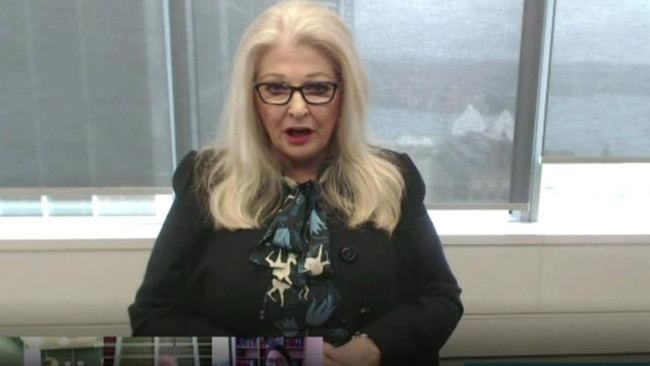

Crown Resorts boss Helen Coonan in fight to save Crown Melbourne

Crown chair Helen Coonan has sought to distance the embattled gambling giant from executives linked to James Packer.

Crown Resorts executive chairman Helen Coonan has admitted that the “old Crown” was still in force as recently as January of this year, and it wasn’t possible for her to turn the ship around until the board was rid of individuals linked to James Packer.

She has also claimed that it was these same board members who blocked her push to have former CEO Ken Barton resign in the wake of the revelations of the NSW Bergin Inquiry last year, which led to Crown being temporarily barred from opening its Sydney casino.

Ms Coonan, the former Howard government cabinet minister, was giving evidence to Victoria’s royal commission into the Packer-backed company, as Crown attempts to retain licences for the gaming giant’s trifecta of casinos in NSW, Victoria and Western Australia.

To this end she is pushing for cultural and governance reforms at Crown to address issues like its so-called profit-first culture and money-laundering.

But counsel assisting Adrian Finanzio moved to question the genuineness of this project, noting that despite Ms Coonan’s overtures to reform, and establishing a collaborative relationship with the Victorian casino regulator, she had “significantly undermined” these attempts by signing off on a belligerent letter to the regulator in January.

“It wasn’t happy with your response, because the response that contained in the letter on the 22nd of January is effectively the old Crown at work, isn’t it?” he said.

“It’s the old Crown, taking every point arguing every issue, not accepting basic propositions of facts that are clearly open.”

Ms Coonan replied: “I think that’s a fair way to characterise it … it’s the old Crown.”

She said she was given legal advice that Crown could not change its approach to the regulator until the Bergin report was released in February otherwise “it would undermine all of the submissions” made to the preceding inquiry.

“It’s not satisfactory, I’m not defending it. I’m simply explaining it,” she said, adding that once the finalised Bergin report forced the mass resignation of the old guard, reform became possible.

“The way boards operate and the way old management operates are not something you should turn around quickly,” she said.

“A real change of approach wasn’t possible with old management and old Crown, I certainly grant you that.”

Ms Coonan said she attempted to force management change before the report was released, asking the board to stand aside CEO Ken Barton after it became apparent through Bergin inquiry hearings that he had ignored repeated warnings of money-laundering through company accounts.

“The board did not support me in that. Ms (Jane) Halton did, and Mr (John) Horvath, but no one else,” she said, adding that her fellow directors thought they would get to keep their Sydney licence.

“The old board was absolutely convinced that we would be found suitable,” she said.

Ms Coonan also said she had wanted Crown to adopt a different, non-combative posture throughout the Bergin inquiry, but this was resisted by other board members based on legal advice from law firm MinterEllison.

Mr Finanzio asked whether Mr Barton’s departure was just a PR move, given he was granted a six month, $1.5m consulting contract when he resigned.

“David Luff says to you, in the email in the email above, the comms strategy is that we get the benefit of the announced departure in line with what was stated and then that we have the safety net of him being on hand if we need specific information,” Mr Finanzio said.

“The real strategy was to make it look like you were cleaning house, wasn‘t it?”

‘I take responsibility’

Earlier, Ms Coonan told the inquiry she took responsibility for not being more proactive in responding to money-laundering allegations against Crown, despite being a board member since 2011.

“With the benefit of hindsight, do you really think that you’ve paid enough attention to what was going on in the company, in the period leading up to the allegations made in Bergin?” Mr Finanzio asked.

“I do honestly believe that I applied myself with diligence and care,” Ms Coonan said.

“The problem for me was that information was either withheld or channelled in a different direction.

“I definitely take responsibility for it, that’s not an issue for me.”

Ms Coonan said Crown needed to undergo substantial cultural change following its revelations, and that change was happening.

“I don’t downplay the fact that this is a journey. It’s not a destination. It’s a journey. The progress has been absolutely enormous. And I think that is what is coming out of this,” she said.

Ms Coonan’s attempts at reform have impressed NSW regulators, who say Crown Sydney could open before the end of the year.

But Commissioner of the Victorian Inquiry, Raymond Finkelstein, voiced scepticism about the genuineness of the reform efforts given the status of its Sydney licence, the Victorian probe, and another in WA, last week declaring: “What choice do they have?”

The commission has examined and unveiled new issues.

It has been heard that between 2012 and 2016 Crown illegally allowed casino patrons to pay for chips through a terminal at the Crown Towers hotel in Melbourne, with the balance invoiced to a real – or fake – hotel room.

Furthermore, it was revealed that Crown has potentially underpaid more than $270m in gaming taxes to the state, a massive oversight that threatens its ability to retain its Melbourne licence.

It heard that Crown Melbourne boss Xavier Walsh knew about the issue since 2018 and only raised it in a vague sense with Ms Coonan and February and directors Toni Korsanos and Jane Halton in March, leading them to voice concerns about his continued tenure at the commission on Wednesday.

Ms Coonan said she was not aware that Crown’s potential underpayment of hundreds of millions of dollars in state gaming tax even concerned the payment of taxes when it was first raised with her by Crown Melbourne CEO Xavier Walsh.

Ms Coonan told the Victorian royal commission into Crown that the issue was raised with her by Mr Walsh on February 23, right after the commision was called, as she wanted employees to raise issues that could come to the attention of the probe.

She said Mr Walsh told her it was a “legacy issue” that went to culture, and that it was “cured or fixed” as the Victorian Commission for Liquor and Gaming Regulation was aware of it.

“He didn’t mention an underpayment at all, let alone the amount,” Ms Coonan said.

“He said to me that in the interest of transparency there was a legacy matter that he wanted to bring to my attention relating to a matter back in 2012.”

Crown directors Jane Halton and Toni Korsanos told the commission on Wednesday that Mr Walsh represented the issue to them in similar terms and said they would be concerned with his ongoing tenure in the role if he intentionally downplayed the issue.

The commission heard from Mr Walsh that Crown had received legal advice over the years that indicated the practice was not above board, and that the issue was never disclosed to the VCGLR.

Ms Coonan said she ordered the issue should be reviewed and sent to Crown’s lawyers for disclosure.

“I didn’t want this to come out in some sort of subterranean way,” she said.

That action led to the creation of the spreadsheet that indicated Crown could have underpaid the tax by up to $272m, which explosively surfaced at the commission.

Ms Coonan denied that the problem indicated she had an ongoing problem with taking directors at face value to the detriment of the company.

“To my thinking, and with great respect, I took the right action,” she said.

The commission continues.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout