Crown has registered with the Australian Taxation Office for the federal government’s JobKeeper program, which should give the 11,500 Crown staff stood down over the past fortnight $1500 a fortnight for the next six months as part of an unprecedented $130bn wage subsidy deal.

Crown is hoping this will mean fewer staff tap into their annual and long service leave, which will be a cash drain on the business after it late last month gave them two weeks’ “pandemic leave” and its casual staff a one off $1000 payment.

He’s also hoping some staff can be temporarily be re-employed at companies such as Telstra, Woolworths and Coles while they remain on Crown’s books, ready to be recalled into action once Crown’s Melbourne and Perth gaming floors re-open.

Barton said on Thursday the cash drain on Crown once its gets over the initial hump of payments will at most be $30 million a month, assuming the PM and Treasurer do their bit for the staff.

After its newly announced $1bn billion debt financing deal and $300m cash in the bank after the payment of the interim dividend tomorrow, Crown can keep operating at that cash burn rate for many months.

Crown has already been offering the government rooms at its Melbourne property for people self-isolating, namely returned overseas travellers.

But it is now going a step further, putting rooms aside for people suffering domestic violence during the coronavirus lockdown.

It is believed this could be as many as 500 rooms across Crown’s 1600 room Melbourne complex.

Beyond the latest news on staff cuts, hotel rooms and executive and director salary cuts – the latter are obligatory in the current environment but are notably less than half the cuts made by rival The Star – the key point for analysts was Crown’s reaffirmation of its ability to finish its flagship Barangaroo project on time by the end of the year.

Of the $1 billion refinancing announced on Thursday, three banks have linked together in a syndicate to provide $440 million to help finish the Crown Sydney project, which will account for the bulk of the $700 million Crown has left to spend on the development.

The project cost remains unchanged, with the gross project cost expected to be approximately $2.2 billion and the net project cost expected to be approximately $1.4 billion.

Crown also still has $650m of outstanding subordinated notes, upon which the first call date is July next year.

Many might ask why Crown is pushing ahead with paying its interim dividend on Friday, which will reduce its $500 million cash balance to $300 million.

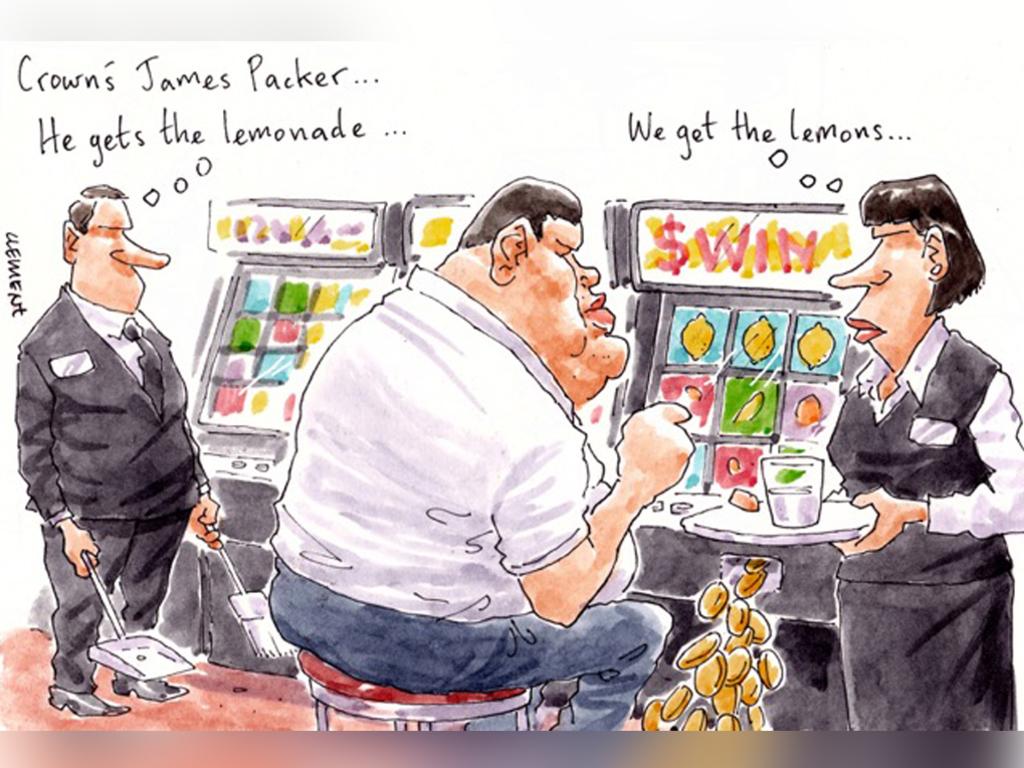

Just over a third of the dividend payment will go to the company’s major shareholder: James Packer.

A further chunk will also go to Crown’s 9.9 per cent shareholder, the Melco Entertainment Group controlled by Lawrence Ho, who could do with the money right now given the firestorm that has engulfed his company following the closure of the Macau gaming market.

Star has notably deferred payment of its dividend until gearing improves as a condition of a temporary waiver of its debt and interest cover covenants announced on Thursday.

A host of other founder-led companies have cancelled their interim dividend payments in recent weeks to conserve cash for the business.

But the Crown board has taken the view that the dividend has already been declared, the shares have traded ex-dividend and the balance sheet can now clearly handle it with the fresh debt financing.

Packer is still keeping a close eye on Crown from self-isolation at his Aspen home, and his key focus has said to have been on the company’s balance sheet.

But for all Packer’s issues in recent years, the string of asset sales he made as he confronted the third nervous breakdown of his life did leave Crown with a strong cash position and minimal debt going into the coronavirus crisis.

That has at least given Barton and the company’s still relatively new chairman Helen Coonan and her board some flexibility and breathing space. With the bonus of an important helping hand from the PM and Treasurer.

Like Star Entertainment chief executive Matt Bekier, Crown Resorts boss Ken Barton is banking on Prime Minister Scott Morrison and Treasurer Josh Frydenberg to help James Packer’s gaming company through the coronavirus firestorm.