Coles to hoard cash amid fears of Armaguard collapse

Coles will hoard cash over the Easter break in case Armaguard collapses with a rescue deal for the money provider in danger of faltering amid ongoing crisis talks.

Coles will hoard cash over the Easter break in case Armaguard collapses with a rescue deal for the money provider in danger of faltering amid ongoing crisis talks.

The supermarket giant confirmed it had restricted cash withdrawals in stores to $200, down from their earlier $400 limit and pulled all its cash deliveries from Armaguard until April 5.

The dramatic move was made over fears a rescue deal for Armaguard is teetering, with Coles concerned cash could be trapped on trucks over the long weekend.

The cash-in-transit business is now looking to negotiate individual deals with its key customers, rather than sign-on to a $26m package before Easter.

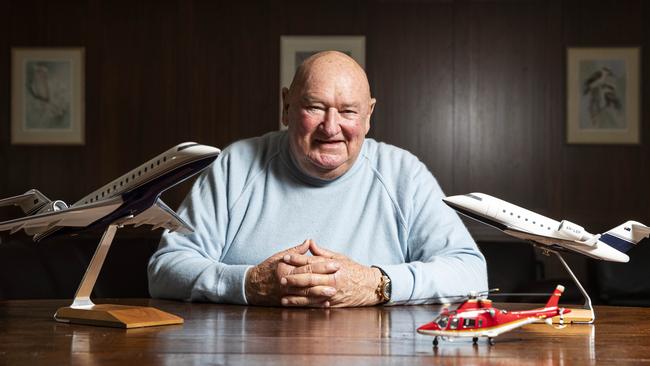

Armaguard, controlled by billionaire Lindsay Fox, has warned that its business, which dominates distribution of coins and notes around Australia, is unsustainable amid a collapse in cash use.

Coles, which operates 840 supermarkets nationwide, is understood to be concerned its cash may be trapped on Armaguard vehicles if the business were to collapse into insolvency in the coming weeks.

A Coles spokesman said the supermarket was “not transitioning to cashless transactions”.

“Due to industry-wide challenges with cash movements, we are taking some temporary steps to prepare for disruption to Armaguard services,” he said.

“Cash transactions continue to be available in all Coles supermarkets and Coles Liquor stores.”

Sources close to the rescue deal have indicated a consortium of Australia’s key cash users – including the banking sector, Coles and Woolworths, AusPost and Wesfarmers – have given Armaguard until Thursday night to agree to a deal.

But Armaguard, which supplies almost 90 per cent of cash in Australia, is now expected to walk away from the rescue amid a dispute over a series of conditions the cash users have attempted to impose on the business.

This is despite concerns Armaguard had enough financial runway to last only until April 3.

Instead, Armaguard’s owners Linfox, and the Fox family, have put their hands in their pockets to fund the allegedly loss-making cash business past Easter amid concerns that it would fall over before that.

The banking industry and the supermarkets had been seeking to force Linfox and Armaguard to a deal on Wednesday, after the latest roundtable between the parties.

The banks and supermarkets gave Armaguard an ultimatum on Wednesday, at talks being co-ordinated by the Reserve Bank of Australia, calling on the company to accept their $26m rescue package by close of business on Thursday.

A potential deal has been on the table since at least last Tuesday. But The Australian understands that the conditions of the deal were a sticking point to the Armaguard negotiating team, led by former trade union heavyweight and superannuation architect Bill Kelty.

Mr Kelty, a non-executive director of Linfox Group, has been close to the negotiations over cash.

The 40-page-deal would force Armaguard to open its books to the negotiating consortium, which has expressed concerns the cash business is using its market dominance to squeeze more money out of its key customers.

Armaguard is also understood to be concerned that the banks would use their knowledge of the company’s cash business to further target their efforts to shift customers to electronic payments.

Armaguard is now expected to commence negotiating new deals with its key cash customers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout