Coles feeling pinch as supermarket wars hit sales

The supermarkets chain has reported one of its slowest rates of sales growth in a decade.

Coles, the long-time earnings engine of Perth-based conglomerate Wesfarmers, has reported one of its slowest rates of sales growth since it was bought 10 years ago as it wages a pitched battle with Woolworths and Aldi that is now threatening its profit margins.

But the supermarket’s boss, John Durkan, has promised the recent investment of $200 million in lower prices and another recent splash on customer service in the last quarter was starting to pay off with food and liquor sales primed to climb over the next year.

“What we have seen actually is our strongest transaction growth for a long time in the quarter and we are seeing more customers coming back more often, which I think is a positive in terms of the underlying business,’’ Mr Durkan said yesterday after Wesfarmers released its latest quarterly sales performance.

For its flagship retailer Coles, the supermarket group posted comparable food and liquor sales growth of 0.4 per cent, while comparable food sales — excluding liquor — rose 0.3 per cent. It was in line with the 0.4 per cent growth in sales for the third quarter of 2017, but is one of the lowest growth rates for Coles since it was bought by Wesfarmers in 2007.

When adjusting for Easter, Coles’ third quarter sales were up only 0.7 per cent, making this quarter its lowest since the takeover 10 years ago.

The Coles sales performance for the quarter was hit by price deflation, especially among the fresh food, fruit and vegetables categories as good growing conditions and a lack of any disruptions from cyclones produced bumper crops that pushed down prices.

Adjusting for deflation, comparable sales were up 2.7 per cent, the highest they have been since the first quarter of 2017.

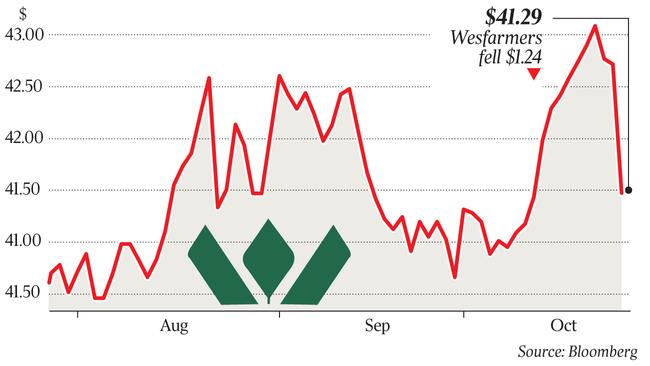

The weak figures for Coles came as Wesfarmers’ other retail businesses — Bunnings, Kmart and Officeworks — were leant on to provide sales momentum. Fears of shrinking profit margins at Coles and a double-digit slump in sales at Bunnings in the UK sent Wesfarmers shares sharply lower yesterday, as investors wiped nearly $1.5 billion in market capitalisation from the group. Wesfarmers shares closed down $1.24, or 2.9 per cent, at $41.49.

Wesfarmers chief executive Richard Goyder, who is stepping down after the company’s AGM in November, said the sales performance of the group’s retail businesses was generally pleasing, in particular the continued strong performances of Bunnings Australia and New Zealand, Kmart and Officeworks.

“Sales growth was achieved despite significant fresh produce deflation during the period, and the business continued to see improvements in key metrics such as transaction growth, unit growth, fresh participation and customer satisfaction.”

Mr Durkan remained upbeat about the supermarket chain as long as competitors remained rational. “There are still many opportunities for growth in the business,” said Mr Durkan. “We continue to focus on increasing our penetration in ‘fresh,’ improving our store network, investing in new routes to market, and simplifying our business in terms of range and cost of doing business.”