CreditorWatch expects more insolvencies as business defaults hit a record high in February

CreditorWatch research shows businesses with one default have a 24 per cent chance of becoming insolvent in the next 12 months and that rises to a 62 per cent likelihood for three defaults.

More businesses will go under in the coming months as cost pressures from interest rates, inflation, wages and labour shortages bite deeper, CreditorWatch says.

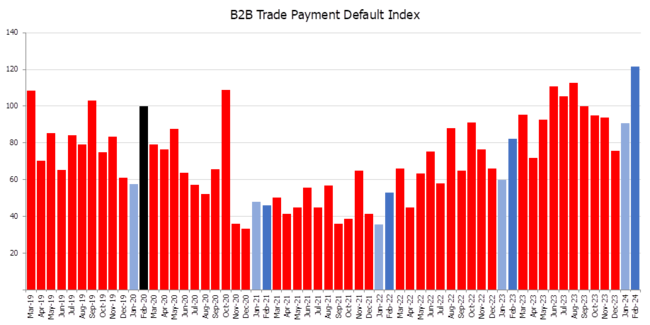

And payment defaults hit a record high in February.

CreditorWatch said conditions would get more difficult and it believed up to four cuts to the cash rate would be needed before consumers started to feel comfortable making discretionary purchases, however this was unlikely to be until early 2025.

The CreditorWatch Business Risk Index (BRI) showed that payment defaults from business-to-business transactions were at record highs, up about 50 per cent in the past year to 122, as companies faced lower consumer demand.

CreditorWatch chief executive Patrick Coghlan said payment defaults going up while invoice values declined was concerning, and he believed cash reserves were being depleted and margins squeezed.

“An increasing number of businesses have less cash coming in, which means they are then finding it more difficult to pay their own suppliers,” he said.

“They are also cutting the size of their orders and running down inventories.”

“More default means there’s an increase in insolvencies and more pressure on businesses to cut costs to make payroll for the existing part of the business, which means we will see an increase in the unemployment rate.”

The Australian Bureau of Statistics last week reported that Gross Domestic Product grew by 0.2 per cent in the December quarter to 1.5 per cent over the year — the lowest annual increase since December 2020, excluding the pandemic years.

Research from CreditorWatch showed a correlation between payment defaults and business failures. Businesses with one default have a 24 per cent chance of going insolvent in the next 12 months. This rises to 42 per cent for two defaults against two businesses and 62 per cent for three defaults against three businesses.

Mr Coghlan said payment defaults were unlikely to peak until the middle of the year and insolvencies would hit a high point shortly after.

“There’s no sugar coating it, businesses are doing it really tough at the moment. Until there is more confidence of interest rate cuts, it’s only going to get worse before it gets better,” he said.

“We’re going to see more businesses go under, and creditors and lenders need to be ensuring that they do their due diligence on their commercial customers.”

Economists expect that the RBA won’t cut interest rates until the back half of 2024 and about two rate cuts have been priced in this year.

Last month CreditorWatch reported that the average value of invoices was at a record low, with volumes down 19 per cent to just under $150,000 in January compared with $300,000 in early 2021.

The rate of external administrations was up 24.6 per cent year on year to be well above pre-Covid levels.

The public administration and safety, mining and electricity, gas, water and waste services industries have all recorded the largest increase in external administrations in the past year.

CreditorWatch said the food and beverage services sector had the highest overall rate of external administrations and should continue to do so, given a sharp pullback in household spending.

Mr Coghlan said that small and medium businesses were doing it tough and, unlike the major ASX-listed firms, did not have as much flexibility in pricing or power to pass on costs.

“People forget that just because inflation is dropping doesn’t mean the cost of goods is dropping; it just means the cost of goods is slowing in its increase, which is a challenge,” he said.

Businesses most at risk were found in the south west of Sydney and South East Queensland.

Merrylands-Guildford had an expected default rate of 7.77 per cent in the coming year compared with 6.36 per cent in the past 12 months, followed by Bringelly-Green Valley and Canterbury in NSW. The most at risk region in Qld was Ormeau-Oxenford on the Gold Coast, which had an expected default rate of 7.4 per cent, followed by Surfers Paradise.

The best performing regions continue to be areas with older-than-average populations, and more businesses that are out of start-up mode, and have lower levels of debt.

The default rate in the worst performing region – Merrylands-Guildford – is projected to be almost 65 per cent higher than the best performing region – Ballarat in regional Victoria, over the next 12 months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout