CIMIC denies cooking books as stock dives

Construction giant CIMIC has hit back at claims of ‘engineering’ its financial accounts.

Construction giant CIMIC has hit back at claims of financial account “engineering” levelled by a Hong Kong research house, releasing a statement to the market almost a week after the allegations were first aired.

CIMIC, previously known as Leighton Holdings, had previously refused to comment on a research note circulated by Hong Kong-based GMT Resources. The research alleged CIMIC had boosted pre-tax profits by up to $800 million by pre-booking contract revenue, and flagged a potential $700m reversal in previously booked revenue in response to newly introduced Australian accounting guidelines.

In a statement to the market late yesterday, however, CIMIC said it was “in compliance with its disclosure obligations”.

“CIMIC notes that its annual reports and full-year financial results are fully audited and in compliance with the accounting standards. CIMIC notes that its most recent announcement, its first quarter result, was released to the market three weeks ago,” the company said.

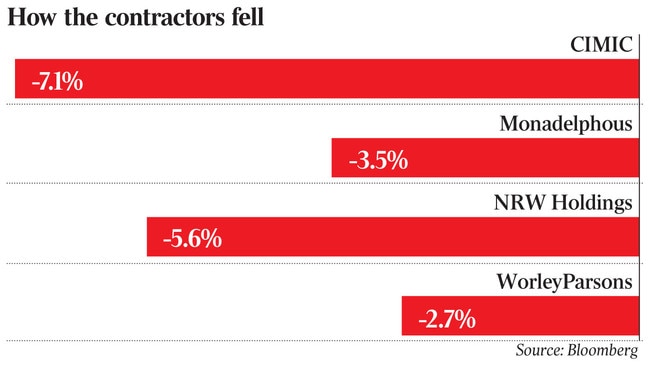

CIMIC shares sank $3.54, or 7.1 per cent to a $46.50 close, making it the worst-performing stock on the S&P/ASX 200 on a bearish day for the market.

But CIMIC was hardly an outlier as Australian construction and engineering services companies took big falls as international markets tanked on renewed fears of a US trade war with China.

Like many of its peers CIMIC has enjoyed a strong run since the beginning of the year, as Australia’s political parties promised to shower marginal seats with billions in road, rail and infrastructure spending in the lead-up to the May 18 election.

In April federal Treasurer Josh Frydenberg declared “cranes, hard hats and heavy machinery” as the dominant theme of his first budget, offering billions for congestion-easing projects and promising a boost to the economy through infrastructure spending.

Up to two-thirds of the projects in the budget’s $30 billion worth of new infrastructure proposals aren’t slated to start until after the 2022 federal poll, but Labor has already promised to match or better the government’s cash splash, and said it will bring as much of the spending forward as it can afford.

The deluge of promises is backed by further billions in state government spending, and helped along by new wave of infrastructure spending by the big miners — as much as $25bn over the next five years — helping create a buoyant outlook for CIMIC and other listed construction and engineering companies.

CIMIC shares hit a 12-month high of $51.67 only last week, having started the year at $42.77. West Australian-based NRW Holdings opened 2019 at $1.60 and crossed the $3 mark in April, for the first time since the heady heights of the WA mining boom. Other mid-tier players enjoyed a similar surge. NRW yesterday closed down 5.6 per cent, or 16c, at $2.69.

But Donald Trump’s return to the trade war spooked the markets and dampened the outlook for commodities, reversing some of the gains for mining services, construction and engineering companies.

Kerry Stokes’s Seven Group Holdings shed $1.10, or 5.6 per cent, to close at $18.65 and heavy equipment rental company Emeco dropped 14c to $1.93.