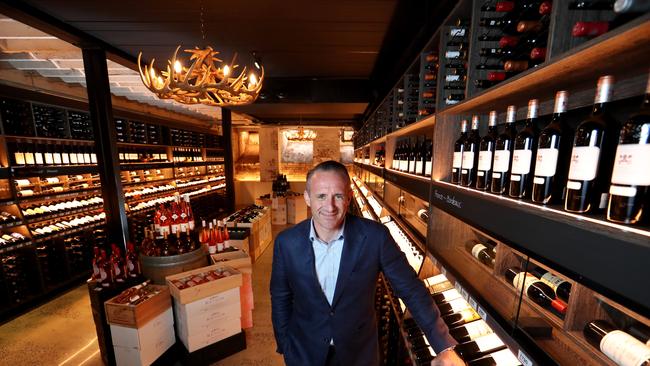

Endeavour director Bruce Mathieson Junior claims he was locked out of a crucial board meeting

The corporate battle has just gone nuclear with Endeavour director Bruce Mathieson Jr claiming he was locked out of a crucial board meeting, making the directors gathering ‘unlawfully convened’.

The corporate battle around liquor and pubs giant Endeavour Group has ramped up with director Bruce Mathieson Junior claiming he was locked out of a crucial board meeting, making the gathering “unlawfully convened”.

Mr Mathieson Jr also remained concerned about the poor performance of Endeavour, which owns Dan Murphy’s, BWS, wineries and 354 pubs, and will continue to lobby other directors and chief executive Steve Donohue his view on how to improve its businesses.

He also claimed his fellow directors and chairman have misrepresented his views on the upcoming AGM and the contentious issue around the election of rebel director candidate Bill Wavish.

In a letter sent to The Australian by Mr Mathieson Jr, the son of Bruce Mathieson Senior who is Endeavour’s largest shareholder with a stake of 15 per cent, Mr Mathieson Jr said the board meeting he was barred from attending approved sending a shareholder letter and investor presentation.

It is believed Endeavour chairman Peter Hearl notified Mr Mathieson Jr on Friday that due to a conflict of interest around the current battle – his father is backing rebel director candidate Mr Wavish – he could not be involved in boardroom discussions.

It was later that weekend Mr Mathieson Jnr was informed of an out-of-cycle board meeting on Sunday and Monday but that he was not invited to it.

“Yesterday afternoon Endeavour issued two releases to the ASX, a shareholder letter and an investor presentation.

“Both documents were approved at a meeting or meetings of the board, which were unlawfully convened,” Mr Mathieson Jr said in his Wednesday letter.

“As a director, I was not invited to join the meeting/s and was excluded from participating in, and approving the content of both the letter to shareholders and the investor presentation.”

Mr Mathieson Jr said both communications inferred they were supported and approved by the full board which was not true.

“As a result, I have been misrepresented as supporting those communications.

“Given the very public dispute Endeavour is engaged in, the market and shareholders should have been advised I was not involved in the content or release of the documents. I remain concerned by the operating performance of Endeavour, which is reflected in the current share price.”

Mr Mathieson Jr said in performing his duties as a director acting in the interests of all shareholders, he continued to consistently advise the board and will continue to do so to improve performance.

“It is unfortunate I must resort to making a public statement which could so easily have been avoided had I been consulted before the releases went out.”

Meanwhile, Mr Donohue has commented for the first time about the boardroom and investor civil war that has erupted around the drinks and pubs giant, defending the company’s performance and rallying his staff to focus on the peak trading period of Christmas.

In an email to his 30,000 staff across Dan Murphy’s, BWS and its 354 pubs, Mr Donohue also hit out at comments from Endeavour’s largest shareholder the Mathieson family and the rebel director candidate Mr Wavish, accusing their camps of disseminating “selective and incomplete information”.

It is the first time that Mr Donohue has spoken about the boardroom battle that has seen Mr Wavish run for the board at this month’s AGM, attracting the support of Mr Mathieson Sr and which has triggered a war of words, lawyers letters, claims and counterclaims.

Of particular angst among the warring factions is comments from the Mathieson and Wavish camps about what they see as Endeavour’s poor financial and operational performance and its sliding share price. They have also claimed that the company’s retail jewel, Dan Murphy’s, is losing market share.

“In line with one of our values of being real, I wanted to correct some of the selective and incomplete information about our performance, strategy and team being said about our company,” Mr Donohue said in his staff email.

“You will remember in our last Town Hall, (chief financial officer Kate Beattie) and I spoke about our strong fiscal 2023 annual results, highlighting the resilience and stability of our business. We continue to lead the market in liquor retail and hotels, and delivered strong growth in fiscal 2023 with our first ever $1bn EBIT result, up 14 per cent since demerger.

“All of this was achieved against a backdrop of some of the most challenging conditions faced by any company, let alone a new one. Not many teams can say they managed one of the largest demergers ever in Australia against the backdrop of a global pandemic while delivering such strong growth.”

Mr Donohue told staff they can all be proud of their collective achievements, from teams in stores and venues helping deliver social occasions for our customers and guests, to the work behind the scenes setting the company up for future growth.

“Our strategy is being brought to life across the group and has resulted in some great outcomes, including Dan Murphy’s and BWS continuing to be the preferred brands for drinks customers, online sales growth up 72 per cent over the past four years, driven by EndeavourX, the delivery of Group-wide digital capabilities, progress on our One Endeavour Transformation, and the efficiency opportunities identified through endeavourGO.”

Mr Donohue conceded there was “volatility” in the company’s share price, but there was a range of opportunities and roles in addressing the market’s confidence in its business. He also addressed concerns from Mr Wavish of a lack of discipline in costs.

“For most of us, our role is to keep supporting each other and delivering for customers and guests – because we know Australians love socialising, and we’re uniquely placed to deliver for all occasions.

“We do face a rigorous regulatory landscape, and we are still normalising capital costs and facing changing economic conditions. An enormous amount of work is ongoing to support our responsibility initiatives and adapt our business plans to meet the evolving market.”

He then called on the staff to focus on the upcoming festive season, a crucial time for the business.

“With our peak trade period ahead of us, now is the time to stay focused on supporting each other to deliver experiences our locals love. I’m immensely proud to work alongside you all, as you make these brands and businesses some of the best in the country.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout