Downer EDI shares tumble 6pc on dividend cut and $386m full-year loss

The contracting giant’s new chief executive Peter Tompkins is confident that the group’s fortunes are beginning to turn after a turbulent year.

Contracting giant Downer EDI has swung to a $385.7m loss as the group continues to struggle with the integration of its takeover of cleaner and caterer Spotless, prompting hefty write downs. But chief executive Peter Tompkins says it is beginning to show signs of recovery.

The result - which compares with a $164.8m profit last year - was in line with what the company flagged last week when it surprised investors with a $550m write down after a turbulent year, with the resignations of two directors, including chairman Mark Chellew, and chief financial officer Michael Ferguson.

The upheaval comes amid a series of profit downgrades, accounting woes and the company being embroiled in an anti-corruption inquiry in NSW.

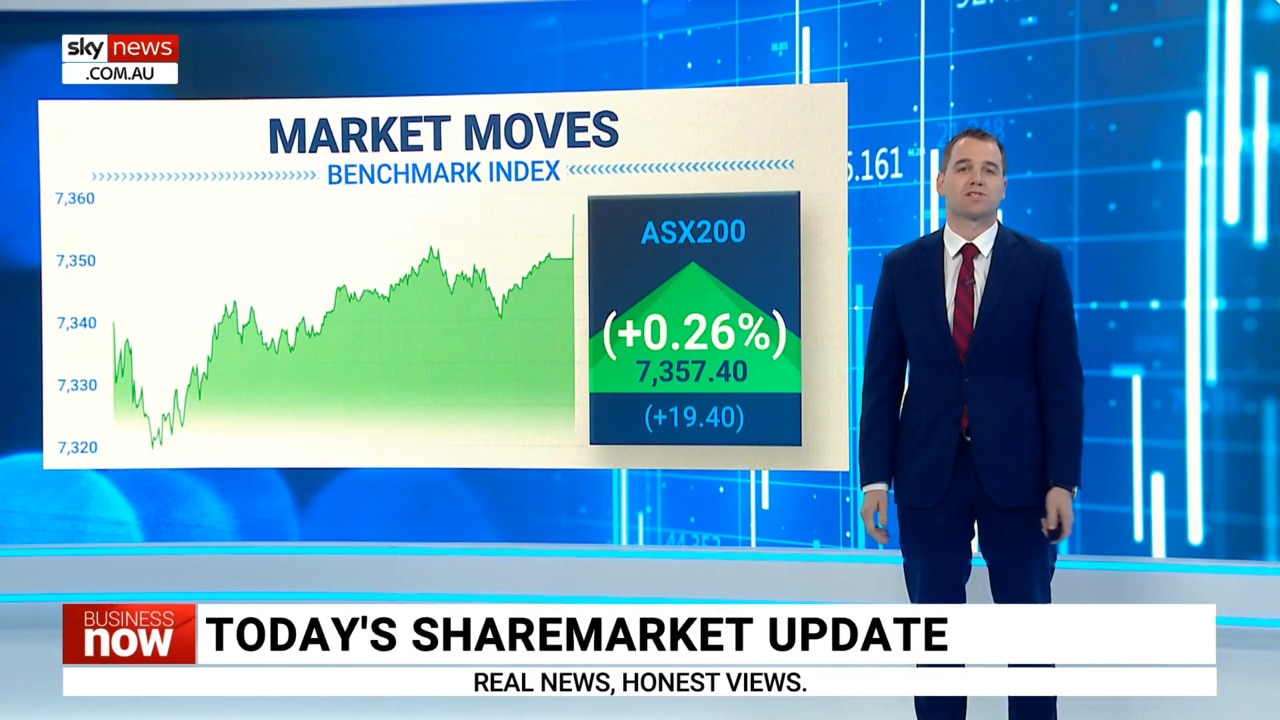

It has cut its final dividend, which it will pay on September 21, from 12c to 8c. The company’s shares sank 6.4 per cent to $4.10 on Thursday against a 0.3 per cent gain across the broader sharemarket.

The non-cash impairment resulted in the statutory net loss the full year, relating in large part to the cost of debt and equity and the impact of the Defence Strategic Review on its facilities division, which includes Spotless.

Revenue, however, firmed 5.4 per cent to $12.6m compared with analyst estimates of $12.19bn.

Mr Tompkins said it was a “challenging year for Downer” but its fortunes were beginning to turn and the company would be more selective about which contracts it bids for.

“FY24 is an important transition year in our turn-around program as we address areas of underperformance, stabilise and reposition the business for future profitable growth. The external market conditions remain challenging for Downer in areas including ongoing cost escalation, labour availability and productivity issues, however we are observing signs of stabilisation,” Mr Tompkins said.

“After a disappointing first half result with significant parts of the organisation impacted by weather and labour productivity, there were encouraging signs of recovery in H2. Our cashflow performance recovered well after a challenging H1, with underlying cash conversion of 110 per cent in H2 and full year conversion of 64.9 per cent. The group is in a strong financial position with net debt to EBITDA of 2.0x.

“Pleasingly, we are making strong progress in relation to the cost-out program, with the 400 head FTE (full time equivalent) reduction target now expected to be completed by the end of this calendar year. We remain on target to achieve the overall transformation cost out benefits of $100m per annum in FY25.”

Downer is targeting an earnings before interest, tax and amortisation margin of at least 4.5 per cent in the year ahead. This compares with delivering an underlying EBITA margin of 2.6 per cent in the past 12 months, down from 3.2 per cent at June 30, 2022

UBS analyst Nathan Reilly said while Downer gave no formal 2024 guidance, outlook commentary was “broadly in line with market expectations for a modestly improved margin performance”.

Downer has also been embroiled in a Independent Commission Against Corruption (ICAC) inquiry, which was announced in March, relating to the conduct of employees of Inner West Council, Transport for NSW and some Downer staff.

“Downer has a zero-tolerance policy in respect of any dishonest or corrupt conduct. Those individuals who counsel assisting referred to in his opening statement as facing specific allegations are no longer employed by Downer,” Mr Tompkins said.

“Downer is taking the ICAC inquiry very seriously and has commissioned a review, with the assistance of advice from external independent procurement and probity experts, into the relevant control environment with an emphasis on corruption and fraud prevention.

“The first phase of the review is already complete. Downer is presently considering areas for continuous improvement and the implementation of appropriate measures to strengthen the control environment. Downer will also consider any recommendations from the ICAC findings, when made available.”

Mr Tompkins was promoted internally to the chief executive role in February this year after the exit of Grant Fenn and tasked with turning around the company, which had disappointed shareholders with a series of profit warnings and share price underperformance.

“Since taking over as chief executive officer, I have worked closely with our board and executive leadership team to understand the factors that led to these results and develop solutions to improve our performance,” Mr Tompkins said.

“Our transformation program is a multi-year journey to drive higher performance and unlock our potential. We know that we must convert our pipeline of opportunities and enviable market positions to become an organisation that is more resilient to external factors, more disciplined in our delivery, and ultimately more profitable.

“I have enormous faith in Downer, our strategy and our people. Downer has a portfolio of outstanding businesses with market leading positions and exposure to economic and social trends including decarbonisation, urbanisation, national security, the reinvigoration of Australia and New Zealand’s local industrial base, population growth and government outsourcing.

The vast majority of last week’s downgrade, or $483m, related to goodwill impairments across the facilities and utilities divisions.

Downer booked a $350m write down in the facilities division, including Spotless which it acquired in 2017, with changes to financial assumptions driven by changes in the cost of debt and equity playing a part.

The value of the division was also affected by “a reassessment of the defence sector pipeline to reflect tightening in market conditions’’ the company said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout