the source of much of global price rises, appears to have stabilised in the northern hemisphere.

Given its use for all kinds of machines from lawnmowers and cars right up to big industrial engines, WD-40 is often seen as a barometer for the global economy. Sales of its flagship brand reach a staggering 176 countries and it has proven to be remarkably recession proof. In the past 15 years annual sales have only taken a dip once, and that was through rolling Covid-linked lockdowns around the world.

In a first quarter earnings update Nasdaq-listed WD-40’s sales had lost momentum after it started pushing through price rises over the past year. The price increases of 8.6 per cent were not uniform with prices going up first in the higher inflation regions from the US and Europe where the price pain was more acute. Last year WD-40’s costs rose 9.9 per cent with packaging costs leading the way.

WD-40’s global sales fell 7 per cent to $US125m ($181m). The company noted pricing is a real driver for loss of volumes but this quickly recovers. Profit fell 25 per cent to $US14m.

WD-40’s chief financial officer Sara Hyzer told investors there were price increases planned in the March and June quarters for the Asia Pacific region, which includes Australia. Beyond that the manufacturer had taken “all the tactical pricing measures” needed to be made.

“We are beginning to see input costs stabilise and are hopeful of this trend continuing,” says Hyzer but noted it was a “dynamic” environment, especially in Europe.

WD-40’s Australian sales remained consistent during the December quarter, as the positive impact of price increases was almost completely offset by slowing volumes in some cleaning products and a weaker Australian dollar. On a constant currency basis, WD-40’s sales in Australia would have increased $US0.7 million, or 12 per cent in the quarter. China remains a soft spot with sales hit hard from lockdowns, current Covid disruption coming out of lockdowns are expected to stabilise by the middle of the year.

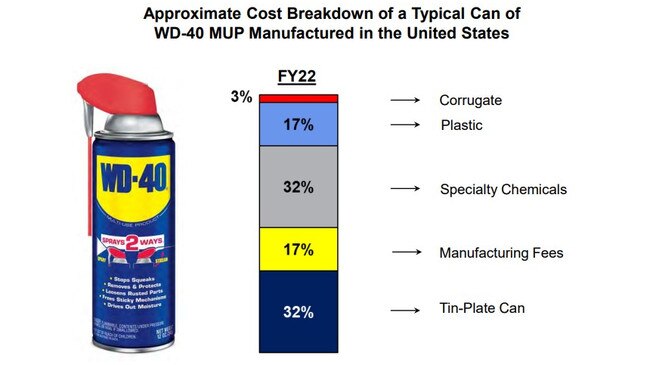

For the first time WD-40 issued a breakdown of costs.

In Australia a 325 gram can retails for $7.89 at Bunnings. Of that price tag 32 per cent goes equally to the cost of the aluminium can and chemicals. Manufacturing fees represent 17 per cent.

johnstone@theaustralian.com.au

Climate and Energy Minister Chris Bowen has given big gas producers and energy-hungry exporters some breathing room in a shake-up to the safeguard mechanism scheme aimed at slashing emissions for the nation’s biggest carbon emitters.