Coronavirus restrictions hit theme park owners

Harsh restrictions on gatherings mean the dream is over for the owners of some of Australia’s most loved theme parks.

The dream is over for the owners of some of Australia’s most loved theme parks, with harsh restrictions on gatherings slamming their operations and leaving once-proud companies such as Ardent Leisure and Village Roadshow on their knees.

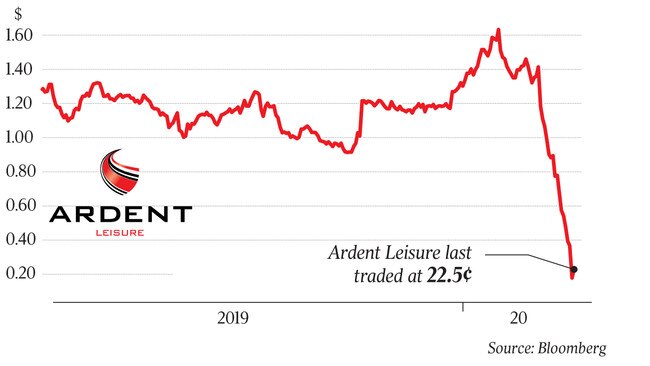

Shares in Ardent, the owner of Dreamworld, bounced from a low of 19c on Tuesday before trading was halted — pending a company announcement — as they hit 25c, but the company has gone into steep reverse, shattering the turnaround plans proposed by chairman corporate raider Gary Weiss.

The company’s famed local park and US operations, the Main Event complexes, are in dire straights, particularly after US President Donald Trump advised Americans to avoid groups of more than 10 and asked them to stay away from bars and restaurants.

Ardent confirmed its announcement was in relation to government responses to COVID-19 that were likely to affect its entertainment and lifestyle businesses.

The Australian understands the expected statement potentially relates to changes in operational and staffing needs of its Australian-based theme parks and US-based Main Events business.

Recent moves by the federal government to limit public gatherings by no more than 500 patrons, combined with a drop in tourist numbers, has been expected to affect visitor numbers to the Gold Coast’s theme parks.

Rival company Village Roadshow’s theme parks Sea World, Warner Bros Movie World, Wet’n’Wild and Paradise Country are also in the gun.

Village Roadshow shares were smashed to a low of $1.725, with the 6.5 per cent drop taking them down to values that are about half proposed takeover offers at $4 a share by private equity groups BGH Capital and PEP.

The company, which has been through a dramatic family feud that resulted in the departure of longtime chief executive Graham Burke and a preliminary agreement by the Kirby family and Mr Burke that control about 40 per cent of the stock to sell to private equity, now appears to be in limbo.

The stock pricing indicates that investors see little hope of these takeover plans proceeding in their present form, particularly if debt markets tighten up, and takeover suitors are also unlikely to pay up.

An Ardent Leisure spokesman said Dreamworld had a capacity of about 10,000 patrons per day.

Queensland Tourism Minister Kate Jones confirmed she had been in discussions with Ardent Leisure chief executive John Osbourne. “We know Ardent were already doing it tough, well before the coronavirus outbreak took a toll this year,” she said.

In an aftermarket announcement on Friday, Ardent Leisure withdrew its earnings guidance for its Main Events division, causing a 52 per cent share price drop on Monday.

The statement indicated growing uncertainty surrounding the pandemic had resulted in attendance falls, prompting Main Event to no longer believe a constant centre revenue growth between 1.5-2.5 per cent was achievable.

It also warned that Main Event’s earnings margin would be about 20 per cent lower than its previously issued guidance.

The company said the impacts on its domestic theme park division from the virus had continued for longer than anticipated.

Ardent’s theme parks have been embroiled in controversy since four visitors were killed by a Dreamworld ride in 2016. A coroner’s report last month noted “systemic failure” within Dreamworld’s safety procedures.

Additional reporting: Ben Wilmot

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout