Coles spin-off allows Wesfarmers chief Rob Scott to pursue acquisitions

Wesfarmers chief Rob Scott will have greater flexibility to undertake merger and acquisitions following the Coles spin-off.

New Wesfarmers chief executive Rob Scott will have greater flexibility to undertake merger and acquisitions to diversify the conglomerate’s earnings base, following the ambitious spin-off of the giant Coles supermarkets business, analysts say.

Mr Scott on Friday outlined plans for Wesfarmers to demerge its Coles grocery division to create a new top 30 company on the ASX. He said the move was about “setting Wesfarmers up for the next decade’’.

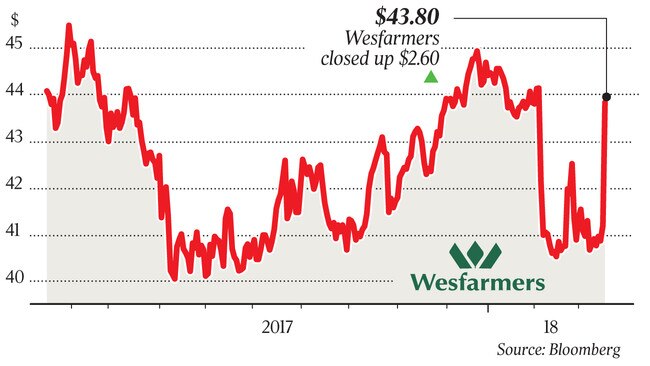

Wesfarmers’ share price shot up more than 6 per cent to $43.80 following the announcement of the spin-off which, subject to shareholder and other approvals, is expected to be completed in the 2019 financial year.

The demerger, which comes amid increasing competition in the supermarket sector, will create a new stand-alone company worth as much as $20 billion.

At the end of December, Coles accounted for about 60 per cent of Wesfarmers’ capital employed and 34 per cent of divisional earnings.

Citi analysts Bryan Raymond and Craig Woolford said the demerger was a positive development for Wesfarmers. “Shareholders can now gain exposure to a Wesfarmers business primarily driven by Bunnings,” they said in a note to clients.

They also said it could lead to potential deal making activity for Wesfarmers. “Demerging the capital intensive Coles business creates an opportunity for Wesfarmers to accelerate acquisitions, likely to be a domestic industrials business”.

Wesfarmers, which owns hardware chain Bunnings, department stores Kmart and Target and office-supply retailer Officeworks, said it would seek to maintain a 20 per cent stake in Coles.

Wesfarmers shareholders will receive shares in Coles proportional to their existing holdings, the company said.

In addition, Wesfarmers said Metcash supermarkets chief Steven Cain would be the new managing director of Coles, succeeding John Durkan who will step down later this year after 10 years in senior leadership positions at the grocer.

Credit Suisse analyst Grant Sallgari upgraded his target price on Wesfarmers from $40.65 to $44.98 a share and upgraded the company to “outperform”.

“The proposal seems unambiguously positive for Wesfarmers and a strong signal of management’s intent to move Wesfarmers to a higher growth group of businesses.

“Although independent decisions, the emergence of a slimmer Wesfarmers also seems to increase the likelihood of cutting loose the underperforming UK business, which would likely be taken positively by the market.”

Mr Sallgari said Coles would emerge as a highly cash generative and probably attractive stand-alone supermarket business. He also said the defensive rationale for Wesfarmers’ ongoing ownership of Kmart and Target would disappear with the demerger of Coles.

Citi’s Mr Raymond said the implication for Woolworths and the broader grocery industry was favourable.

Wesfarmers Mr Scott told analysts that Coles had delivered strong returns to Wesfarmers shareholders since it was bought for $19.3bn in 2007, but those returns couldn’t be repeated in the next decade.

S&P said the demerger would continue to support its “A-” long-term credit rating.