Cleanaway Waste Management likely to avoid first strike against remuneration report

Cleanaway strikes a minor victory while the board works through a protracted scandal involving chief executive Vik Bansal.

Under-pressure Cleanaway Waste Management will likely avoid an embarrassing ‘first strike’ against its remuneration report at its annual meeting on Wednesday after the Australian Council of Superannuation Investors, a key adviser to the nation’s biggest industry superannuation funds, urged support for all AGM resolutions.

In a lengthy advisory note sent to its superannuation fund members, who collectively look after almost $500bn in Australian retirement savings, and obtained by The Australian, ACSI has advised support of the remuneration report as well as the re-election or election of three directors and the increase of the non-executive director fee cap.

It marks a minor victory for Cleanaway and its board in the midst of a protracted scandal involving its chief executive Vik Bansal which has been played out in the media over the last few months and involves issues around workplace bullying, high executive turnover and allegations of Cleanaway cutting corners on safety and environmental performances.

The support of ACSI was won following meetings held by the superannuation industry advisor and the Cleanway board in the wake of allegations of bullying against its controversial chief executive Mr Bansal, and sweetened by a decision to cancel $2.3m worth of short term and long term incentive bonuses Mr Bansal was in line to receive.

ACSI, which advises 37 Australian and international asset owners and institutional investors who combined own on average 10 per cent of every S&P/ASX200 company, told its members in its Cleanaway AGM report that if resolutions relating to bonuses to Mr Bansal had not been subsequently removed from the AGM agenda it would have pushed for a vote against the adoption of the remuneration report.

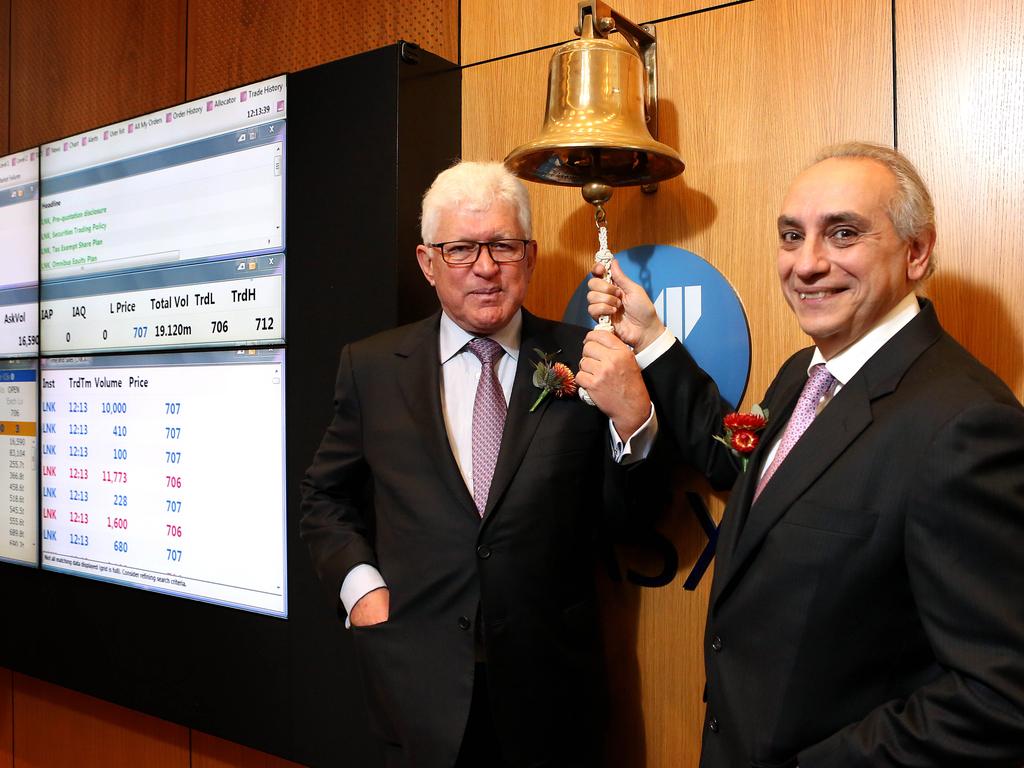

However, the Cleanaway board led by chairman Mark Chellew might still face a hostile audience from shareholders at the virtual AGM on Wednesday as they question and dissect the litany of scandals and revelations about Mr Bansal and the company’s operations that have been played out in public this year.

Meanwhile, in the ACSI executive summary sent to its superannuation fund clients it said on September 24 Cleanaway announced to the ASX that in response to concerns expressed regarding the chief executive’s fiscal 2020 short term incentive (STI) outcomes, the CEO would forgo his deferred STI rights for fiscal 2020 – around $84,900 in face value – and would not be granted his annual long term incentive (LTI), which had a face value of $2.25m at grant date.

“[B]oth of these grants were set to be voted on by shareholders at this AGM and these resolutions (4a & 4b) have now been withdrawn. Had these changes not occurred, ACSI would have recommended subscribers vote against item 2 at this meeting,’’ the ACSI executive summary said.

In a summary of its own engagement with the Cleanaway board ACSI said it engaged with Cleanaway in September on issues regarding the CEO’s behaviour and remuneration outcomes. “The withdrawal of the resolutions 4a and 4b (the granting of the STI and LTI) reflect the board’s actions in response to ACSI’s and investor engagement on CEO remuneration outcomes.”

Last month The Australian revealed that ACSI has demanded a meeting with the board of Cleanaway after revelations of alleged bullying by its high-profile chief executive dragged the company into scandal.

Mr Bansal admitted that he had overstepped the mark and was “overly assertive” with staff, and later in an email to staff apologising for his behaviour in the workplace and for the negative attention it has brought to the company.

“This week there have been a series of stories in the media relating to my behaviour in the workplace,’’ Mr Bansal began the email, which was obtained by The Australian at the time. “The board put out a statement to the ASX acknowledging that there had been an investigation into my behaviour as a CEO and elements of my management style. As a result, we introduced a range of measures including executive leadership mentoring, enhanced reporting relating to my engagement with employees, and monitoring of my conduct.”

A trimming of Mr Bansal’s bonuses was enough to swing over ACSI and although it has some reservations about other aspects of the waste management’s corporate governance and some other proxy advisors are pushing for a stronger stance against the Cleanaway board at the AGM, all resolutions should pass. It means Cleanaway will likely avoid a ‘first strike’.

But not all proxy advisors are happy with Mr Bansal and the performance of the board in dealing with revelations he acted inappropriately at work including allegations of workplace bullying.

Proxy advisory service CGI Glass Lewis have told their subscriber investors to vote down key resolutions at the Cleanaway AGM because the company “lacks transparency” and offered seemingly conflicting statements over the decision to trim Mr Bansal’s bonuses. Rival proxy advisors Institutional Shareholder Services and Ownership Matters is supportive of the company and its AGM resolutions.

In its own report, ACSI conceded however it still has what it called a “high” level of concern over Cleanaway’s accounting treatment of earnings.

“Cleanaway has a history of reliance on using underlying earnings when presenting to investors, as well as for incentive purposes,’’ the ACSI report said.

“Investors should pay close attention to which items are included/excluded from underlying measures. For example, fiscal 20 statutory net profit after tax was around 25 per cent lower than underlying net profit after tax, the largest percentage gap between the two measures since fiscal 2016.

“Cleanaway does have a track record of also excluding positive items, such as tax benefits or gains on sale. The accounts have been further complicated via the integration of Toxfree and the related acquisition accounting via business combinations.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout