Crown Resorts verging on junk status after Moody’s downgrade

Moody’s has downgraded Crown Resorts’ credit rating to one level above junk.

Moody’s has downgraded Crown Resorts’ credit rating to one level above junk as a NSW inquiry into the company continues to raise serious corporate governance concerns.

On Friday afternoon the ratings agency downgraded the Crown’s issuer rating and their backed senior unsecured medium-term notes to Baa3 from Baa2 and said that the company remained on review with a possibility of further downgrade.

A Baa3 rating is one notch above what is considered non-investment grade on Moody’s rating scale.

In a statement, Crown Resorts said the move would increase the interest cost of its Euro medium term notes by approximately $US1m ($1.37m) per annum.

“A further downgrade would entitle the noteholder of Crown’s Euro medium term notes to elect to redeem the notes at a market whole,” the statement said.

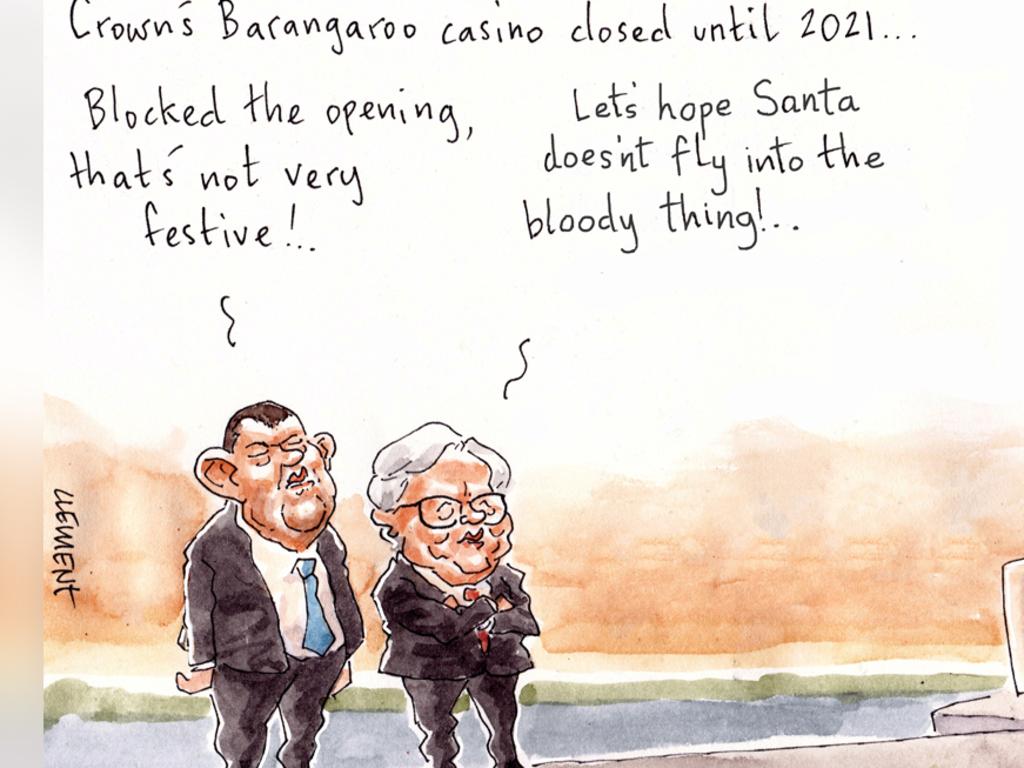

Moody‘s analyst Maadhavi Barner said the downgrade reflected the decision of the NSW gaming regulator to delay the opening of the Barangaroo casino and the risk of regulatory action against Crown Perth and Melbourne.

“The downgrade reflects our opinion that there is an increasing likelihood of material downside implications from the escalating regulatory investigations Crown is facing,” she said.

“In particular, the review will focus on the potential for further material negative outcomes that could not only affect the license for Crown Sydney, but could also bring forth regulatory challenges to Crown‘s other licenses.“

Despite the escalation of regulatory risk, Moody’s said they considered the loss of the Sydney licence as a result of the inquiry “still unlikely.”

Another key factor influencing the credit risk was “a number of governance and compliance shortfalls” revealed throughout the inquiry.

Moody’s said Crown’s outlook could be changed to stable if Crown was found to be suitable to operate Barangaroo, or suitable after making certain mandated changes, but could be downgraded if it is unable to make any necessary changes or is found unsuitable.

The downgrade comes as Crown received a battering at Friday’s session of the NSW Independent Liquor and Gaming Authority inquiry.

Late on Wednesday night Crown submitted evidence that money laundering “more likely than not” occurred in company bank accounts and that AML officer Louise Lane sought to have the accounts reviewed, but legal advice from MinterEllison prevented the company from doing so.

The crucial information was not submitted at the beginning of the inquiry due to oversight by company lawyers during summons and the MinterEllison advice could not be produced despite the demands of the Commissioner, Patricia Bergin.

Counsel assisting Scott Aspinall said the failure of Crown to produce this information showed it was unsuitable for the licence, as the inquiry operated on the basis that the accounts were accidentally overlooked for months.

“The lack of the submission appears to be because of the way the search was conducted with Southbank and Riverbank combined with investments [which] brought up too many documents so exclusions happened,” Mr Aspinall said.

“In my submission, there is no explanation for why a document that said ‘I would like to look into the riverbank invest am accounts’ was not picked up and produced in February.

“It‘s a very serious concern, commissioner,” he said. “It shows a problem of regulating Crown. “A regulator of a casino licensee needs to be confident when it asks for information from the regulated entity that what it gets in response is correct.”

Ms Bergin said that the fact Ms Lane‘s desire to audit the accounts was ignored was a concern.

“I think the deeper concern is the fact that the suggestion … the fact that the sensible and professionally appropriate step that Ms Lane suggested, was in fact shut down.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout