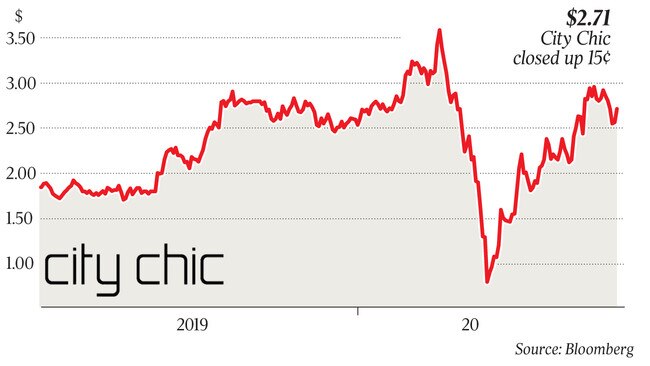

City Chic culls 14 stores after rent negotiations

Womenswear group City Chic says it has renegotiated rents with landlords but announced 14 stores will have to close.

Fashion retailer City Chic is the latest bricks-and-mortar chain to close down a number of its physical stores to focus on its digital strategy after it failed to agree to a reduction in its rents from shopping centre landlords, with other retailers expected to follow at a time when online shopping is a growing force in the sector.

City Chic said on Monday it had secured new rental agreements with its landlords for some of its outlets in the wake of the coronavirus pandemic and the resulting economic shocks to the $320bn retail sector, but rents on 14 stores currently in between leases — also known as holdover — could not be agreed and those will be shut down.

The decision to close 14 of its total portfolio of 106 stores across Australia and New Zealand represents 13 per cent of City Chic’s physical store portfolio and marks a continuing shift in the balance of power between often combative landlords and tenants that is seeing many chains walk away from traditional shopping centres.

City Chic, much like other retailers, believes it can further accelerate its sales growth online, where many retailers across a wide range of categories have witnessed rocketing growth since March, when the COVID-19 shutdowns spurred online shopping.

A recent UBS report forecast that online sales will double in the wake of the pandemic, shifting the balance of power between landlords and tenants, while up to 20 per cent of mature bricks-and-mortar stores could shut for good.

Last month, jeweller Michael Hill International said it would not reopen some stores and would focus more on online sales, while Wesfarmers chief executive Rob Scott signalled the conglomerate, which owns Bunnings, Kmart, Target and Officeworks, would also invest more heavily online.

In a statement to the ASX on Monday, City Chic said it had completed negotiations with landlords and agreed to reduced rents for periods covering store closures, as well as appropriate rents in the future.

But as part of the process, City Chic has decided to close 14 “holdover stores” not covered by a current lease, where it was unable to reach agreement on appropriate post COVID-19 rents.

The impact of the store closures on future earnings was expected to be minimal as customers were redirected to nearby stores and the company’s online channel, City Chic said.

“The decision to close these stores reflects our focus on appropriate store economics,’’ City Chic chief executive Phil Ryan said.

“We remain committed to opening new stores and converting stores to large formats where deals can be structured to reflect the current retail environment.

“As an omnichannel retailer we will continue to engage with our customers across multiple touch points, but recognise the ongoing shift to online and are well positioned to execute on our digital strategy.’’

Citi estimates that the 14 closed City Chic stores will account for 3 per cent of group sales for the 2020 fiscal year and 2 per cent of group EBITDA. These stores could account for about $2m in rent, Citi said.

In a trading update last month, City Chic said online sales jumped 57 per cent while its stores were closed due to the coronavirus pandemic. With an already large chunk of its earnings coming from online, the gains by its online store during the period ensured City Chic traded profitability during a shutdown from March 27.

The decision to permanently close 14 of its stores after rental talks failed to produce a deal comes after shopping centre tenants in the $320bn retail sector have been scrambling to negotiate rents in the face of collapsing sales and foot traffic. Some landlords have refused to budge and pressure is coming from the federal government for both sides to sign deals that reflect the economic downturn.

Powerful retailers such as Solomon Lew and his Premier Investments had initially at the outset of the coronavirus pandemic refused to pay rents on closed stores and later signalled a deal of paying rents that were a reflection of the fall in sales.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout