Corporate Travel Management targeted by VGI hedge fund

The fast-growing $3bn travel agency has gone into a trading halt following questions over how it books its revenue.

Short-sellers VGI Partners have taken aim at $3bn share market success story Corporate Travel Management, accusing the company of changing the way it recognises revenue to beef up its financial results, claiming to have offices around the world that aren’t there and boasting of technology patents that don’t exist.

VGI told wholesale investors that in recent months it had “significantly increased the size of our short position in Corporate Travel” to 2m shares and had identified 20 “red flags” that “paint a troubling picture” of the company.

The fund’s short position in CTM stock (CTD) is estimated to be worth more than $50m.

“While we have sought to raise questions with management in recent weeks, responses to date have failed to address many of the more substantive issues,” VGI said in a letter to investors enclosing a 176-page presentation on CTM, obtained by The Australian.

CTM today announced it had been placed in a trading halt “so that the company can review and respond to a research report which it has recently received”.

Earlier, a CTM spokesman said the company “takes the claims seriously and we look forward to providing a detailed response as quickly as possible”.

He said CTM noted VGI’s statement that it had a short position and therefore “a vested interest in Corporate Travel’s share price declining over time”.

VGI, which also runs a $700m ASX-listed retail fund, VGI Partners Global Investments, is best known for its successful raid on listed law firm Slater & Gordon in 2015.

Slater & Gordon came close to collapse after its disastrous purchase of UK personal injury claims business Quindell — itself the remains of a company shattered by fraud — drove it to a $1bn loss.

Like Slater & Gordon, CTM, which organises corporate travel for clients, has grown through aggressive acquisitions, splashing out about $530m on 20 purchases over the past decade, according to VGI’s analysis.

The Brisbane-based company, which holds its annual meeting on Wednesday, was founded in 1994 by Jamie Pherous, who remains its managing director.

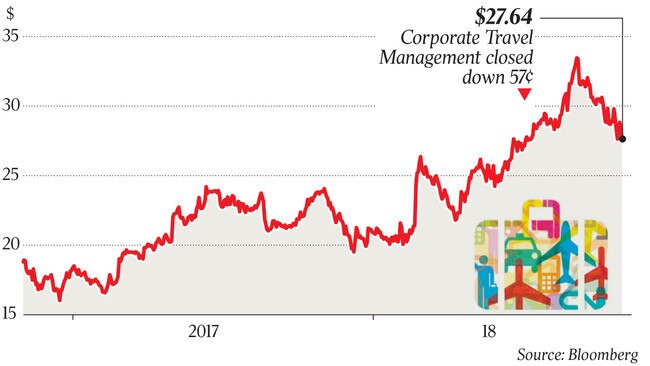

Its turbocharged growth — revenue has soared from $110m to $372m over the past four years — has helped put a rocket under its share price, which has exploded from $1 at its stock market debut in 2010 to $27.64 at market close on Friday.

VGI says CTM’s profitability is “supernormal”, pointing to earnings margins three times the average in the travel industry.

The fund claims results for the 2017-18 financial year — the first since 2010 not bolstered by a significant acquisition — were propped up by an accounting change that brought revenue forward from the following year.

CTM declared a profit after tax for the year of $80.6m, up 39 per cent from the previous year.

The company’s annual report shows that it decided to recognise some commissions when trips were booked, rather than when the money was received, reversing a change it made in 2014.

In 2014, the company told the market it was no longer recognising “pay direct commissions” on booking due to “a deteriorating rate of PDC recoveries in the past six months and the uncertainty that surrounds PDCs at the time of travel booking”.

“The directors concluded that it was not probable that revenue would flow to CTM until the point of receipt,” the company said at the time.

VGI complained that while in 2014 CTM explained the impact of the accounting change, it did not do the same when “flip-flopping” back to recognising the commission upfront.

The hedge fund said that although CTM claims to have “patented” proprietary technology to help it gobble up bookings, it had no registered patents anywhere in the world.

However, VGI acknowledged that CTM did file an application for a patent over a “travel product selection and booking, method, device and system” with IP Australia in 2014.

The hedge fund told investors it visited European and US office locations listed on CTM’s website — only to find many of them were either “phantom” offices with no trace of the business or “ghost” ones that existed but were unoccupied during business hours.

At the address CTM gave for its office in Amsterdam, VGI said that “the building appeared abandoned, with so signs of recent activity”.

“A neighbour said the travel agency at this location has not shown any activity for at least six months,” VGI said in its presentation.

VGI also took aim at CTM’s bloated goodwill, which at $407m makes up more than half its assets.

The company’s “North America segment is vulnerable to a potential writedown,” VGI said in its presentation.

VGI said it also suspected the company held far less cash during the year than it declared on the balance dates in its accounts — $6.6m against a declared figure of $82m last year.

This was because interest earnings were as little as a tenth of the returns reaped by peers on their cash piles, it said.

VGI questioned the long tenures of Mr Pherous and chief financial officer Steve Fleming, who has been with the company since its 2010 IPO.

It said the “long-serving and entrenched management team” was a red flag because it led to an “absence of independent thought provided by a fresh set of eyes” and a “propensity to prioritise protection of legacy over confronting reality.”