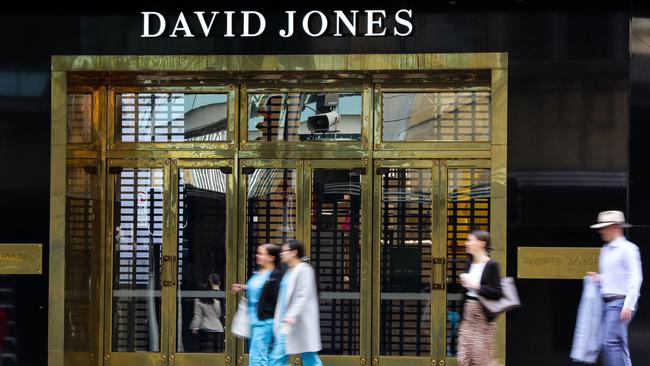

David Jones sells flagship Sydney store to Charter Hall consortium

David Jones’ iconic store in central Sydney will be taken over in a $510m sale that may also pave the way for Country Road to be sold.

The $510m deal to sell the flagship David Jones Elizabeth Street store will clear the debts of the retailer, while locking in one of the best sites in Sydney for commercial property giant Charter Hall.

The sell-off of the flagship store overlooking Sydney’s Hyde Park on the corners of Elizabeth and Castlereagh streets marks the latest round in a string of sales by David Jones’s South African owners.

A consortium of funds managed by Charter Hall will scoop up the 12-level, 3560sq m site in a leaseback arrangement that will see David Jones retain occupation of the site over the next 20 years.

The Australian understands the Charter Hall deal, following the recent sale of David Jones’ menswear building on Bourke Street in Melbourne for $121m to Newmark Capital, extinguishes the retailer’s debts.

The $510m purchase price reflects an initial 5 per cent yield and comes with a locked-in 2.5 per cent annual rent increase, supplemented by an 7.97 per cent turnover rent if sales at the store exceed $320m.

The sale of the Sydney site allows the separation of the existing combined Australian debt facilities of the David Jones and Country Road groups.

David Jones and Country Road Group will now hold secured debt and financing facilities separate to each other.

The separation of the two retailers could also open the door to a potential sale of Country Road.

The restructure is subject to sign-off from the Foreign Investment Review Board, because of the South African ownership.

The effective date of handover of the site is set to be four months following the signing of the sale agreement.

Charter Hall Long WALE REIT will own 50 per cent of the asset, with Charter Hall Group and the Charter Hall DVP partnership splitting the remaining 50 per cent interest.

Charter Hall CEO and managing director David Harrison said the acquisition of the Elizabeth Street building was “consistent with our strategy” of securing long-leased assets and prime real estate deals.

“Combined with other recently announced acquisition and pre-leased development projects across office and industrial sectors, we expect the group’s (funds under management) to exceed $45bn as at 31 December 2020,” he said.

Mr Harrison said Charter Hall was keen to buy into the Sydney centre retail market given its enduring strength.

“It’s a fantastic site, one of the biggest CBD sites and when you think long term there’s plenty of other alternative uses,” he said, noting David Jones had the opportunity 10 years into the lease to walk away.

“The way we look at these things, it’s a set-and-forget investment and ultimately the underlying real estate gives us lots of options,” he said, noting the property giant was always looking for more high value properties.

“In 2021 I think we’ll be doing more of what we’ve been doing, you’ll see us continue to expand,” he said.

“We’ve still got $8bn-$9bn of dry powder to play with.”

Charter Hall has been on a tear in recent years in the sale and leaseback space, doing more than $9bn in deals, including snapping up the Telstra building on Pitt Street, Sydney.

It recently made headlines by paying $682m alongside Singapore’s sovereign wealth fund to buy up 203 Ampol sites.

This followed a deal in 2019 that saw Charter Hall spend $840m to take a 49 per cent stake in 225 BP fuel station sites around Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout